This Vanguard fund could help diversify your ETF portfolio.

Vanguard has long been synonymous with passive investing, pioneering low-cost index funds that have helped millions build wealth over time. While index investing remains a cornerstone strategy, some investors seek opportunities to potentially outperform the broader market through actively managed funds.

The Vanguard U.S. Momentum Factor ETF Shares (VFMO -0.53%) stands out as an intriguing option for those looking to add momentum exposure to their portfolios. Let’s explore how this actively managed exchange-traded fund (ETF) could enhance your investment strategy through its distinctive approach.

Image source: Getty Images.

A strategic mid-cap advantage

The fund’s portfolio architecture reflects a calculated strategy for capturing market momentum. Its median market capitalization of $14.2 billion stands markedly below the $188.7 billion of its benchmark, the Russell 3000, positioning investors to capitalize on companies in their dynamic growth phase.

This deliberate mid-cap emphasis may provide distinct benefits compared to conventional large-cap focused funds. These companies typically offer greater growth potential while maintaining sufficient market presence and financial foundation to weather market cycles.

Value-conscious momentum investing

With a price-to-earnings ratio (P/E) of 21.5, the fund trades at a compelling discount to its benchmark’s 26.3 multiple, reflecting more attractive valuations throughout its portfolio.

What’s particularly noteworthy is that it maintains this valuation edge while keeping pace with its benchmark’s impressive 17.8% annualized five-year earnings growth rate across its holdings.

This skillful balance between growth prospects and valuation discipline underscores the fund’s sophisticated approach to building shareholder value. The strategy enables investors to capture momentum while remaining anchored to fundamental value principles.

Cost-effective active management

At just 0.13%, Vanguard U.S. Momentum Factor ETF Shares’ expense ratio rivals that of many passive index funds, allowing investors to retain more of their returns while getting professional active management. This fee structure stands in stark contrast to the category average of 1.07% — a difference that compounds meaningfully over time.

However, the fund’s active strategy is reflected in its substantial 73.4% turnover rate, which far exceeds that of typical passive index funds. This elevated trading activity may trigger significant taxable events, suggesting the fund might be best positioned within tax-advantaged accounts such as IRAs to help shield investors from these implications.

Broad diversification meets focused strategy

Encompassing 611 holdings, this actively managed Vanguard fund delivers comprehensive diversification across the U.S. market. The fund maintains its domestic focus with just 0.5% allocated to foreign securities, concentrating on U.S. opportunities.

This thoughtful portfolio construction balances broad market exposure with momentum-driven selection. Such disciplined diversification may help mitigate volatility while positioning the fund to capitalize on strong market conditions.

A compelling addition to long-term portfolios

Since its 2018 launch, this Vanguard offering has showcased the potential of cost-efficient management to harness market momentum factors while delivering meaningful returns to investors. The fund occupies a strategic middle ground between conventional index tracking and premium-priced active management, carving out its niche in the investment ecosystem.

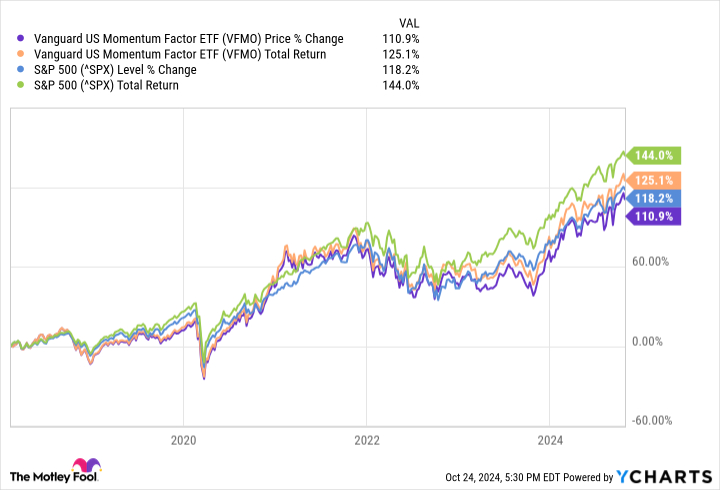

However, despite its innovative approach, this actively managed Vanguard ETF has modestly underperformed the S&P 500 since its inception:

For investors looking to diversify beyond traditional index funds, this Vanguard fund provides momentum exposure through a distinctive cost framework pairing Vanguard’s characteristically low expense ratio with the potential for higher tax consequences stemming from its active trading approach.

The Vanguard U.S. Momentum Factor ETF Shares could thus play a valuable role within a thoughtfully constructed growth portfolio housed in a tax-advantaged account.

George Budwell has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.