The first wave of crypto ETFs allowed investors to onboard crypto assets into traditional brokerage accounts – and tax-advantaged retirement accounts. Given the long-term return potential of cryptocurrencies, that’s a win-win.

But cryptos are still volatile. Last week’s $19 billion leveraged wipeout in bitcoin surpassed the wipeout at the Covid bottom in March 2020. And the FTX collapse in late 2022.

Crypto ETFs Might Not Hold Good Income Potential

Investors in traditional assets like the upside potential of crypto. But the downside volatility is a bit much to stomach.

They want products that take some of the extreme swings out of it, even if it means a lower upside.

Sponsored

Sponsored

Today, a new wave of ETFs are coming online. They boast higher fees, but more active management.

Not content to simply buy and HODL, they’re employing different strategies to take advantage of the higher volatility in cryptocurrencies.

For more cautious investors, crypto income ETFs may be attractive investment opportunities. But as with anything, buyer beware.

A peek under the hood of some of the income ETFs show that – whether in a crypto-specific ETF or a basket of crypto stocks – there aren’t great total returns.

The Pros and Cons of Crypto Income ETFs

On paper, crypto income ETFs offer investors most of the upside from cryptocurrencies, but with income along the way.

But there’s a catch. Actually, quite a few. The most important is that these ETFs use crypto futures, rather than hold crypto itself.

Being able to manage crypto futures allows for the ability to create income. By buying long-dated futures and then selling short-dated futures, income can be generated from price swings.

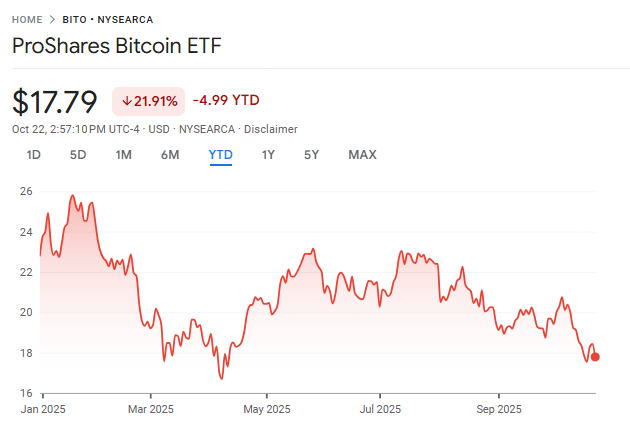

Some of the income returns look good, at least during a bull market. For instance, the ProShares Bitcoin ETF (BITO) boasts a dividend yield of over 50% annualized.

However, investors need to look at the total return. BITO shares are down nearly 20% year-to-date.

Sponsored

Sponsored

With the underlying asset of Bitcoin up over 20%, BITO has generated only a modest gain on top of that. Anyone who has to sell shares of BITO will experience capital loss despite having to pay taxes on dividends received.

And on top of that, investors are paying a 0.95% management fee.

Why The Disconnect?

Using futures, ETFs effectively buy an asset with a time premium that decays. During a bull market, the impact is muted. But in sideways markets or a crypto winter, the losses can be brutal.

Combine that with leverage, and the results can get pretty bad, pretty quickly.

The Defiance Leveraged Long Income Ethereum ETF (ETHI) launched at the start of October.

Designed to return 150-200% of the daily performance in Ethereum and using credit spreads to generate income, shares dropped 30% within their first few weeks of trading.

October 10’s liquidation massacre is the immediate culprit. But the way this ETF is structured, it would likely bleed out over time.

Sponsored

Sponsored

Currently, crypto income ETFs are set up to make investors only during a hot bull market – not a crypto winter, or even a sideway market.

But the crypto space is now more than just cryptocurrencies themselves. There’s an ETF for everything after all, and it’s no surprise that crypto stock ETFs are making a debut.

Beware the Returns In Crypto Stock ETFs, Too

ETFs tracking crypto-related stocks have started to launch this year.

In theory, these may be more attractive for investors compared to a single-crypto income ETF, since they offer some diversification. Let’s take a look at two of them:

At the start of the year, the REX Crypto Equity Premium Income ETF (CEPI) launched.

Boasting a monthly dividend payment, the ETF owns shares of several crypto-related companies, from mining companies, Bitcoin treasury company MicroStrategy, and even credit card giant Visa.

Shares have been volatile since their launch, in a rising market for stocks – not good. But the dividends paid out have exceeded 20% year to date, for a positive total return.

A second ETF that launched this year, the long-winded YieldMax Crypto Industry Portfolio Option Income ETF (LFGY), has a reported distribution of 19.9% annualized.

Sponsored

Sponsored

Yet the ETF, which holds assets such as Coinbase, IBIT, MARA Holdings, and other runaway stock winners this year, is down nearly 25% since inception.

With less than $200 million under management, it’s clear that this ETF is failing to attract investors. And with these returns in the first year of operation, it’s easy to see why.

Managing Volatility Smartly

Despite the increasingly mainstream integration of cryptocurrencies, the October 10th massacre in altcoins serves as a painful reminder.

Cryptocurrency is volatile. And while that volatility should decline as crypto assets gain traction and become integrated with traditional finance, it’s still subject to big swings.

Investors looking to get into the cryptocurrency space don’t want to sit through a 30-50% decline – or more. They want the upside volatility, but may be willing to give up some gains if it means reducing the risk of having to sit through massive declines.

But for now, crypto income ETFs are living up to their name by providing income – but they’re failing to hold their value. That’s a problem over time.

Given the number of new crypto ETFs coming online, more competition in the space should drive ways to improve returns.

For crypto enthusiasts, the ETFs are no reason to switch out of owning the real asset.

For investors looking for crypto exposure, the spot ETFs that hold the underlying crypto still appear to be the best game in town.