For all the recent buzz around fixed-income retirement solutions, bonds themselves are increasingly falling out of favor with some financial advisors. In their place, fixed-income ETFs are emerging as a popular alternative, offering a simple wrapper that sidesteps many of the clunky mechanics of owning individual bonds.

Processing Content

According to a

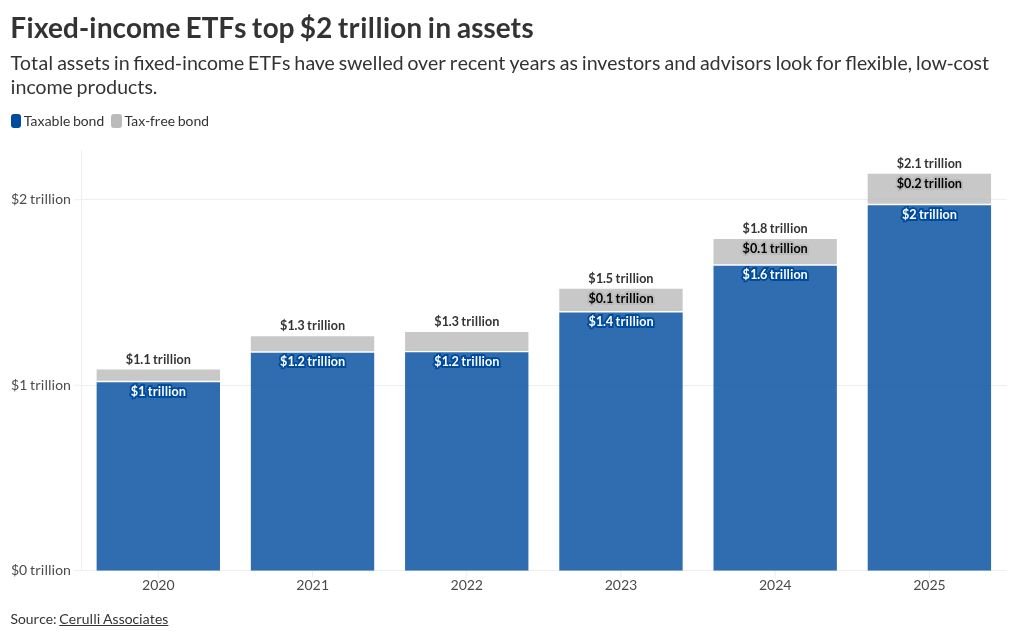

Researchers say that growth is being driven by a convergence of factors, including increased advisor familiarity with these products, a favorable interest rate environment and an ongoing expansion of fixed-income ETF offerings.

More than 300

Growing demand among advisors for such products is a major driver behind that growth, according to the report. A majority of ETF issuers, 71%, say that greater advisor familiarity with these products will be the leading factor behind fixed-income flows over the coming years.

Automating fixed-income investing

For many financial advisors, the appeal of fixed-income ETFs comes down to simplicity.

Building and maintaining

“I would argue the only reason to use actual bonds is if you are attempting some sort of liquidity matching for a client’s personal need,” said Alex Caswell, founder of San Francisco-based Wealth Script Advisors. “With bond ETFs, you get the performance and risk exposure of a directly held bond portfolio, but in one simple, elegant solution.”

Fixed-income ETFs can also deliver diversification that is difficult to replicate with individual bonds.

Bond ladders tend to focus on higher-quality securities, which can narrow diversification. Bond funds, by contrast, benefit from scale and professional management, allowing them to invest across a broader range of credit qualities, including higher-yielding bonds. As a result, clients relying on bond ladders may be forgoing some return potential available through bond funds.

Leveraging institutional scale

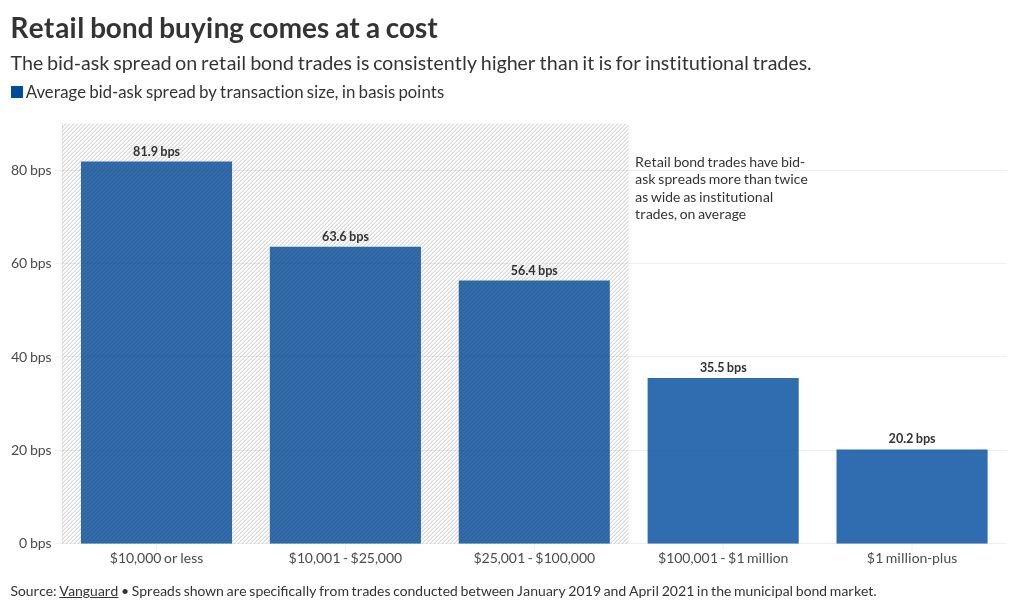

Another hurdle for advisors looking to buy bonds directly is the “bid-ask spread,” the difference between the buying and selling price of a bond. Because many bonds still trade in traditional, mechanical ways, retail traders often

“Spreads are a big consideration when trading bonds,” Caswell said. “ETF fund managers have the advantage of a dedicated trading team, which allows them to trade large volumes of bonds and often secure much better bid-ask spreads as part of that deal.”

Vanguard research has found that retail bond trades (defined as transactions of $100,000 or less) experience significantly higher bid-ask spreads than institutional investors, on average.

With fixed-income ETFs, advisors can access the benefits of institutional scale while trading at smaller, retail levels. That structure also makes fixed-income diversification easier, Caswell said.

“You can buy as little or as much of the bond fund as you want,” he said. “This means a client can get a very diversified bond portfolio at small dollar amounts.”

The next 24 months of fixed-income ETF growth

Issuers are showing no signs of slowing down. According to Cerulli’s report, 59% of ETF issuers say U.S. fixed income is a priority for new product development. That focus will likely concentrate on taxable bonds,

As more products come onto the market over the next two years, issuers say that advisor education, institutional investment and higher fixed-income yields will be key drivers behind asset flows.

About a third of issuers surveyed by Cerulli said they expect asset flows over the coming years to be driven by advisors’ specific needs, including easing concerns about fixed-income ETF risks, such as liquidity, and rising demand for lower-cost fixed-income investment options.

“As ETF issuers expand their product lineups, they also continue to develop a more robust educational platform, providing advisors with additional resources to better understand how these products operate and behave in various market conditions. This has allowed advisors to become more comfortable and familiar with fixed-income ETFs,” Kevin Lyons, a senior analyst at Cerulli, said in a statement.