Press Release

LONDON — August 27, 2024 — ETFGI, a prominent independent research and consultancy firm specializing in providing subscription research on trends in the global ETFs industry, reported today that ETFGI reports the ETFs industry in Japan gathered net inflows of US$268.53 million in July, bringing year-to-date net inflows to US$6.04 billion, according to ETFGI’s July 2024 Japanese ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $588.48 Bn invested in ETFs industry in Japan at the end of July.

- Assets of $588.48 billion invested in the ETFs industry in Japan are the second-highest, the highest recorded was $595.83 billion at the end of March 2024.

- Net inflows of $268.53 Mn gathered in July.

- YTD net inflows in 2024 of $6.04 Bn are ninth highest on record, while the highest recorded YTD net inflows were $51.54 Bn in 2020, followed by YTD net inflows of $43.57 Bn in 2018 and YTD net inflows of $32.88 Bn in 2017.

- 2nd month of consecutive net inflows.

“The S&P 500 index increased by 1.22% in July and is up 16.70% YTD in 2024. The developed markets excluding the US index increased by 3.37% in July and is up 8.12% YTD in 2024. Ireland (up 6.48%) and Belgium (up 6.42%) saw the largest decreases amongst the developed markets in July. The Emerging markets index increased by 0.57% during July and is up 8.70% YTD in 2024. Greece (up 6.93%) and United Arab Emirates (up 6.18%) saw the largest increases amongst emerging markets in July”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

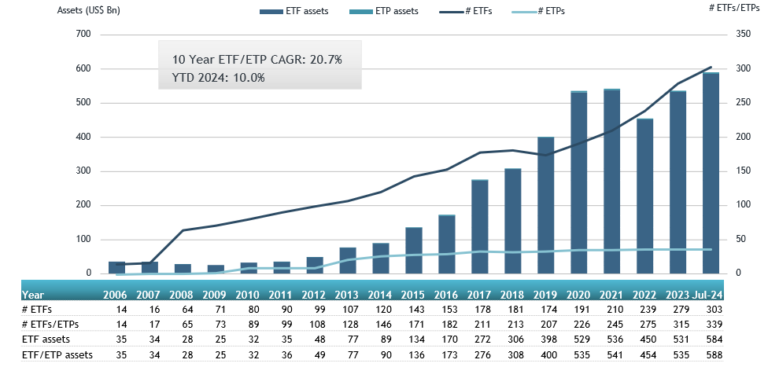

Asset growth in the ETFs industry in Japan as of the end of July

The ETFs industry in Japan had 339 products, with 361 listings, assets of $588.48 Bn, from 15 providers listed on 2 exchanges at the end of July 2024.

Equity ETFs reported net outflows of $823.16 Mn during July, bringing YTD net inflows to $3.82 Bn, much higher than the $622.64 Mn in net outflows YTD in 2023. Fixed income ETFs reported net inflows of $178.68 Mn during July, bringing YTD net inflows to $1.15 Bn, slightly lower than the $1.25 Bn in YTD net inflows in 2023. Commodities ETFs reported net inflows of $39.58 Mn during July, bringing YTD net inflows to $406.40 Mn, higher than the $97.76 Mn in net inflows YTD in 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $2.99 Bn during July. NEXT FUNDS Nikkei 225 Leveraged Index ETF (1570 JP) gathered $1.17 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets July 2024: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

1570 JP |

3,210.81 |

965.01 |

1,174.00 |

|

Listed Index Fund TOPIX |

1308 JP |

74,480.02 |

1,846.03 |

346.31 |

|

iShares Core Nikkei 225 ETF |

1329 JP |

9,374.06 |

92.21 |

317.57 |

|

NEXT FUNDS TOPIX Exchange Traded Fund |

1306 JP |

156,091.60 |

452.11 |

199.84 |

|

iFree ETF-TOPIX Quarterly Dividend Type |

2625 JP |

543.61 |

2.80 |

90.34 |

|

Rakuten ETF-Nikkei 225 Leveraged Index – Acc |

1458 JP |

229.11 |

121.26 |

85.16 |

|

Global X US Tech Top 20 ETF |

2244 JP |

389.29 |

337.76 |

81.27 |

|

NZAM ETF Nikkei 225 |

2525 JP |

639.19 |

(939.83) |

77.38 |

|

iShares 20 Year US Treasury Bond JPY Hedged ETF |

2621 JP |

1,385.15 |

593.88 |

75.46 |

|

NEXT FUNDS Nikkei Semiconductor Stock Index ETF |

200A JP |

113.61 |

116.13 |

63.98 |

|

Listed Index Fund 225 |

1330 JP |

33,861.14 |

342.50 |

63.12 |

|

NEXT FUNDS Nifty 50 Linked Exchange Traded Fund |

1678 JP |

563.27 |

206.38 |

60.45 |

|

NEXT FUNDS International Bond FTSE WGBI ex Japan Yen-Hedged Exchange Traded Fund |

2512 JP |

1,159.90 |

465.46 |

58.31 |

|

NEXT FUNDS Nomura Japan Equity High Dividend 70 ETF |

1577 JP |

953.97 |

165.37 |

53.81 |

|

iShares Core 7-10 Year US Treasury Bond JPY Hedged ETF |

1482 JP |

1,108.61 |

170.34 |

50.74 |

|

iShares MSCI Japan High Dividend ETF |

1478 JP |

616.63 |

122.60 |

42.48 |

|

iShares S&P 500 ETF – Acc |

1655 JP |

636.74 |

602.18 |

41.36 |

|

Listed Index Fund US Equity (S&P500) ETF |

1547 JP |

364.81 |

55.05 |

40.91 |

|

SMDAM NIKKEI225 ETF |

1397 JP |

840.66 |

(24.73) |

38.42 |

|

MAXIS S&P500 US Equity ETF |

2558 JP |

453.29 |

75.34 |

33.73 |

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

Please support us by voting for ETFGI here!

A big thank you to all our friends and colleagues who nominated us for the ETF Express US Awards 2024! Based on your support we are happy to announce ETFGI has been shortlisted for the “Best ETF Research Provider” category (Item Number 23).

Cast your final vote for ETFGI here

Voting closes on Friday, 20th September 2024. Your support is greatly appreciated.

|

|

|

|

|