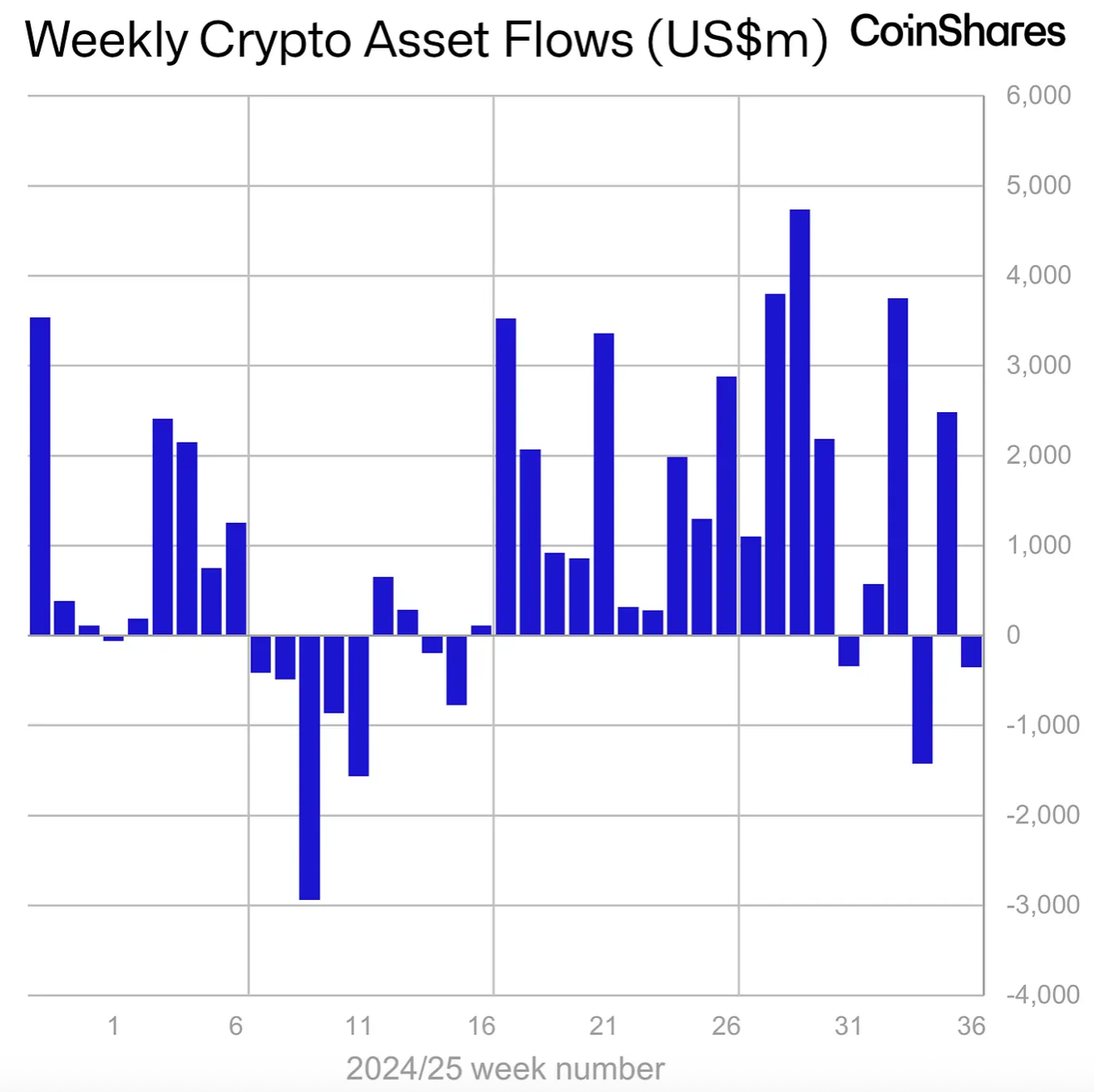

Publicly traded crypto investment products saw a decline in flows in early September, with weekly trading volumes sliding by 27%, according to CoinShares data.

Lower trading volume pushed crypto funds to post $352 million in outflows over the past week, despite a positive outlook for riskier assets following a weak US jobs report and a potential cut in interest rates in the US.

According to CoinShares analysis, the slower activity was pushed by Ether (ETH) products and suggests mainstream investors’ falling demand for cryptocurrencies. “Trading volumes fell 27% week on week, this in combination with minor outflows suggests the appetite for digital asset has cooled a little.”

Ether funds saw the largest losses in the first days of September, shedding $912 million in a week. In contrast, Bitcoin (BTC) products received $524 million in inflows, helping offset broader market weakness.

Across countries, funds listed in the US market amassed $440 million in outflows last week, while Germany recorded inflows of $85 million.

Publicly traded crypto funds give investors exposure to digital assets without requiring them to directly buy or manage cryptocurrencies. Traded on traditional brokerages, these vehicles package crypto tokens into shares that track the underlying price, making them a popular way for mainstream investors to access the crypto market.

Despite the slowdown in appetite for crypto ETFs, inflows in 2025 are still ahead of last year’s performance, indicating that “in a broader sense, sentiment remains intact,” CoinShares said.

Related: SEC approval of listing standards can mainstream crypto ETFs

ETH outflows likely driven by profit-taking, macro trends

Jillian Friedman, chief operating officer of crypto staking protocol Symbiotic, commented on Monday on ETH ETFs cooling demand, saying the funds are “risk-asset plays” and that “profit-taking near ATHs and macro economics seem more likely drivers.”

“U.S. spot ETH ETFs now hold around US$26 billion AUM, with BlackRock’s ETHA controlling over US$16 billion. That’s just a slice of total ETH but highlights capital rotation, not narrative collapse.”

The spot price of Ether has mainly remained level for the past week, ranging from $4,450 to $4,273, according to Cointelegraph indexes.

Kronos Research chief investment officer Vincent Liu recently told Cointelegraph that not only is ETH “entering a period of profit-taking” but that the inflows into Bitcoin ETFs indicate a flight to hard assets, such as gold, due to macroeconomic uncertainty.

Magazine: X Hall of Flame: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer