Over the past year, the Indian stock market has steadily climbed to near record levels, supported by strong domestic earnings, robust retail investor participation, and persistent SIP flows.

However, under the surface of this bullish rally, investors are already posing some key questions: Are markets overvalued? Is it the right time to invest? What is the right strategy for long-term investors?

We believe, India’s structural growth narrative continues to look good. Short term corrections and volatility notwithstanding, Indian stocks remain well-placed for the next decade.

Timing the market in this scenario is becoming progressively more challenging. For long-term investors with moderate to high risk tolerance and a 10-year time horizon, investing via equity mutual funds is a better strategy.

In this editorial, we describe why a 10-year time horizon favours equity mutual funds.

We also present 4 well-researched fund categories (and funds) to build a balanced, high-conviction equity portfolio for long-term wealth creation.

Read on…

#1 Large Cap Mutual Funds

Large cap funds gained focus in 2025 with absolute returns ranging around 18–21%. Institutional flows are turning back to quality large caps as mid and small cap valuations seem stretched.

Fund managers are increasingly stock-selective, investing in high-ROE, cash-surplus companies with consistent dividends.

Amid the numerous choices, finding a fund with consistent long-term performance is crucial.

If you’re looking for consistency backed by robust historical data, one fund that stands out is the Nippon India Large Cap Fund.

What sets it apart is its 10-year rolling CAGR of over 15.25%, among the best in the category.

This performance highlights not only the fund’s ability to capture upside during bull runs but also to protect capital during drawdowns—exactly the kind of balance a long-term investor seek.

The fund’s assets under management (AUM) is Rs 438.29 bn. The portfolio demonstrates a deep belief in India’s growth.

HDFC Bank (8.46%), Reliance Industries (7.2%), and ICICI Bank (5.44%) are its largest holdings. Sector-wise, it has the highest exposure to financial services (30.25%), IT (7.35%), and crude oil (7.2%).

#2 Mid Cap Mutual Funds

The mid cap space has attracted considerable importance from investors on account of the robust earnings growth. In 2025, the Nifty Midcap 150 Index has returned more than 20%, comfortably outpacing the large cap benchmarks by a considerable margin.

But with higher return opportunities come the relatively higher volatility of mid-caps.

Investors should concentrate on mid-cap funds that adopt a disciplined strategy and have proven track record of risk-adjusted returns.

Motilal Oswal Midcap Fund is one such fund. It has an AUM of Rs 330.53 bn and a portfolio focused on high-conviction investments with a comparatively low turnover ratio.

The latest portfolio figures Coforge (10.48%), Persistent Systems (9.59%), and Trent (9.39%).

With a 10-year CAGR of 20.58%, the fund has performed well across cycles. Its sector exposure to IT (24.63%), electricals (12.01%), and retail (9.39%) indicates an investment strategy in tune with India’s economic growth and increasing domestic demand.

#3 Flexi Cap Mutual Funds

In a market scenario with high valuations across large, mid, and small cap segments, Flexi Cap funds have proven themselves.

Their inbuilt ability to move allocations between market caps best positions them to ride out times of increased volatility and high valuations.

Their unconstrained mandate is the key benefit — being able to allocate to the large caps when stability is desired, and to the mid/small caps when there is valuation comfort.

One of the leading schemes in this category is Parag Parikh Flexi Cap Fund. It has an AUM of Rs 1.1 trillion. It has showcased a consistent long-term strategy by having a multi-cap diversification with a firm bias towards quality stocks.

Based on value investing with a world-wide focus, the fund distinguishes itself through the investment of up to 30% in overseas equities.

This provides diversification and a hedge against home market risk. It has produced robust long-term performance, with its 10-year CAGR of 18.58% demonstrating sound risk management.

The portfolio has HDFC Bank (8.06%), Bajaj Holdings (6.92%), and Power Grid Corp (6.09%) indicating a diversified allocation. Top sectors are banks (29.32%), IT (9.85%), and automobile & ancillaries (7.98%).

#4 Value Mutual Funds

Value mutual funds, look for fundamentally strong businesses available at a discount to their intrinsic value. These funds take advantage of a possible change in market leadership — particularly if there’s a correction.

With momentum trades causing frothy valuations in most mid and small caps, value strategies provide a contrarian and cautious path.

One value fund takes a diversified path to uncovering deep-value stocks across market sizes – JM Value Fund.

The fund has an AUM of Rs 11.1 bn and adopts a bottom-up approach, identifying mispriced stocks with a high margin of safety. It does not invest in richly priced names but instead looks at cyclical or recovery plays at reasonable prices.

With steady returns and 10-year CAGR of 18.27%, it attracts long-term investors who are willing to stick with short-term underperformance.

Recent investments are Godfrey Phillips India (3.94%), HDFC Bank (3.24%), and Larsen & Toubro (3.23%). It’s sector exposure is biased towards finance (12.67%), capital goods (11.55%) and banks (10.79%).

Last Decade Market Performance

Past performance is not an indicator of future returns.

This list is not exhaustive.

The securities quoted are for illustration only and are not recommendatory.

(Source: ACE MF)

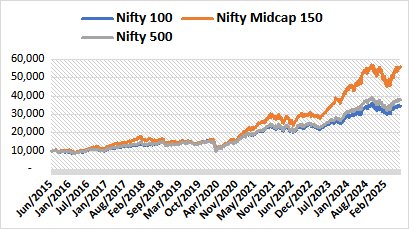

The 10-year trend of performance for Nifty 100, Nifty Midcap 150, and Nifty 500 distinctly indicates the mid cap space has been the leader in performance, particularly after 2020.

But this outperformance has been at a cost of increased volatility and valuation risk, as evidenced through sharp rebounds and corrections since 2023.

Largecaps, in the form of Nifty 100, have given more stable, consistent returns, serving as a buffer in market declines.

The Nifty 500 has given a balanced performance, representing opportunities across segments.

This trend underlines the value of diversifying portfolios. Just following past champions such as mid-caps may put investors in line for steeper drawdowns in the future.

Rather, blending strategies — with large, mid, flexi cap, and value exposure — is a better option over the next decade.

Final Thoughts: Investing for the Next Decade

As the Indian stock market matures and investor involvement deepens, there is an imperative for the careful selection of funds.

Historical returns might grab attention, but what supports long-term wealth generation is a strategy-based portfolio aligning with the shifting market environment and investor objectives.

Rather than following recent winners or responding to market noise, investors would be better served by embracing a framework that balances growth potential with a long term orientation.

In the end, effective long-term investing involves less about selecting the ‘best’ fund and more about being invested through cycles, managing expectations, and letting compounding do its magic.

The next 10 years may not look like the last but with thoughtful fund choices, disciplined allocation, and patience, investors can profit from the opportunities that lie ahead.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.