TLDR

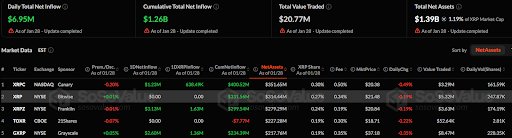

- XRPC ETF on NASDAQ saw a slight decrease of -0.20%, with a net inflow of $1.23 million and $400.52 million in assets.

- XRPZ on NYSE experienced a small decline of -0.01% but recorded a $3.13 million net inflow with $279.29 million in assets.

- GXRP on NYSE showed a +0.05% rise despite a -0.35% drop in market price, with a substantial $2.60 million inflow.

- TOXR on CBOE had no net inflows and a decline of -$7.77 million, indicating weak market activity with $52.64K in value traded.

- XRP (NYSE) recorded minimal daily changes, with no net inflow and stable performance, trading $5.32 million in value.

As of January 28, the total net inflow of XRP ETFs was $6.95 million, contributing to a cumulative inflow of $1.26 billion. The XRP ETFs have been actively traded, with a total value traded of $20.77 million. The total value stood at $1.39 billion, which is approximately 1.19% of the XRP market cap.

XRPC, XRPZ, and GXRP XRP ETFs Records Inflow

A deep dive into the performance of all XRP ETFs reveals that the XRP ETF on NASDAQ (XRPC) experienced a small decrease of -0.20%, with a net asset value of $400.52 million. Its total net inflow was $1.23 million, and the market price was $20.38, reflecting a daily change of -0.49%. It traded around $3.29 million in value, with 161.59K shares changing hands.

XRPZ, another ETF on NYSE, witnessed a -0.01% change, with net assets at $279.29 million. It saw a net inflow of $3.13 million, with its market price standing at $20.84. Despite the small decrease, its total value traded was $3.63 million, with 174.19K shares traded. This suggests a marginal downward trend for this particular XRP ETF.

GXRP on NYSE showed a small rise of +0.05%. Its market price was $37.18, with a decrease of -0.35%. Despite this, it recorded a substantial trading value of $8.47 million and $2.60M inflow, with 228.35K shares changing hands.

TOXR and XRP ETF Hold Stable

On the CBOE exchange, the TOXR XRP ETF experienced a decline in cumulative net inflow of -$7.77 million. It had no recorded net inflow and saw a market price of $18.71. It traded only $52.64K in value, with 2.81K shares.

The XRP ETF on NYSE (XRP) showed a minimal increase of +0.01%, with net assets of $331.56 million. The market price stood at $21.48, declining by -0.1% in daily value change. It recorded no change in flows and traded $5.32 million in value, with 247.87K shares. This indicates a stable trend in the inflows and market performance.