Cathie Wood, CEO of Ark Investment Management, is well-known for her focus on small- and mid-cap technology stocks. She rose to fame after Ark Innovation ETF (ARKK – Free Report) delivered a remarkable 73% return in 2020.

However, the long-term success of Cathie Wood’s strategy has not been remarkable. ARKK, her flagship exchange-traded fund (ETF) with $5.5 billion in assets, has posted a 25.7% return over the past year, and a modest 12.2% over five years. By comparison, the S&P 500 has returned 35% over one year, and 95.4% over five years.

Wood’s investment philosophy thrives on emerging high-tech companies in fields such as artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics. However, she occasionally taps mega-cap stocks to provide stability for her funds, which primarily consist of higher-risk assets. Sometimes, Wood even buys these stocks during price increases.

Cathie Wood’s Recent Moves: Amazon & Meta Stocks

Despite the challenges, Wood has lately made notable moves in the market. On Oct. 8, 2024, Ark Innovation ETF purchased 76,505 shares of Amazon, valued at $14 million. Amazon’s stock has risen 18% since Aug. 5, although it did record a 9.8% decline from Sept. 24 to Oct. 8.

Morningstar analyst Dan Romanoff is also optimistic about Amazon, assigning the company a wide moat tag due to its dominant position in e-commerce and cloud services, and setting a fair value of $195, as quoted on street.com.

Plus, Ark Next Generation Internet ETF acquired 2,365 shares of Meta Platforms, worth $1.4 million at the Oct. 8, 2024 close. Meta’s stock has surged 16% over the past month. Morningstar analyst Malik Ahmed Khan views Meta as slightly overvalued but believes it holds a wide moat, largely due to its unchallenged social media presence across platforms like Facebook, Instagram, WhatsApp and Messenger, as quoted on street.com.

Should You Play Amazon Stock & ETFs?

Amazon.com has a Zacks Rank #3 (Hold). The stock has the best VGM Score of “A.” The stock comes from the top-ranked Internet – Commerce industry (top 18%). Amazon is gaining on solid Prime momentum owing to ultrafast delivery services and a strong content portfolio.

Amazon is often considered as a wide-moat stock. Amazon is the clear leader in e-commerce, with a cost advantage and network effects that attract more buyers and sellers. The company has been disrupting the retail industry for more than two decades, per Morningstar. Thus, picking Amazon stock ahead of the start of the holiday season could be a good idea.

Meanwhile, the growing adoption of Amazon Web Services (AWS) is aiding Amazon’s cloud dominance. In Q2 of 2024, Amazon and Google upped their cloud market share. “Google is bigger than the next four largest players, while Microsoft is twice the size of Google and Amazon is 35 percent bigger than Microsoft,” said John Dinsdale, chief analyst at Synergy Research Group in an email to CRN.

A deepening focus on generative AI is a major plus. Amazon is developing its own processors to limit its reliance on costly NVIDIA chips. Amazon’s Annapurna Labs, which it acquired in 2015, is spearheading the effort in this area. According to Sinno, the director of engineering at Annapurna Labs, there is a growing demand among Amazon’s customers for cheaper alternatives to NVIDIA’s chips, as quoted on Firstpost in July 2024.

Amazon Stock’s Valuation & Potential

Amazon’s stock trades at a price/earnings (trailing 12 months) ratio of 44.29X versus the underlying industry’s P/E of 57.54X. However, Amazon’s Price/Book (Most Recent Quarter) ratio is pricey. Amazon’s P/B ratio is 8.30X versus the industry average of 2.02X. Amazon’s price/cash flow (most recent fiscal year) ratio is 24.74X versus the industry average of 14.28X.

Amazon’s this year’s growth rate is 63.45% versus the industry’s growth rate of 13.20% and the S&P 500’s 15.67%. Amazon’s next year’s growth rate is 23.21% versus the industry’s growth rate of 23.10% and the S&P 500’s 11.34%.

AMZN Stock Price Target

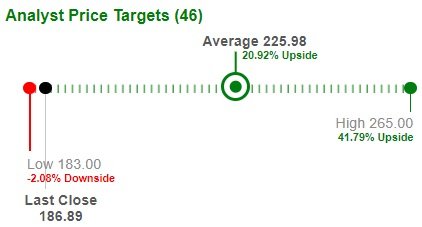

Based on short-term price targets offered by 46 analysts, the average price target for Amazon comes to $225.98. The forecasts range from a low of $183.00 to a high of $265.00. The average price target represents an increase of 20.92% from the closing price of $186.89 recorded on Oct. 16, 2024.

Image Source: Zacks Investment Research

Amazon-Heavy ETFs in Focus

Given the ongoing uncertainties related to competition in the cloud and AI business, it may be better to track the company through an ETF approach. The basket approach minimizes the company-specific concentration risks. Amazon-heavy ETFs include the likes of Consumer Discretionary Select Sector SPDR Fund (XLY – Free Report) (weight 22.52%), ProShares Online Retail ETF (ONLN – Free Report) (weight 22.33%) and Fidelity MSCI Consumer Discretionary Index ETF (FDIS – Free Report) (weight 22.25%).