The dollar slid and Treasuries rose after Joe Biden ended his reelection campaign and endorsed Vice President Kamala Harris. European stocks rebounded from their worst week this year.

Article content

(Bloomberg) — The dollar slid and Treasuries rose after Joe Biden ended his reelection campaign and endorsed Vice President Kamala Harris. European stocks rebounded from their worst week this year.

Market reaction to Biden’s decision has so far been fairly muted, with a Bloomberg gauge of the US currency’s strength slipping 0.1%, while the 10-year Treasury yield dropped 3 basis points. Democrats face the task of uniting around a new nominee with just weeks before their convention, and must rapidly make up ground against Republican frontrunner Donald Trump.

Advertisement 2

Article content

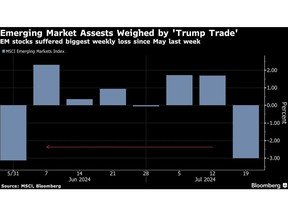

Investors have been wagering on Trump’s return to the White House for weeks, trimming holdings of long-term US bonds and buying Bitcoin, among other things. Now, they’re considering whether the “Trump Trade” is still on. The uncertainty may translate into volatility for markets, though for now, much of the attention is on earnings and the outlook for monetary policy.

“We are more focused on the cadence of the business cycle than on the outcome of the election,” said Morgan Stanley strategist Michael Wilson. “While markets have been digesting the rising odds of a Trump win, cyclical upside from here will likely be dependent on growth.”

In equities, Europe’s Stoxx 600 index rose 0.5%, clawing back some of last week’s 2.7% slump. US stock futures ticked higher.

Investors will have their hands full dealing with major earnings this week. Strategists at Morgan Stanley said companies in Europe have made a positive start to the second-quarter reporting season, with 29% beating profit expectations. Ryanair Holdings Plc failed to boost that track record Monday, falling 13% after the Irish budget carrier cut its outlook for ticket prices in the crucial summer travel period, saying fares will be “materially lower” in its second quarter as consumers grow more cautious.

Article content

Advertisement 3

Article content

In the US, Tesla Inc. and Alphabet Inc. will be the first of the “Magnificent Seven” to report on Tuesday. Analysts will likely press Elon Musk’s electric-vehicle giant on the progress of its plans for robotaxis. And investors will delve into the details of Google’s parent revenue boost from artificial intelligence.

In Asian trading, stocks continued to be dragged lower by a weak tech sector. Chinese bonds were a highlight, gaining after the central bank cut a policy interest rate. The country’s stocks fell, as investors continued to express disappointment at a lack of strong stimulus measures from a recent major Communist Party meeting.

Elsewhere this week, traders will be focused on economic activity data in Europe, US second quarter growth and a Bank of Canada rate decision.

Key events this week:

- Hong Kong CPI, Monday

- Taiwan jobless rate, export orders, Monday

- Mexico retail sales, Monday

- Israeli Prime Minister Benjamin Netanyahu embarks on visit to Washington, Monday

- EU foreign ministers meet in Brussels, Monday

- Singapore CPI, Tuesday

- Taiwan industrial production, Tuesday

- India’s budget for fiscal year through March 2025, Tuesday

- Turkey rate decision, Tuesday

- Eurozone consumer confidence, Tuesday

- Alphabet, Tesla, LVMH earnings, Tuesday

- Malaysia CPI, Wednesday

- South Africa CPI, Wednesday

- Eurozone HCOB PMI, Wednesday

- UK S&P Global PMI, Wednesday

- Canada rate decision, Wednesday

- IBM, Deutsche Bank earnings, Wednesday

- ECB Vice President Luis de Guindos speaks, Wednesday

- Hong Kong trade, Thursday

- South Korea GDP, Thursday

- US GDP, initial jobless claims, durable goods, merchandise trade, Thursday

- G-20 finance ministers and central bankers meet in Rio de Janeiro, Thursday through Friday

- Bitcoin 2024 conference in Nashville, Thursday through July 27

- Japan Tokyo CPI, Friday

- US personal income, PCE price index, University of Michigan consumer sentiment, Friday

- Mexico trade, Friday

Advertisement 4

Article content

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 rose 0.6% as of 8:26 a.m. London time

- S&P 500 futures rose 0.2%

- Nasdaq 100 futures rose 0.4%

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index fell 0.6%

- The MSCI Emerging Markets Index fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0886

- The Japanese yen rose 0.6% to 156.49 per dollar

- The offshore yuan was little changed at 7.2923 per dollar

- The British pound rose 0.1% to $1.2928

Cryptocurrencies

- Bitcoin fell 0.6% to $67,304.73

- Ether fell 0.6% to $3,476.55

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.21%

- Germany’s 10-year yield declined two basis points to 2.45%

- Britain’s 10-year yield declined one basis point to 4.11%

Commodities

- Brent crude rose 0.5% to $83.04 a barrel

- Spot gold rose 0.1% to $2,403.65 an ounce

This story was produced with the assistance of Bloomberg Automation.

—With assistance from Joanna Ossinger, Richard Henderson, Winnie Zhu and Farah Elbahrawy.

Article content