Narratives meet reality

Amid last year’s runaway market teeming with adventurous investors hungry for returns, asset managers resorted to their old tricks. They went on overdrive hawking differentiated and exotic themes, woven around compelling narratives. The flavours ranged from broader fare like business cycles, consumption, innovation and public sector undertakings to narrow, focused ideas like conglomerates, defence, electric vehicles, manufacturing and tourism. “In the last couple of years, mutual fund houses have aggressively marketed thematic and sectoral funds—those that chase specific macro trends, sectors, or policy narratives. Investors were pitched with stories promising exponential growth,” observes Rajani Tandale, Senior Vice President, Mutual Fund at 1 Finance.

Investors fell for the spiel. 2024 saw a total of 180 new fund offers (NFO) for equity funds; 73 of these were of thematic variety and another 32 were sector oriented. Investors loosened their purse strings generously, putting in a staggering Rs.88,000 crore in these offerings. Comparatively, in 2022, only eight out of 179 new scheme launches were thematic or sectoral funds.

Data from the Association of Mutual Funds in India (AMFI) shows that thematic or sectoral schemes have been mopping up the highest monthly flows in the mutual fund industry, outpacing flexi-cap funds. To put this in perspective, assets under management (AUM) in thematic and sectoral funds have tripled from Rs.1.7 trillion in March 2023 to Rs.5.1 trillion as of 30 June 2025. Comparatively, AUM in flexi-cap funds—which offer diversified exposure to Indian equities—has doubled from Rs.2.4 trillion to Rs.4.9 trillion in the same period.

Big coffers, missing returns

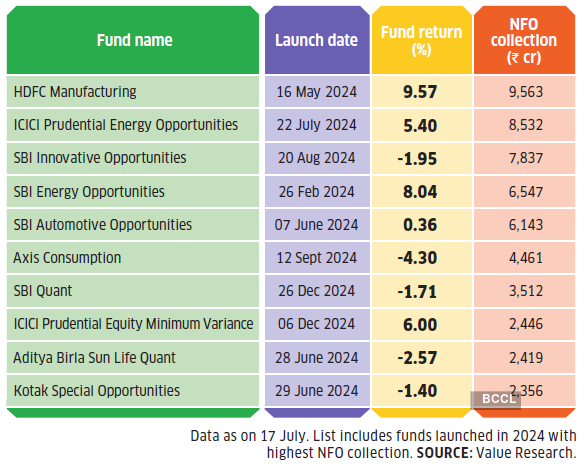

Many thematic NFOs raised big sums but have performed poorly.

So has investors’s faith in differentiated themes been rewarded? Only a few of these have lived up to expectations. WhiteOak Capital Special Opportunities, Motilal Oswal Business Cycle, Tata Nifty Capital Markets Index Fund, and Bandhan Innovation have fetched more than a 25% return since making their debut in 2024.

But for most investors, reality has proved sobering. The performance of most has been mediocre. The NFOs have collectively averaged a measly 5% return from inception. “Despite the flashy launches, only a handful of these funds have managed to outperform broad-based indices like the Nifty 500 over a one-year horizon. In fact, nearly 48% of thematic and sectoral funds failed to beat the Nifty 500 Index during this period,” points out Tandale.

The largest NFO, HDFC Manufacturing Fund, which collected Rs.9,563 crore, has fetched a 9.57% return since its inception in May 2024. The next biggest, the Rs.8,531 crore NFO of ICICI Prudential Energy Opportunities, has clocked 5.4% since its July 2024 launch. SBI Innovative Opportunities, which raised Rs.7,837 crore in August 2024, has lost 1.95%. A total of 19 funds are currently in losses.

To be sure, one year is too short a time frame to judge any fund on performance. Only time will tell how some of these themes will pan out. But the odds are not in investors’ favor. ET Wealth had previously warned about the risks of pursuing such exotic ideas. No investment theme can rely on narratives alone. It needs support of earnings growth in underlying companies and valuations that leave room for upside. Unfortunately, many recently launched thematic funds lack these ingredients.

Timing is everything

This is not to say that a thematic fund has no role to play in your portfolio. These allow you a degree of control over which sector gets to play a meaningful role in your portfolio. When chosen well, a thematic fund can give a fillip to your returns. Vivek Banka, Co-founder, Goalteller, says, “Individuals keen to participate in the growth of specific sectors or themes can invest some amounts to gain from those views.”

But timing is a crucial part of playing any sector or theme. “Thematic and sector funds are inherently cyclical. Timing matters, both while entering and exiting,” asserts Tandale. “Thematic and sectoral funds can go out of vogue and remain underperformers for years,” remarks Banka. Unfortunately, most themes only get offered when there is already a significant tailwind in their favor and are priced with premium valuations. Further, the onus is on the investor to time the exit right. Unfortunately, investors often hold on long after the narrative has already played out. “Mutual fund companies will not issue a recall when the theme peaks. Once the NFO is done, it’s up to the investor to manage entry/exit decisions,” adds Tandale.

Investors who have put large sums in these funds of late must recalibrate. Banka suggests thematic funds should not be more than 25% of one’s equity fund portfolio, and any single theme should not be more than 10%. “If both metrics are within limits and you are not in need of funds over the next 3 years, continue to stay invested. If not, pare back your exposure and move into diversified funds like flexi- or multi-cap funds,” he adds.