If you are in your retirement years, building wealth through the stock market might not be the best idea. It doesn’t mean you need to chase the next growth stock or time the market. But it could take long for you to build wealth by only investing in individual stocks. One market downturn could have a significant impact on your profits, and you shouldn’t expect an explosive upside. This is why retirees are piling up on exchange-traded funds (ETFs).

ETFs own a basket of stocks, which reduces risk. Some ETFs pay regular dividends like individual stocks, generating passive income for you. In retirement, the best way to invest your money is to look for ways to generate income while keeping the capital secure. Retirees are piling into Invesco S&P 500 High Dividend Low Volatility ETF (NYSEARCA:SPHD), Schwab US Dividend Equity ETF (NYSEARCA:SCHD), and Fidelity High Dividend ETF(NYSEARCA:FDVV). Here’s why.

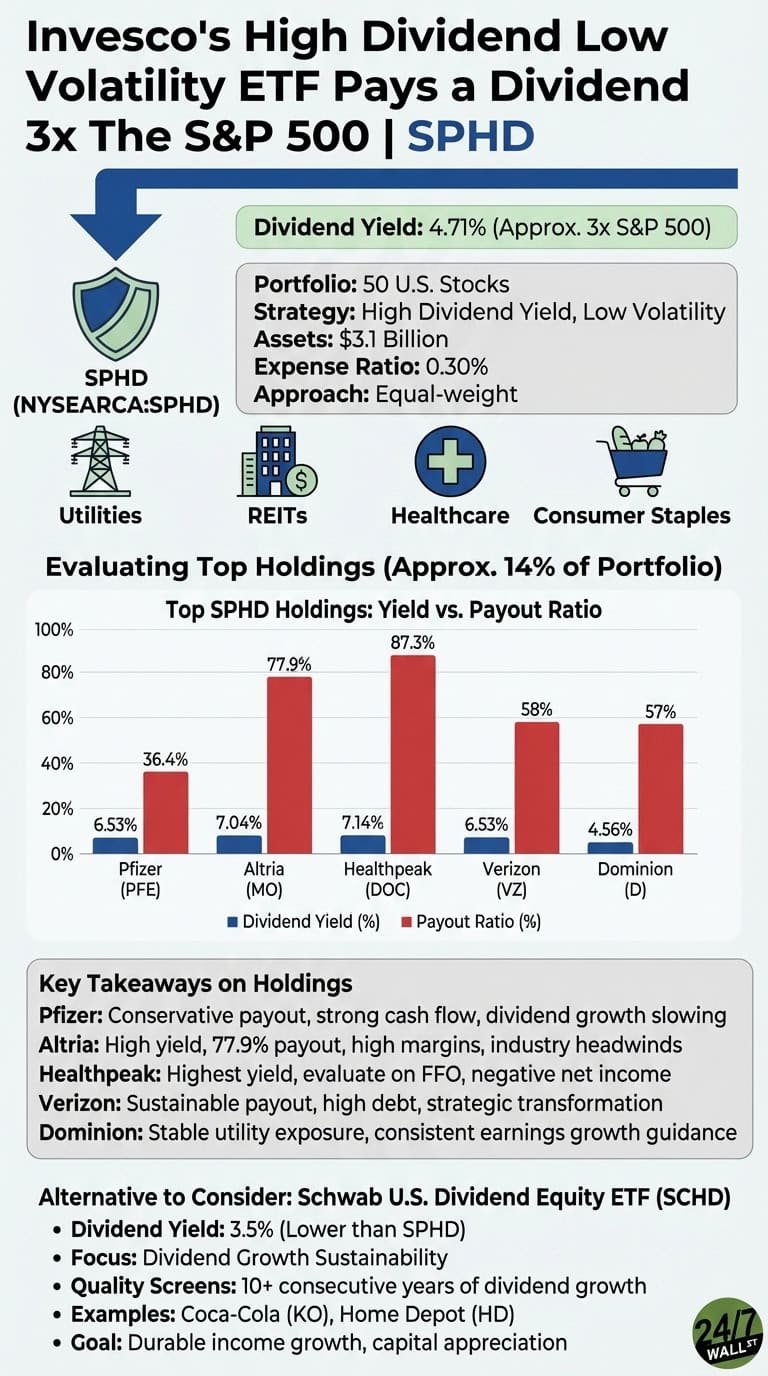

Invesco S&P 500 High Dividend Low Volatility ETF

The Invesco S&P 500 High Dividend Low Volatility ETF is a low-volatility ETF ideal for investors who seek passive income. It has a yield of 4.62% and has $3.39 billion in assets under management.

The fund holds 50 stocks from the S&P 500 and only invests in stocks that have a history of high dividends and low volatility. SPHD has an expense ratio of 0.30%. The fund invests in real estate investment trusts (REITs) and utilities, which could see steady growth this year. It has no technology exposure, setting itself apart from hundreds of other ETFs. SPHD allocates 21% of the fund to the real estate sector and 16% to consumer staples.

While the tech industry is rallying today, SPHD brings stability by investing in diverse sectors that can sustain market ups and downs. When an ETF is heavily inclined to the tech sector, any volatility can directly impact the returns. Since it aims to invest in low volatility stocks, it has picked companies that have strong fundamentals and steady performance.

The top holdings include Altria, Pfizer, Verizon Communications, and Healthpeak Properties. SPHD has generated a 1-year return of 7.64% and a 3-year return of 7.78%.

SPHD has gained about 6.5% in the past year and is exchanging hands for $52.63. One huge reason why retirees are piling into the ETF is the steady income and low risk.

Schwab US Dividend Equity ETF

An excellent fund by Schwab, the Schwab US Dividend Equity ETF is a top choice of retirees for two reasons. One, it has a dividend yield of 3.51%, and second, the fund has gained 12.93% in the past year. It offers steady income and capital appreciation. SCHD is one of the top ETFs for an uncertain market.

It tracks the total return of the Dow Jones U.S. Dividend 100 Index and identifies companies that have paid dividends over the last decade and then scores them based on the dividend growth rate, yield, cash flow to debt, and return on equity. Only the top 100 stocks with the best combination of all these factors will make the cut.

It has an expense ratio of 0.060%. SCHD is a passively managed fund and has the highest allocation to the energy sector (19.88%), followed by consumer staples (18.50%) and healthcare (16.20%). It only allocates 8.20% to the technology sector.

The ETF’s top 10 holdings are strong dividend payers such as Verizon Communications, PepsiCo, Chevron Corporation, Lockheed Martin, and Texas Instruments. It has generated an average annualized 1-year return of 11.34% and a 3-year return of 9.07%.

Exchanging hands for $31.61, SCHD has a smart strategy of investing in only those companies that have shown steady dividend growth. This will ensure passive income for retirees over the years.

Fidelity High Dividend ETF

The Fidelity High Dividend ETF is highly acclaimed for a strong yield and recent performance. It has $7.7 billion in assets under management and an expense ratio of 0.15%. FDVV has a dividend yield of 2.81%. The fund holds 106 stocks and is tech-heavy with 26% allocation to the sector. This is followed by a 22% allocation to the financial sector and 12% to the consumer defensive sector.

The ETF is highly tilted towards dividend yield and considers dividend growth rate and payout ratio when adding a stock to its portfolio. It will only add stocks that have been able to grow their dividends. Hence, the fund has managed to generate strong total returns.

Its top 10 holdings include the Magnificent Seven, such as Nvidia, Microsoft, and Apple. Since it is tech heavy, the fund has also generated impressive returns. FDVV has more than doubled since 2021. It has generated an average annualized 1-year return of 17.20% and a 3-year return of 18.92%. FDVV is ideal for retirees since it doesn’t chase growth and avoids the risky ultra-high yield stocks. Thus, it ensures steady passive income and reliable growth.

FDVV has gained 13.49% in the past year and is exchanging hands for $58.88 at the time of writing. The fund offers a perfect combination of income and growth.

If You’ve Been Thinking About Retirement, Pay Attention (sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance, and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor. Here’s how:

- Answer a few simple questions

- Get Matched with Vetted Advisors

- Choose Your Fit

Why wait? Start building the retirement you’ve always dreamed of. Get started today! (sponsor)