These ETFs have lower price-to-earnings ratios and higher yields than the S&P 500.

The anticipated 10-for-1 split of Broadcom (AVGO -1.98%) has officially arrived. Investors can now buy a full share for around $171 instead of $1,710, although there are now 10 times more shares. Stock splits can affect price-weighted indexes like the Dow Jones Industrial Average but don’t alter market-cap-weighted indexes like the S&P 500 or Nasdaq Composite or market-cap-weighted exchange-traded funds (ETFs).

Broadcom remains the largest holding in the Vanguard Value ETF (VTV -0.72%) and the Vanguard Mega Cap Value ETF (MGV -0.76%). Here’s why both ETFs are worth buying now.

Image source: Getty Images.

Is Broadcom a value stock?

You may be wondering why a red-hot chip stock that has seen its market cap go from $200 billion to nearly $800 billion in just two years is the largest weighting in a value ETF. After all, that performance sounds more like an unstoppable growth stock than a value stock.

Broadcom is an infrastructure software and solutions company with more of a picks-and-shovel model than a specialized chip designer like Nvidia. Broadcom makes chips and network hardware for a variety of end markets, like smartphone makers, internet companies, data centers, and more. It benefits from the increasing computing power needed to run artificial intelligence (AI) models, but not in the same way as a specialized solution like an Nvidia graphics processing unit.

This fiscal year, Broadcom is guiding for $51 billion in revenue and $31.1 billion in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) — a 42.4% increase in its top line, compared to fiscal 2023. Traditionally, Broadcom has sported a premium (but reasonable) valuation, given its consistent growth.

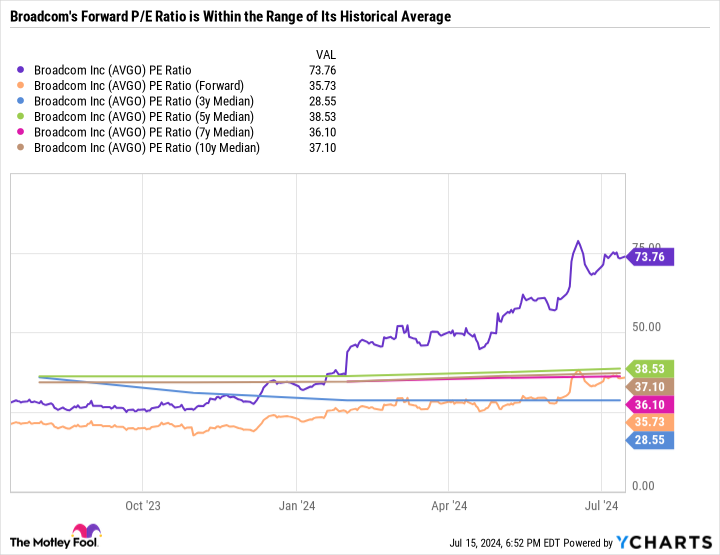

AVGO PE Ratio data by YCharts.

The chart shows that Broadcom’s current price-to-earnings ratio (P/E) is high, but earnings over the next 12 months are expected to soar and bring the P/E back down to its historical range. From that perspective, Broadcom isn’t overvalued.

Cyclical industries, like semiconductors, tend to have low P/E ratios during expansion periods and higher ones when earnings fall during a downturn. Broadcom has been growing earnings at a breakneck pace, but its stock price has outpaced its earnings growth, which is why the P/E ratio has increased. However, the earnings growth has been so strong that the P/E ratio is still not at a nosebleed level.

In sum, Broadcom is a balance between a growth stock and a value stock. However, it’s more value-orientated than high-flying chip stocks like Nvidia, so it’s included in some of Vanguard’s value funds and excluded from its growth funds.

Comparing two of Vanguard’s top value ETFs

The Vanguard Value ETF and the Mega Cap Value ETF are similar but have some key differences in how they apply weightings to individual holdings.

|

Company |

Weighting in Vanguard Value ETF |

Weighting in Vanguard Mega Cap Value ETF |

|---|---|---|

|

Broadcom |

3.6% |

4.6% |

|

Berkshire Hathaway |

3% |

3% |

|

JPMorgan Chase |

2.8% |

3.6% |

|

ExxonMobil |

2.5% |

3.2% |

|

UnitedHealth |

2.3% |

2.9% |

|

Procter & Gamble |

1.9% |

2.4% |

|

Johnson & Johnson |

1.7% |

2.2% |

|

Home Depot |

1.7% |

2.1% |

|

Merck |

1.5% |

1.9% |

|

AbbVie |

1.5% |

1.9% |

Data source: Vanguard.

As you can see in the table, both funds have the same top 10 holdings, but the weightings of the largest holdings are higher in the Mega Cap Value ETF. This is in part because the Mega Cap Value ETF has 136 holdings, compared to 342 in the Value ETF. With fewer positions, the Mega Cap Value ETF concentrates on the largest companies, whereas the Value ETF spreads its allocation across more names.

Both funds have 2.3% yields (paid quarterly). The Value ETF has a slightly lower expense ratio at 0.04%, compared to 0.07% for the Mega Cap Value ETF, but that’s just a $3 difference for every $10,000 invested.

In terms of valuation, the Value ETF has a slightly lower P/E at 18.4, compared to 19.4 for the Mega Cap ETF. This makes sense considering blue chip stocks can garner higher premiums due to their consistency and quality, relative to smaller companies.

Perhaps the most interesting difference between the two funds is their size. The Value ETF has a whopping $168.5 billion in net assets, compared to just $7.6 billion in the Mega Cap Value ETF. But the latter is slightly outperforming the former, with a 19.5% total return over the last year, compared to 18.1% for the Value ETF.

It’s also worth mentioning that there are growth versions of both funds — the Vanguard Growth ETF and the Vanguard Mega Cap Growth ETF. These funds’ top holdings include megacap tech companies like Apple, Microsoft, and Nvidia. Both ETFs provide low-cost ways to invest in top growth stocks.

A simple yet effective way to invest in quality companies

The term “value stock” can sometimes be associated with dirt cheap, bargain-bin companies selling at a steep discount to their intrinsic value, book value, or historical valuations. The Vanguard Value ETF and Mega Cap Value ETF take a different approach by targeting top companies that are a good value based on their current results, track records for returning value to shareholders through dividends and buybacks, and trajectory for future earnings growth.

Sure, there are some inexpensive stocks in both funds. However, the largest holdings aren’t cheap in the traditional value-stock sense. Both funds are excellent choices if you’re looking for quality companies and a lower valuation and higher yield than the S&P 500 — which has a P/E ratio of 29.4 and a dividend yield of 1.3%.

The funds could be a good fit for folks who already own a lot of growth stocks and are looking to put new capital to work in blue chip dividend stocks. Since so many megacap growth stocks have increased in value, a portfolio’s weight in growth stocks could be significantly higher now than a year ago. Investing in a value-focused ETF is a low-cost way to rebalance a growth-orientated portfolio.

The Vanguard Value ETF and Mega Cap Value ETF haven’t put up returns as good as Vanguard’s growth funds but still have rewarded investors handsomely with a reliable passive-income stream and solid returns. Both funds serve as excellent plug-and-play choices if you simply want broad-based exposure to the market through a value lens but don’t want to incur high fees.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Home Depot, JPMorgan Chase, Merck, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Growth ETF, and Vanguard Index Funds-Vanguard Value ETF. The Motley Fool recommends Broadcom, Johnson & Johnson, and UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.