It’s been a head-spinning week for investors.

Last week, the S&P 500 briefly entered a technical correction a mere one month after it hit an all-time high. Donald Trump’s tariff uncertainty is the cause of this volatility, and its erratic implementation has some commentators now asking whether a “transition”1 is really an impending recession. JPMorgan now puts the chance of a US recession at 40%, while Goldman Sachs has it at 20% (and rising)2.

In this piece, we discuss seven ETF ideas that could help protect your portfolio if investors’ fears are realised.

Sentiment is falling and uncertainty is rising

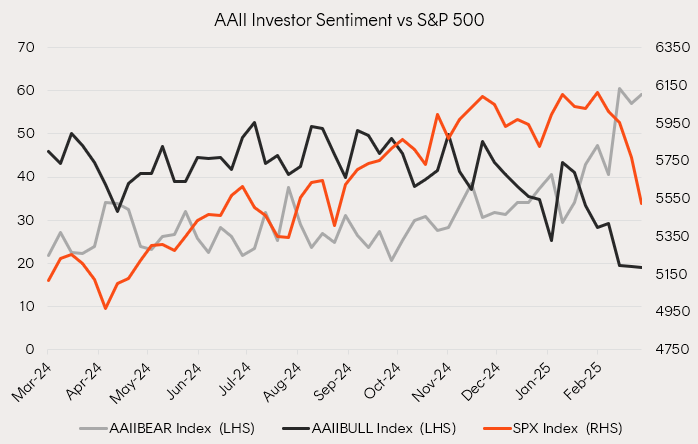

One useful way to gauge how markets are feeling is to look at several charts which combine market performance and sentiment indicators.

The first is one that compares institutional investor sentiment (think hedge funds, superannuation funds and insurance companies) against the S&P 500. These opinions matter given some of their larger trades can move markets single-handedly. Note that as negative sentiment has moved sharply higher, positive sentiment has moved lower just as sharply as has the S&P 500 itself.

Source: AAII, Bloomberg. The AAII, or the American Association of Individual Investors, is a nonprofit investor education organisation. As of 14 March 2025.

The second chart measures the global economic policy uncertainty index against the benchmark US stock market volatility index (the VIX). It’s a well-known trope that markets dislike uncertainty. The surge in the policy uncertainty index (black line) has helped fuel the spike in stock market volatility (orange line) we have seen of late.

Source: Bloomberg, as of 14 March 2025.

The last chart reflects how market and economic uncertainty is affecting corporates. The following data from AlphaSense shows that the number of companies mentioning the words “soft landing” (i.e. a cyclical slowdown in economic growth that ends without a recession) in conference calls has crashed from a high of 170 in 2024 to just eight in the current quarter.

Source: AlphaSense, Wall Street Journal

Put together, these charts may help to explain why investors seem to be feeling more jittery today than they have in some time. For the rest of this piece, we will look at some tangible ideas that investors could consider helping protect their portfolio in the event of a material drawdown.

First rule of market volatility: Stay calm

Even before we get into the ideas, there is one important thing investors of all stripes can do – don’t panic. In markets like this, rash decisions to liquidate your positions may not be conducive to your long-term investment plan. In addition, selling a position means you may miss out on a potential rebound in that asset and any gains that come after that rebound.

Depending on an investor’s circumstances, often the best thing an investor can do in times like these is to calmly assess the state of their portfolio and seek ways to defend the gains they’ve made until now. In the following sections, we’ll analyse some ways you can do that.

3 equity ETFs to consider

In uncertain times, it helps to find investment ideas that diversify your exposure, reduce volatility, and manage your potential downside risk. Two such ideas are the S&P 500 Yield Maximiser Fund (managed fund) (ASX: UMAX) and its Australian ‘cousin’, the Australian Top 20 Equity Yield Maximiser Fund (managed fund) (ASX: YMAX).

Both products aim to generate income and reduce the volatility of portfolio returns by using a ‘covered call’ strategy. By writing call options, holders of YMAX and UMAX receive option premiums which can generate an additional source of income as well as providing a partial hedge against portfolio value declines.

Both YMAX and UMAX aim to outperform a conventional share portfolio in falling, flat and gradually rising markets but underperform in a strong bull market.

It may also help investors to look at sector-specific approaches. ‘Defensive’ sectors like healthcare often attract a valuation premium for good reason. When markets are in turmoil, investors want to be positioned in such sectors and companies that have tended to be less vulnerable to market downturns.

One possible way to gain access to this theme, if you so wish, is through the Betashares Global Healthcare Currency Hedged ETF (ASX: DRUG). DRUG tracks the performance of an index featuring global (ex-Australian) healthcare leaders like Eli Lilly (NYSE: LLY), Merck (NYSE: MRK) and AstraZeneca (LON: AZN). Although this fund has underperformed in recent times, it’s still recorded a 9.17% p.a. return over the past five years (as of 28 February 2025).

3 fixed income ETFs that could help to cushion your portfolio

In February 2025, the Australian ETF industry recorded $537 million in inflows for fixed income and cash strategies alone3.

Investors have historically tended to move into bonds when fears around economic growth have been rising. The 2-year bond yield in the US recently fell to levels not seen since before the re-election of Donald Trump while the 10-year bond yield is down more than 50 basis points in less than two months (as at 14 March 2025). Lower yields mean higher prices and greater demand for safe haven assets.

For investors looking to protect their portfolio, investing in longer duration bonds could be one option. Given this is a US-led story, the U.S. Treasury Bond 7-10 Year Currency Hedged ETF (ASX: US10) could be considered by such investors. In a recession, fixed-rate government bonds (like the ones US10 are invested in) may be an attractive option if interest rates have to be cut to spark economic activity again.

A more domestic-facing option can be found in the Australian Government Bond ETF (ASX: AGVT). This fund invests primarily in a portfolio of relatively ‘long duration’ Australian government bonds that have a term to maturity of between 7 and 12 years.

Lastly, if you’re concerned about whether US tariff policies could create a material economic growth scare, a lasting inflation surge, or both, you could consider the Inflation-Protected U.S. Treasury Bond Currency Hedged ETF (ASX: UTIP).

UTIP invests entirely in US Treasury Inflation-Protected Securities (TIPS), a special type of fixed rate bond issued by the US Treasury. Although the interest rate is fixed, the amount you initially invest adjusts with inflation4. TIPS have tended to outperform traditional fixed rate bonds when growth has been muted and inflation/inflation expectations are rising.

Don’t forget the ‘safe haven’ asset

Finally, investors should not forget the role of gold as both a ‘lower correlation’ asset (compared with equities and bonds) and as a potential portfolio ‘diversifier’. As a diversifier, gold’s price historically has tended to go up during times of geopolitical uncertainty, and falling interest rates.

The Gold Bullion ETF – Currency Hedged (ASX: QAU) provides investors with exposure to this asset. Over the 12 months to 28 February 2025, QAU saw a 38.17% net return (9.30% p.a. over the past five years, as of 28 February 2025), which demonstrates the value of gold during uncertain times.

Never miss an update

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire