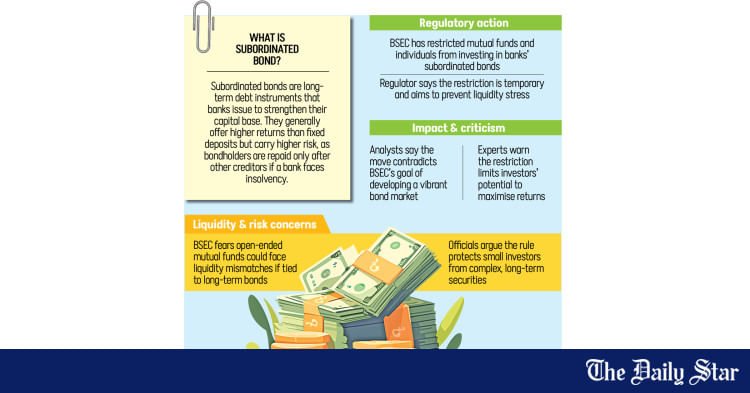

The Bangladesh Securities and Exchange Commission (BSEC) is restricting mutual funds and individual investors from investing in banks’ subordinated bonds, a move that market insiders say contradicts the regulator’s stated goal of developing a vibrant bond market.

Recently, the commission approved a Tk 500 crore subordinated bond for Trust Bank with the condition that “mutual funds and individual investors shall not be eligible to subscribe to the bond.” The same condition has been imposed on similar bonds issued by BRAC Bank, United Commercial Bank (UCB), Pubali Bank, and Jamuna Bank.

While the restriction is not a permanent rule, it raises questions as to why investors will be deprived of the chance to invest in the lucrative securities.

A mid-level BSEC official, speaking on condition of anonymity, said the regulator imposed the restriction mainly to avoid potential liquidity problems for open-ended mutual funds and to protect individual investors who may not fully understand the risks of these long-term securities.

Most mutual funds in Bangladesh are open-ended, meaning investors can withdraw money at any time. If these funds hold large volumes of long-term instruments like subordinated bonds, the regulator fears a liquidity mismatch, where fund managers might struggle to meet withdrawal requests because their money is tied up for years.

Subordinated bonds are long-term debt instruments that banks issue to strengthen their capital base. They generally offer higher returns than fixed deposits but carry higher risk, as bondholders are repaid only after other creditors if a bank faces insolvency.

Senior bankers say the regulator’s move hinders the potential to maximise the wealth of their investors.

Tanzim Alamgir, managing director and CEO of UCB Investment Ltd, said mutual funds should have the freedom to make investment decisions based on proper liquidity analysis instead of being restricted outright.

“Mutual funds should have the flexibility to invest in high-yielding bank bonds where the fundamentals and liquidity profiles justify such exposure,” Alamgir told The Daily Star.

He pointed out that the restrictions are being imposed at a time when government treasury bond yields have dipped below the central bank’s 10 percent policy rate for the first time in two years, while bank bonds are offering around 13 percent returns.

“Preventing mutual funds from accessing these opportunities ultimately hinders the wealth-maximisation potential of their unitholders,” he stated.

Regarding individual investors, Alamgir added, “If individuals can keep fixed deposits with banks at around 9 percent interest, it is worth considering why they shouldn’t be allowed to invest part of that money in the same banks’ bonds that offer higher yields, roughly three percentage points above a six-month FDR.”

He said instead of limiting mutual fund investments in bonds due to exit constraints, policymakers should focus on strengthening the secondary bond market to enable smoother transactions and more liquidity. He also recommended that policymakers consider introducing a formal yield curve to enhance price discovery.

“To make the bond market truly functional, mutual fund participation is essential,” he said, noting that in India, mutual funds account for nearly 20 percent of total bond market participation, which has helped improve liquidity and market depth there.

Speaking on condition of anonymity, a senior official of an asset management company said the liquidity issue regarding subordinated bonds mostly stems from the fact that these bonds are not traded in the secondary market.

“The government should focus on making them tradable there. Public interest is strong because of their attractive returns, and since they’re not perpetual, they should be allowed to trade,” he said.

Responding to the criticism, BSEC spokesperson Abul Kalam said mutual funds should prioritise listed securities and government treasury bonds that are easily liquidated.

“Mutual funds pool investors’ money, and those investors can ask for their funds back anytime,” he said.

“If subordinated bonds are listed on the stock exchange and remain in the ‘A’ category, then mutual funds will be allowed to invest in them,” he added.

He stressed that the restriction is conditional, not permanent. “If the bonds become listed and asset managers apply for permission, the commission will review the matter.”

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.