The catastrophe bond asset class continued to deliver for its investors through the first-half of 2025, exhibiting low correlation with broader financial markets, while spreads continue to track at levels that exceed those seen in high yield benchmarks, Swiss Re Capital Markets has reported.

In its latest Insurance-Linked Securities Market Insights report, the Swiss Re Capital Markets team discuss the volatility seen in global financial markets through the first-half of this year.

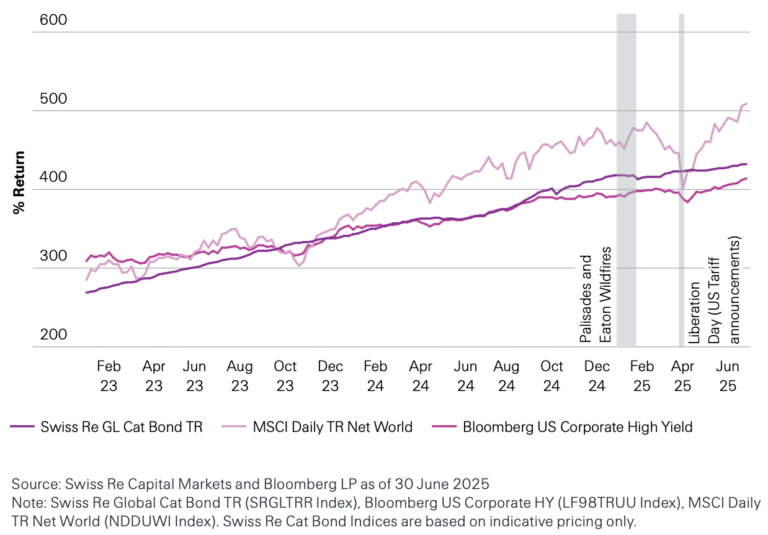

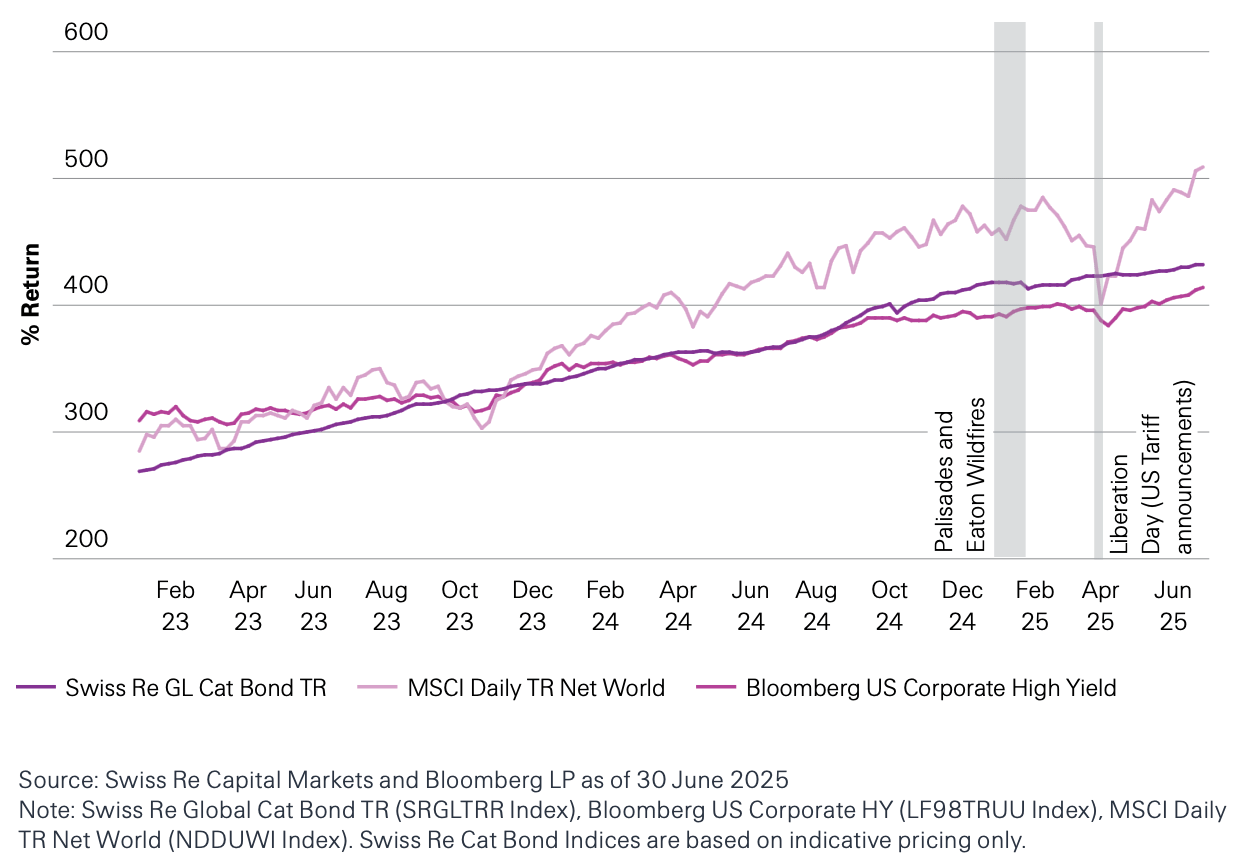

The company explains, “Despite broader financial market volatility driven by factors such as tariffs and foreign exchange fluctuations, the catastrophe bond market has once again demonstrated its low correlation to these macroeconomic events.

“Deal flow remained steady, with new issuances continuing and secondary market values showing no signs of disruption. The Swiss Re Global Cat Bond Index (SRGLTRR) has continued to show low volatility in comparison to corporate high yield instruments and has returned 2.77% in H1.”

In the image below you can see how Swiss Re’s index of catastrophe bond market total returns compares to two broad benchmarks, the MSCI stock index and a Bloomberg corporate high yield index. The cat bond index shows relative stability through periods of broader market volatility.

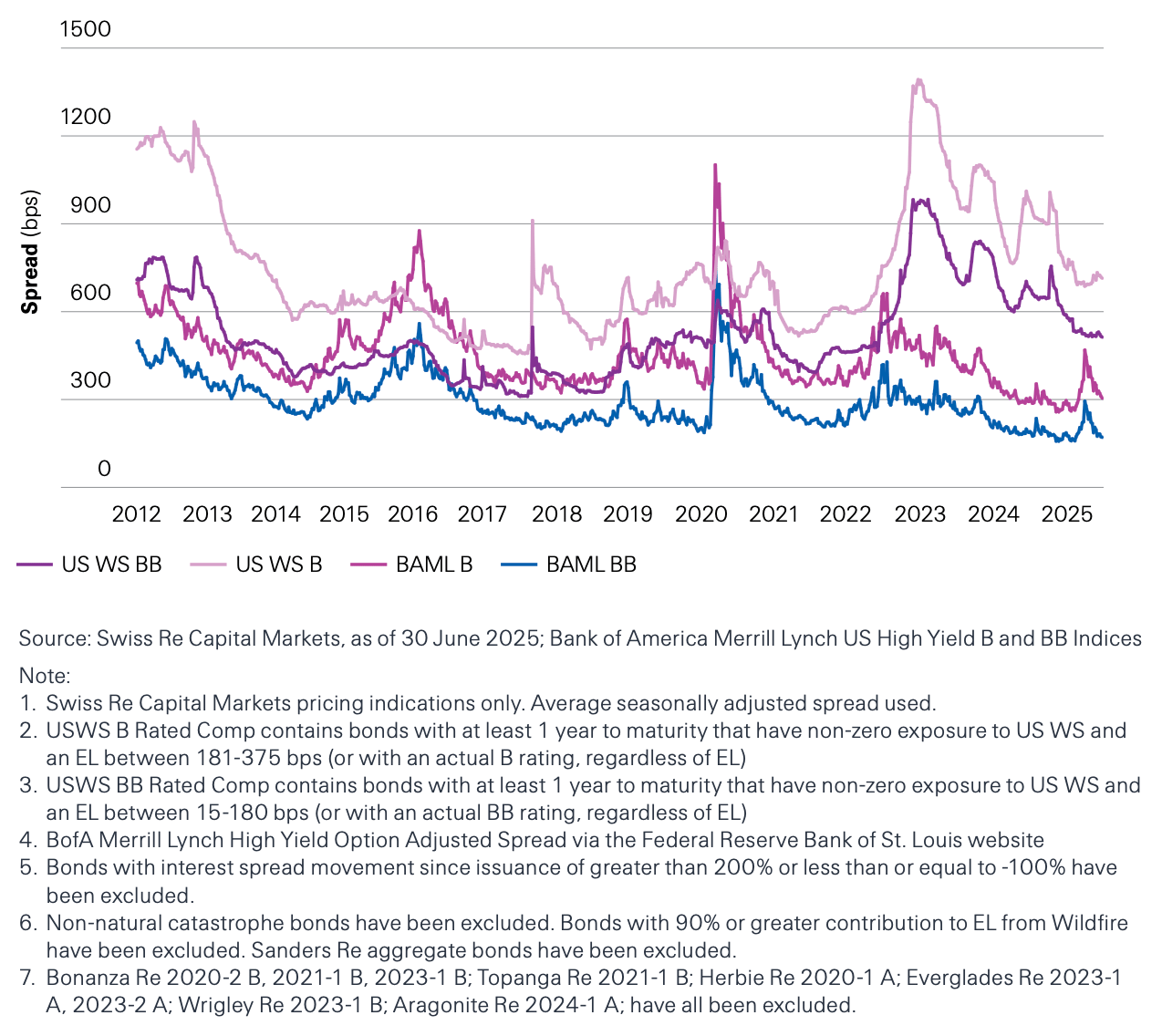

Swiss Re Capital Markets’ report then looks at how cat bond spreads have tightened, but concludes that investors are still deriving attractive returns from the market.

The report states, “Although the market experienced tightening over the first half of the year, buy and hold investors are likely still benefiting from the multi-year nature of cat bonds and the elevated yields of transactions placed in 2023 and, to an extent, 2024. Many of these issuances will continue to pay out coupons through 2026 and 2027.

“Additionally, treasury yields remain elevated compared to pre-Hurricane Ian levels, contributing to the continued attractiveness of cat bond yields, even if the risk interest spreads have tightened considerably since 2024 and on a weighted average basis have returned to pre-Ian levels.”

As another way to demonstrate that catastrophe bond yields remain attractive to investors, the Swiss Re Capital Markets team looks at the average secondary market spreads for US wind-exposed catastrophe bonds, breaking them out into two risk tiers based on expected loss and compares them to certain high yield bond benchmarks.

They explain, “Cat bonds continue to deliver spreads that significantly exceed those of the BofA Merrill Lynch High Yield indices, even during the local peak in high yield credit spreads observed in April.

“This premium underscores the value proposition of the asset class within fixed income portfolios—offering both compelling yield and meaningful diversification benefits relative to comparable credit instruments.”

You can see Swiss Re’s chart showing the relative value of cat bonds versus these high yield benchmarks below.

The charts from Swiss Re Capital Markets help to drive home the value proposition of investing into catastrophe bonds, demonstrating their relative lack of correlation and how the insurance-linked securities (ILS) asset class can act as a diversifying asset for investor portfolios, while showing that cat bonds continue to offer excess spread compared to certain traditional asset class benchmarks.