J Studios

Long/short strategies have had a hard time the last decade in general. Being long-only and having full exposure to the S&P 500 has clearly been the winning trade. But that’s not to say that the next 10 years couldn’t be different. I actually think there’s a lot of opportunity in the space as stock picking returns, and if you agree then you may want to consider the Convergence Long/Short Equity ETF (CLSE). This strategy manages a mix of long and short positions to take advantage of market gaps and produce better risk-adjusted returns. This fund uses a dynamic quantitative model to build a portfolio of long and short equity positions actively. Unlike traditional long-only strategies, CLSE’s two-way approach aims to profit from both rising and falling stock prices offering a varied source to generate alpha.

CLSE’s investment philosophy is based on the idea that markets aren’t always efficient, and undervalued or overvalued stocks can create profitable opportunities for smart investors. By examining a wide range of fundamental data, the fund’s managers try to find companies with strong fundamentals for their long positions and those with weakening business models for their short positions. It does this through a process which blends quantitative and fundamental methods, which they term a “quantamental” approach. This mixed strategy combines the bottom-up fundamental analysis of seasoned managers with state-of-the-art quantitative tools and tech. By using huge datasets and advanced algorithms, the fund tries to find and profit from market inefficiencies that old-school stock-picking might miss.

A Look At The Portfolio

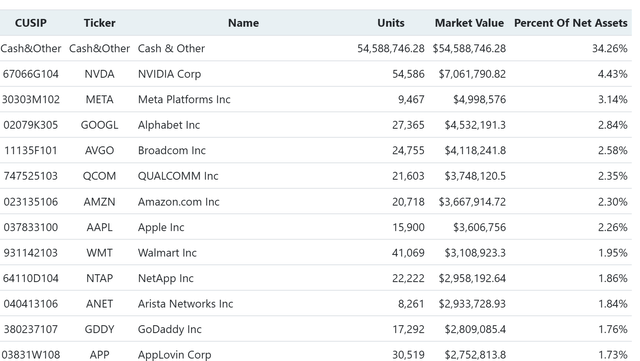

The long side has clearly been well picked as we can see there’s a heavy emphasis on Tech, with Nvidia (NVDA) up top. The weightings are modest, so it’s not a high concentration fund in the top holdings as we see in other long-only strategies. Note the cash position here, which is the effect of the longs being offset by the short allocation.

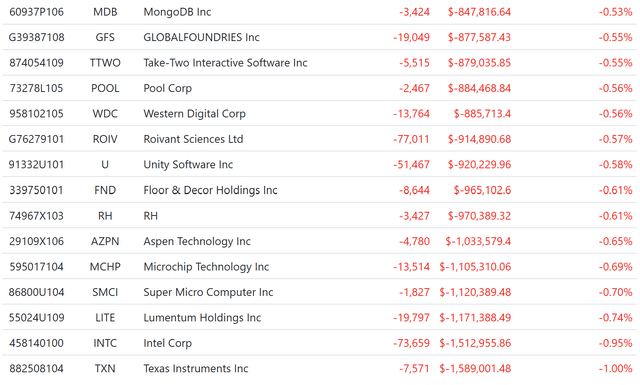

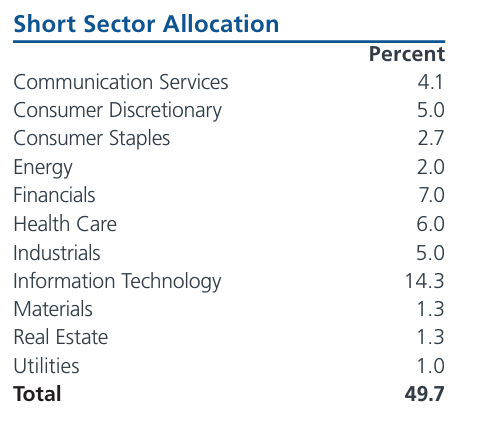

CLSE’s short positions focus on companies showing basic flaws, losing market share, or having business models that can’t last. The fund picks and keeps a close eye on these positions to lower the risks that come with short selling. Note the individual company short positions are smaller in exposure than the top long positions. I think this makes sense given that shorting is notoriously difficult, and you want to be even more diversified there just in case of some gap higher that can come at any moment in time.

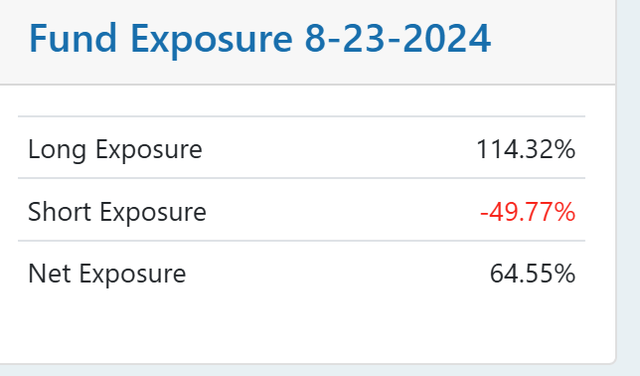

The current net exposure is 65%, which explains the cash allocation (longs minus shorts).

Sector Composition and Weightings

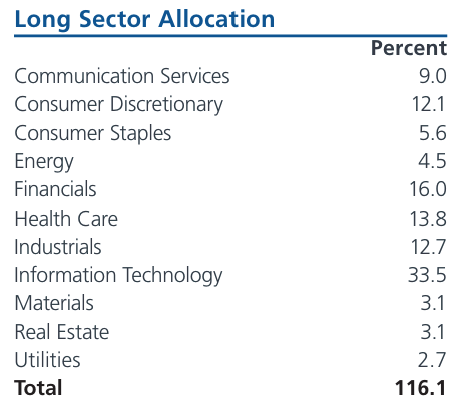

CLSE’s portfolio spreads across various sectors. The fund’s long exposure is currently dominated by Tech, as it should be given how well that sector has performed. Financials come in second followed by Health Care third.

investcip.com

The interesting thing is the largest short allocation also goes to Tech. I actually very much like this as it’s clear the managers are playing spread trades within the sector, going long the winners and short the losers (example of long Nvidia short Intel).

investcip.com

Peer Comparison

While CLSE doesn’t have a monopoly on the long/short equity strategy, its quantamental approach and hands-on management make it stand out from many similar funds. To get a clearer picture of where it stands, we should compare how CLSE performs and what makes it unique against a proxy for the total stock market to see if the fund’s positioning causes it to outperform. When we compare CLSE to the S&P 500 ETF (SPY), we find that the fund has outperformed the S&P 500 since inception, but has broadly been in a wide range. Still impressive given it’s been incredibly hard to beat large-caps in this cycle given how dominant they’ve been.

Pros and Cons

On the positive side, by taking an active role in managing both long and short positions, CLSE tries to create value from multiple sources, which could lead to better risk-adjusted returns over time. The fund’s ability to profit from both rising and falling stock prices can offer a diverse way to create value, something that traditional strategies that buy stocks can’t do. In addition, CLSE’s short positions do more than just hedge; they serve as active alpha sources. When markets tumble, these short positions can balance out losses from the long portfolio. This gives some downside protection and helps to reduce the overall ups and downs in the portfolio. While CLSE looks like an interesting investment option, it’s crucial to recognize and weigh the possible risks and downsides linked to this strategy.

The downside? Short selling itself. While a key part of CLSE’s approach, shorting has its own risks. When a stock you’ve shorted goes up in price, you could lose a lot of money. There’s no limit to how high a stock’s price can climb so your losses could keep growing. Also short sellers might face higher costs to borrow stocks and might struggle to find enough stocks to borrow, which can affect how well the fund does. In addition, CLSE’s hands-on management and use of short positions make things more complicated than simple buy-and-hold strategies. This extra complexity often means you’ll pay more in fees and costs (total expense ratio at 1.55%), which can eat into your profits over time.

Conclusion

The Convergence Long/Short Equity ETF takes a different approach to equity investing. It has the potential to boost risk-adjusted returns through its flexible long/short strategy. CLSE aims to make the most of market inefficiencies and deliver better performance while reducing volatility. It does this by managing both long and short positions. I actually find it impressive how well the fund has done overall, and think the stock picking opportunities going forward will provide a broader tailwind here. This is an ETF worth considering.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.