(Bloomberg) — China’s central bank left a key interest rate unchanged, keeping a lid on a bond frenzy as it stays patient in supporting the economy.

Most Read from Bloomberg

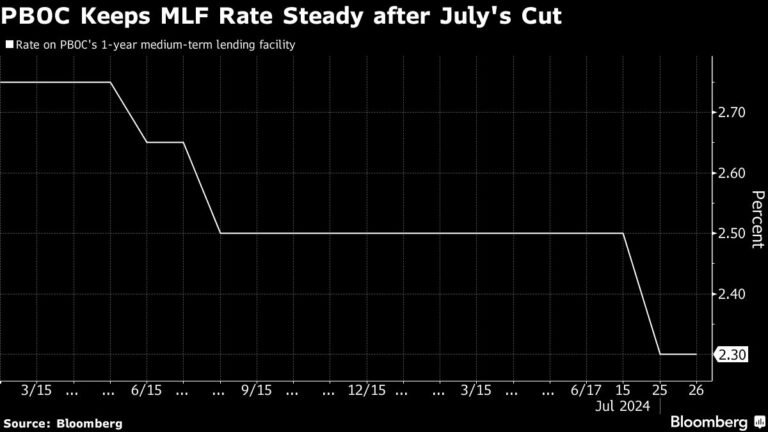

The People’s Bank of China kept the rate on its one-year policy loans, or the medium-term lending facility, at 2.3%, after a slashing the rate by 20 basis points in July. Meanwhile, the central bank withdrew a net 101 billion yuan ($14 billion) from the banking system this month, as 401 billion yuan of the loans expired on August 15.

The net withdrawal is “indicating that the PBOC is keeping reasonably ample and balanced liquidity and preventing excessive liquidity in order to curb the bond bulls,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc.

The decision underscores Beijing’s cautious approach in supporting the economy, even as China reported a rare contraction in bank loans amid weak demand. The PBOC has been walking a fine line of stimulating growth and cooling a government-bond buying spree to limit financial risks in recent months.

In its latest push to limit risks in the debt market, China has initiated stress tests with financial institutions on their bond investments to make sure they can handle any volatility should a record-breaking rally reverse, according to a Monday report by a central bank-backed newspaper.

Read: China Won’t Ban Bond Trading But Sees Risk in Buying Frenzy

Another reason why PBOC chose to drain cash may be that the demand for such loans is tepid. The financing cost for AAA rated commercial banks to seek funding from each other stood at 1.96%, much lower than the cost on MLF.

That said, economists are not ruling out the possibility of further PBOC easing by the end of the year, especially as the Federal Reserve is expected to kick start its rate cut cycle as soon as in September.

“We think the PBOC will likely cut the reserve-requirement ratio by 25 to 50 basis points to support increasing liquidity needs and partially replace maturing MLF,” said Xiaojia Zhi, an economist at Credit Agricole. Banks currently have ample cash, but that may change with maturity of policy loans rising significantly in coming months and the pace of government bond issuance may pick up, she added.

In order to keep liquidity ample at the end of the month, the central bank on Monday also injected 471 billion yuan of short-term cash via seven-day reverse repurchase agreements, it said.

The one-year MLF operation was delayed by the PBOC in August from the previous 15th every month. That’s part of the central bank’s overhaul of its policy rate system that seeks to gradually downplay MLF and pivot to using the short-term rate to guide markets like its global peers.

In an announcement last week, Chinese banks also kept the benchmark lending rates flat for August, wary of potentially smaller profit margins.

–With assistance from Yujing Liu.

(Updates with more details and quotes.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.