Edsel Querini

The iShares MSCI Chile ETF (BATS:ECH) has been an underperformer for many years now, and most investors have probably given up on the country, if they were ever even interested at all. However, I believe Chile’s resilient pro-business institutional structures, strong export-led economic model, and diversified equity market offer opportunity at today’s price.

The first thing to realize is that Chile is incredibly tied to commodity prices. The country is a dominant copper exporter. The metal is sometimes called Dr. Copper because it is used in so many economically sensitive applications and thus is significantly correlated to global economic conditions. Chile’s government also uses the profits earned from the copper industry to help fund investments and social services in other parts of its economy.

This commodity exporting model hasn’t served Chile particularly well over the past 15 years, however. In fact, since the MSCI Chile ETF launched, it has now declined close to 50% on a price basis. Chilean stocks pay a reasonable quantity of dividends, but even including those, the total return is still at -18% overall since launch. That’s much worse than the iShares MSCI Emerging Markets ETF’s (EEM) 29% total gain over that period, though Chile has fared only moderately worse than the iShares Latin America 40 ETF (ILF) over the same time period:

To be fair to Chile, the market performed extraordinarily well in the early 2000s as it successfully rode the so-called Chinese economic supercycle of that period. However, as sometimes happens with ETFs, the iShares MSCI Chilean ETF product launched too late to cash in on most of Chile’s equity returns from that favorable period. The Chilean equity market would hit its peak in 2011 and hasn’t come anywhere near its prior highs since.

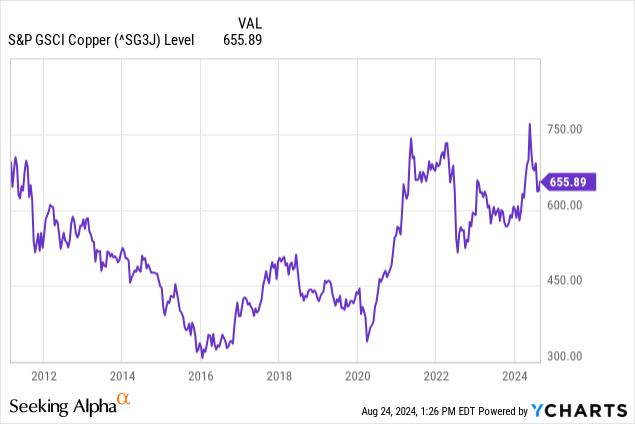

Given the sluggishness in China and other key commodity consumers in recent years, it’s no surprise that copper and by extension Chile have been laggards since 2011. In fact, copper prices are still around where they were back when Chile was firing on all cylinders in 2011 — on the other hand, due to inflation, Chile’s copper is earning much less in real terms than it did 13 years ago:

However, the country has diversified the funds from its copper exports into other industries such as lithium, salmon, fresh fruit and wine exports. Chile has also invested heavily in education and has more potential for tech-driven innovation than many other countries in Latin America.

Regardless, Chile is still heavily tied to precious metals and copper mining. Thus, as the chart above shows, Chile’s outlook has brightened since 2020. Copper has doubled off the COVID-19 lows and has seemingly found a price base at a far higher level than it was trading at in the late 2010s. The invasion of Ukraine and rise in geopolitical tensions around the world more broadly have strained supply chains. Higher levels of inflation also tend to lead to higher commodity prices and demand for hard assets. Chile’s emphasis on fish and fruit exports also gain standing if food supplies from other markets are constrained from geopolitical considerations.

Chile should also be a major beneficiary of the electrification theme. You need a great deal of copper for building out the electric grid, semiconductors, and other components of such networks. In addition, Chile was world-class lithium reserves and assets already in production. If electric vehicles take off at the sorts of rates that proponents are currently projecting, that should drive massive demand for copper and lithium and thus boost Chile’s exports.

The electric vehicle theme hit a bump in the road over the past year, however, with adoption rates slowing and heavy pricing pressure across the industry. EV stocks, especially for smaller firms, have plunged and investors are being more careful with capital allocation to the sector.

In conjunction with that, the price of lithium has collapsed, with Chinese lithium futures dropping more than 80% from their 2022 peak levels. Lithium miners such as Sociedad Química y Minera de Chile (SQM) have seen their stock prices plummet as a result:

This hurts the Chilean ETF not only from the loss of export revenues on its lithium production, but also because stocks like SQM are major components of the Chilean ETF, dragging down its overall results.

In addition, commodity food prices have largely come back down as the world has successfully replaced a lot of the lost production from Ukraine and Eastern Europe that was incurred due to Russia’s invasion. With the global economy seemingly decelerating and countries like China remaining sluggish, commodity tailwinds have faded.

To sum up, Chile’s overall position is stronger than it was five years ago. Its key export, copper, has found itself at a far higher price than it was prior to the pandemic. And trends such as higher inflation and the electrification of the transportation sector should boost key Chilean exports over the next decade. But these favorable trends are currently on pause as the global economy has started to stall over the past 12 months.

The Chilean ETF: More Diversified Than You Might Expect

An interesting point for the Chile is that its market is quite well diversified.

Often times, in emerging markets, you’ll see an ETF end up overly tied to the country’s main industry. For example, look at neighboring Peru, where its iShares MSCI Peru and Global Exposure ETF (EPU) has its top 10 holdings being overwhelmingly in mining companies. That makes the Peru ETF especially correlated to metals prices, thanks to direct exposure from the mining companies and indirect exposure, as the overall Peruvian economy lives and dies by its mining industry.

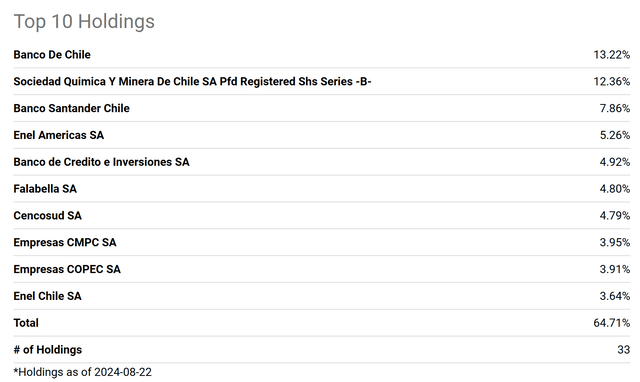

By contrast, Chile’s ETF is far more representative of its whole economy, including consumer-facing companies. Here are ECH’s top 10 holdings as of August 22nd, which constitute 65% of the entire fund:

ECH top holdings (Seeking Alpha)

Banco de Chile (BCH) is the top holding at 13.2% of the ETF. Lithium miner SQM remains 12% of the ETF, even after its recent tumble. If you are bullish on a recovery in lithium but don’t want the single company risk in SQM directly, the Chilean ETF offers reasonable exposure there without being an all-in lithium bet.

Following the top two, a bank, a utility, and another bank make up the top five, respectively. Then things get particularly interesting, with two retailers making up the next two spots. Falabella is a dominant department store chain, mall operator, and e-commerce company which does business in a number of LatAm countries. Similarly, Cencosud operates grocery stores both in Chile and abroad.

Of note, several prominent Chilean companies, including Cencosud, were previously listed in the United States but withdrew their listings once Chile went into a bear market and management felt it was no longer worth paying the fees and compliance costs to retain a foreign listing. As such, this ETF gives investors access to Chilean companies that would be hard to own otherwise. That’s a significant contrast to many emerging market ETFs, where the big holdings are listed in New York and you can largely dodge the ETF annual fee simply by buying the top couple of holdings in said country ETF. Here, however, Chile’s ETF is more broadly diversified and has significant holdings in a number of companies with no ADRs, adding more value for the fund’s holders.

ECH Bottom Line

Finally, a quick word on the outlook for Chilean politics and sentiment going forward. A few years ago, the country elected Gabriel Boric, a young left-wing president, who some analysts felt would be a threat to upend Chile’s long-running stridently pro-business political environment. This was also tied to a reform process that could have gotten rid of the Pinochet-era Chilean constitution and replaced it with a far more socialist-flavored alternative.

However, the Constitutional reform went down to defeat by a massive margin at the ballot box, and Boric has become unpopular in Chile. His cabinet was shaken up and has moved to the political center. And the right-wing is quite likely to win the next election in Chile, which is set for late 2025. All this to say that politics were a real concern to ECH a few years ago — and I bought my position during a sell-off related to such fears — but that dark cloud has long since passed.

That leaves the global commodity market as the fundamental driver for Chilean equities going forward. In my view, Chilean stocks are discounted and too cheap simply because ECH never rallied, even though copper has jumped significantly:

I get all the concerns around copper and lithium demand in the short term. But it’s hard to argue that Chile’s situation is not materially better now than it was five years ago. Despite that, Chilean equities are down slightly, even including dividends, over the past five years. Add in the fact that Chile’s ETF is surprisingly well diversified and offers exposure to a number of companies that are otherwise hard to get access to, and I am a fan of this fund.