These stocks can be set-it-and-forget-it holdings for most investors.

There are many different ways to approach stock investing, but my favorite — and what I recommend to most investors — is through exchange-traded funds (ETFs). ETFs take a lot of the legwork out of investing by allowing you to invest in multiple companies at once. This could range from a few dozen to several thousand.

Vanguard is a financial institution that has over 100 ETFs on the market. Many of them are good investments, but three in particular I’d invest in for the long haul. They each have a different focus that complements the other well.

Image source: Getty Images.

1. Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO +0.55%) mirrors the S&P 500, which is the stock market’s most-followed index. Tracking around 500 of the largest American companies on the market, the S&P 500 is a great way to get exposure to the broader U.S. economy. They’re not directly tied, but the index tends to grow as the U.S. economy expands.

One of the biggest selling points of investing in VOO is the exposure you get to some of the world’s top companies. Larger companies account for more of the ETF than smaller companies, so it has become tech-heavy in recent years (36.1% of the ETF), but it still contains most of the top companies from all major U.S. sectors.

Today’s Change

(0.55%) $3.46

Current Price

$628.41

Key Data Points

Market Cap

$0B

Day’s Range

$625.71 – $628.63

52wk Range

$442.80 – $634.13

Volume

3M

Avg Vol

0

Gross Margin

0.00%

Dividend Yield

N/A

Whether it’s JPMorgan Chase and Visa for financials, Eli Lilly and Johnson & Johnson for healthcare, Coca-Cola and Walmart for consumer staples, or dozens of others, you know you’re getting exposure to some top-tier blue chip stocks when you invest in VOO.

It’s also one of the cheapest ETFs on the market, with an expense ratio of 0.03%. That works out to just $0.30 per $1,000 invested, which is as good as it gets. VOO is a trifecta: diversification, blue chip holdings, and cheap. You can’t go wrong with that.

2. Vanguard Dividend Appreciation ETF

While some dividend ETFs focus on companies with a high dividend yield, the Vanguard Dividend Appreciation ETF (VIG +0.48%) is true to its name. To be included, a company must have increased its dividend for 10 consecutive years and have the financials that show that the dividend increases are sustainable.

Vanguard Dividend Appreciation ETF

Today’s Change

(0.48%) $1.07

Current Price

$222.67

Key Data Points

Market Cap

$0B

Day’s Range

$221.55 – $222.81

52wk Range

$169.32 – $222.81

Volume

836K

Avg Vol

0

Gross Margin

0.00%

Dividend Yield

N/A

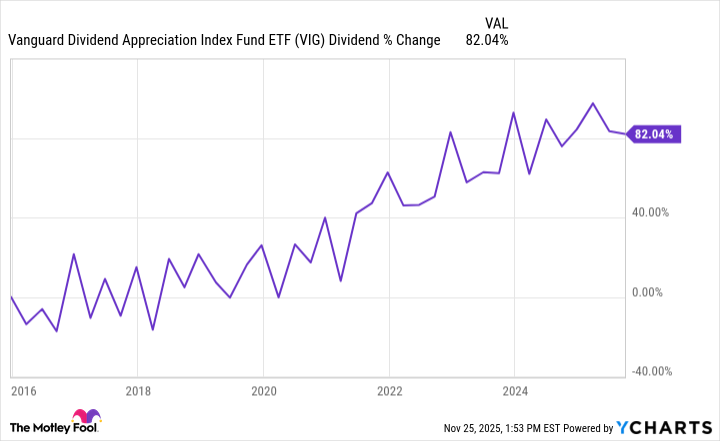

At the time of this writing, VIG’s dividend yield is 1.6% (1.7% over the past five years), which is less than that of other dividend ETFs on the market. However, it’s the focus on dividend increases that makes this ETF a good option for the long haul. In the past decade, VIG has increased its dividend payout by over 82%.

VIG Dividend data by YCharts

Dividend ETF payouts aren’t as straightforward as dividend stocks‘ because each company in the ETF pays dividends at different times. However, you can count on VIG’s payout increasing over time, even with the fluctuations along the way.

3. Vanguard Total International Stock ETF

The two ETFs above hold only U.S. companies, but the Vanguard Total International Stock ETF (VXUS +0.44%) is a great way to gain exposure to international stocks.

One thing I appreciate about VXUS is that it includes companies from virtually every part of the world (outside the U.S.). It holds over 8,600 companies from both developed and emerging markets, giving investors a taste of the stability that often comes with developed markets and the growth potential that comes with emerging markets. Below is how the ETF is divided by region:

- Europe: 37.5%

- Emerging markets: 27.6%

- Pacific: 26%

- North America: 7.7%

- Middle East: 0.7%

- Other: 0.5%

Vanguard Total International Stock ETF

Today’s Change

(0.44%) $0.33

Current Price

$74.94

Key Data Points

Market Cap

$0B

Day’s Range

$74.58 – $74.96

52wk Range

$54.98 – $75.89

Volume

2.5M

Avg Vol

0

Gross Margin

0.00%

Dividend Yield

N/A

Banking on the U.S. economy (by investing in VOO, for example) is one of the safer long-term bets you can make in the stock market, but as the old saying goes: Don’t put all your eggs in one basket. It’s good to have an ETF that serves as a hedge against the U.S. economy, especially during recessions or other downturns.

I don’t recommend having a large chunk of your portfolio in international stocks, but around 10% is a good baseline for most investors.

JPMorgan Chase is an advertising partner of Motley Fool Money. Stefon Walters has positions in Coca-Cola, Vanguard S&P 500 ETF, Vanguard Total International Stock ETF, and Visa. The Motley Fool has positions in and recommends JPMorgan Chase, Vanguard Dividend Appreciation ETF, Vanguard S&P 500 ETF, Vanguard Total International Stock ETF, Visa, and Walmart. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.