The energy sector, which had been lagging the major indexes year to date, is up 8% in the last week. There are plenty of ways to invest in the sector, from majors like ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX), exploration and production (E&P) companies like ConocoPhillips, pipeline giants like Kinder Morgan, or refining companies like Valero Energy. Some investors may prefer the benefits of diversification that come with exchange-traded funds (ETFs).

Here’s why the Vanguard Energy ETF (NYSEMKT: VDE), the iShares Global Energy ETF (NYSEMKT: IXC), and the iShares U.S. Oil & Gas Exploration & Production ETF (NYSEMKT: IEO) stand out as great buys now.

Image source: Getty Images.

The Vanguard Energy ETF

Vanguard has a fund for each of the 11 stock market sectors. The Vanguard Energy ETF targets U.S. oil and gas companies — with over 35% of the fund in ExxonMobil and Chevron, 26.9% in E&Ps, 13.3% in storage and transportation (midstream) companies, and 10.3% in refining and marketing (downstream).

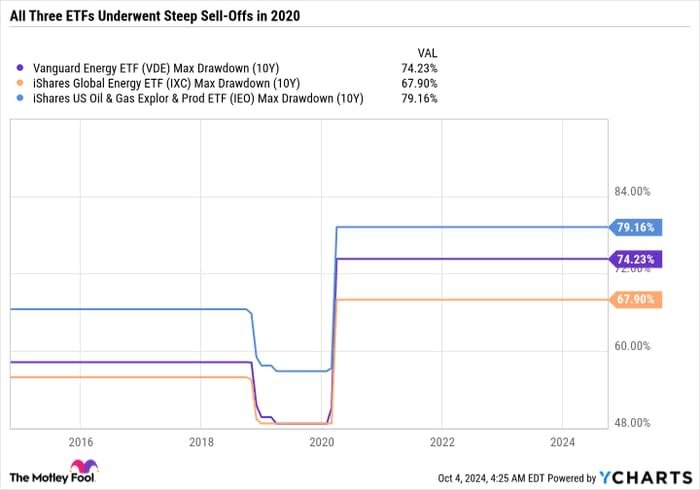

The fund reflects the broader energy sector, which is heavily concentrated in the upstream aspect of oil and gas. Upstream companies tend to be more vulnerable to oil price movements, meaning the fund can be highly volatile when there are big swings in oil prices. For example, when oil prices crashed in 2020, the Vanguard Energy ETF suffered a staggering 74.2% drawdown — mainly due to steep declines in E&Ps. A drawdown is the percentage decline from a peak to a trough.

VDE Max Drawdown (10Y) data by YCharts

The Vanguard Energy ETF stands out as a good choice for investors confident in the U.S. energy sector. The fund has a 0.1% expense ratio and a 3% yield, making it a low-cost way to generate passive income.

iShares Global Energy ETF

The iShares Global Energy ETF is a great way for investors to target some of the top oil and gas companies from around the world. 60% of the fund is in U.S. companies. Like the Vanguard Energy ETF, the fund’s top two holdings are ExxonMobil and Chevron, but they both have lower weightings. In fact, 55.7% of the iShares Global Energy ETF is in integrated oil and gas companies from around the world, including names like Shell, TotalEnergies, BP, Woodside Energy, ENI, Equinor, Petróleo Brasileiro, PetroChina, Repsol, and more.

The concentration in upstream is high, with nearly 75% of the fund in integrated majors or E&Ps. However, some of the largest holdings are Canadian pipeline giants like Enbridge, which are excluded from the Vanguard Energy ETF.

Due to its exposure to global companies — which tend to sport lower valuations than their U.S. peers, the fund has a price-to-earnings (P/E) ratio of just 7.7 and yield of 3.7%. However, the expense ratio is 0.41%, which is pricey for an ETF.

Still, the ETF is arguably worth the fee if you’re interested in the global energy sector because buying shares in companies listed on foreign exchanges can be complicated. Some companies have American depositary receipts, commonly known as ADRs, which allow investors to buy foreign stocks using U.S. dollars. For foreign companies that don’t offer ADRs, an investor would potentially have to buy the stock on a foreign exchange and use foreign currency, which can be complicated and inconvenient.

The iShares U.S. Oil & Gas Exploration & Production ETF

The iShares U.S. Oil & Gas Exploration & Production ETF is misleading, as 77.8% of the fund is in oil and gas E&Ps while 22.1% is in refining, marketing, and transportation companies.

One downside of ETFs is that they can produce redundancies. For example, if you own ExxonMobil but want general exposure to the energy sector, chances are many energy-focused ETFs will hold a significant amount of ExxonMobil. Since the fund doesn’t own ExxonMobil or Chevron, it is an excellent way to invest in the U.S. energy sector if you want more exposure to the upstream industry without the majors.

The top holding in the iShares U.S. Oil & Gas Exploration & Production ETF is ConocoPhillips with a 19.1% weighting. It’s a good choice for standout holding because it is arguably one of the best E&Ps out there due to its efficient asset portfolio, sizable cash flow generation, and solid dividend.

Like the other discussed iShares fund, this ETF has a fairly high expense ratio at 0.4% but a dirt-cheap P/E ratio at just 6.4 and a yield of 2.6%.

Three worthwhile considerations for higher oil prices

ETFs can be particularly effective tools in the energy sector. In addition to the volatility and unpredictability of oil prices, companies face risks when they bet big on a geographic region or a country with less clarity on regulations or government stability. There are also capital structure risks with companies that carry too much debt. An ETF reduces the chance of one major holding blowing up your oil and gas portfolio. However, the price movement of the three discussed ETFs can still be volatile, as we saw with the maximum drawdowns in each fund.

The best ETF for you will depend on how much you are comfortable paying in fees and how each ETF could complement your existing holdings. Regardless of your choice (if any), all three ETFs stand to gain if oil prices keep surging.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Daniel Foelber has positions in Equinor Asa. The Motley Fool has positions in and recommends BP, Chevron, Enbridge, and Kinder Morgan. The Motley Fool recommends Equinor Asa. The Motley Fool has a disclosure policy.