Key Takeaways

What’s driving altcoins?

The upcoming deadlines of crypto ETFs in October have revived new interest in altcoins.

Will the altcoin rally hold?

The price pattern shows a potential breakout, which could help the current sentiment hold.

In the last 24 hours, the crypto market capitalization rebounded by 2.2% but still stayed below the $4 trillion mark.

The turn in the market direction has mainly been influenced by altcoins, especially the trending narrative of DEX and launchpad tokens.

These DEX tokens included MYX Finance [MYX], Aster [ASTER], and Pump.fun [PUMP], among others.

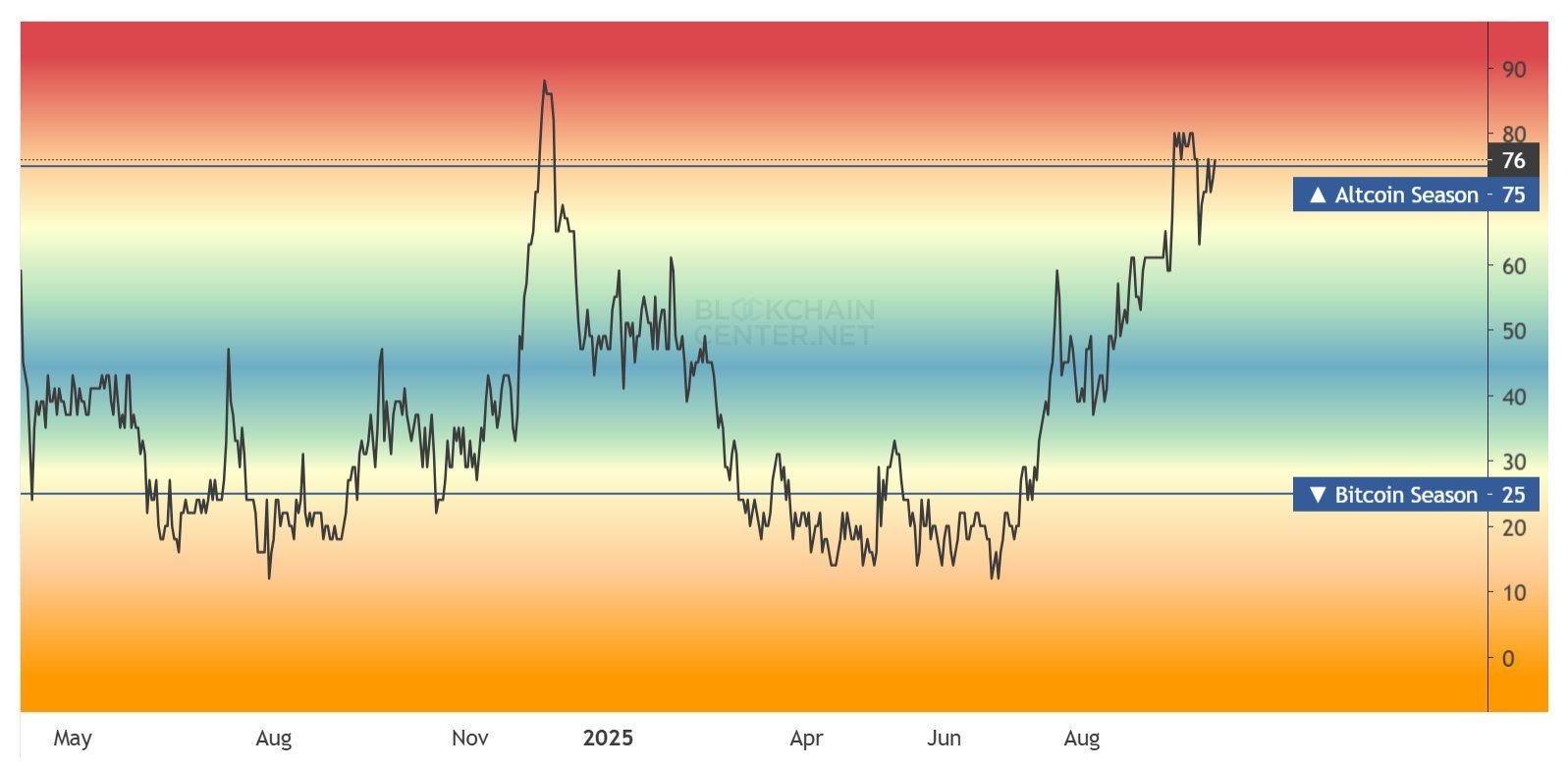

As a result, the altcoin season index on CoinGlass reached the 75% milestone.

Altcoins are poised for a rally due to the approaching approval deadlines of many more ETFs and the expected seasonal performance in the upcoming month.

Is altcoin season back?

The press time reading of the altcoin season index was trading at the 76 mark, indicating the return of Altseason.

More than 75 of top 100 cryptos were outperforming Bitcoin [BTC] at the time of writing, per analyst That Martini Guy B.

Bitcoin was up about a percent on the day, while MYX led with gains across the board. As of press time, the market was entering the final quarter in about a day’s time, and this could be a sign of what could unfold.

In the meantime, if this value failed to hold, the altcoin season could fade away, bearing its usual short stints.

Upcoming crypto ETFs and October rallies!

However, the upcoming crypto ETFs and seasonal tendencies could drive the altcoin rally. Grayscale, among others, will be seeing deadlines for most of their altcoin ETFs in the month of October.

As per Ted Pillows on X (formerly Twitter), the decisions for Solana [SOL], Ripple [XRP], Dogecoin [DOGE], and Litecoin [LTC] ETFs were set for October.

The analyst noted that there were two possible scenarios from the market.

Altcoins could either rally immediately after approval and then retrace, or they could first retrace and then rally. The latter was more sustainable and highly probable, since most of the leverage would have been wiped out.

Additionally, the month of October has been bullish for crypto since 2019, as Bitcoin data shows on CoinGlass. However, Ethereum [ETH] dropped in October 2024 but has been green since 2019.

Still, the technical outlook must align with current developments.

Is a breakout coming?

The chart pattern of the altcoin market cap showed it was on the verge of a breakout. Altcoins were attempting to break above the 2021 highs with prices above the 20 Exponential Moving Average (EMA).

The pattern has seen some resistance, but the upcoming events could change this outlook.

The seasonal performance of October and the potential approval of a couple of altcoin ETFs could set the stage for a continuation of this rally.