The primary markets have been buzzing with many companies coming with new issues. Some of them are unique from industries that have hitherto not found representation in the Indian indices.

However, retail investors often find themselves in situations where they do not get any allotments. Even in cases where they do, the allotment is tiny-sized.

Besides finding it difficult to judge which issues could have listing gains, retail investors may also find it challenging to time their exit in cases where they do make a profit. Or there may be situations they may exit too early to cut losses without realising a stock’s potential. There could also be situations where they could be latching on to weak stocks in the hope of turning a profit.

The situation is further muddied by ‘grey market premium’ predictions around listing-day gains or losses of issues.

As a way to address these issues, and as a unique offering, investors have the option to take exposure to an equity fund that actually invests in IPOs or those companies that have listed recently.

Edelweiss Recently Listed IPO fund (Edelweiss IPO) seeks to invests in recently listed 100 companies or upcoming IPOs. With a track record of over seven years, the fund has delivered a reasonable performance over this period, though it has not been spectacular like select schemes from regular diversified categories.

Steady showing

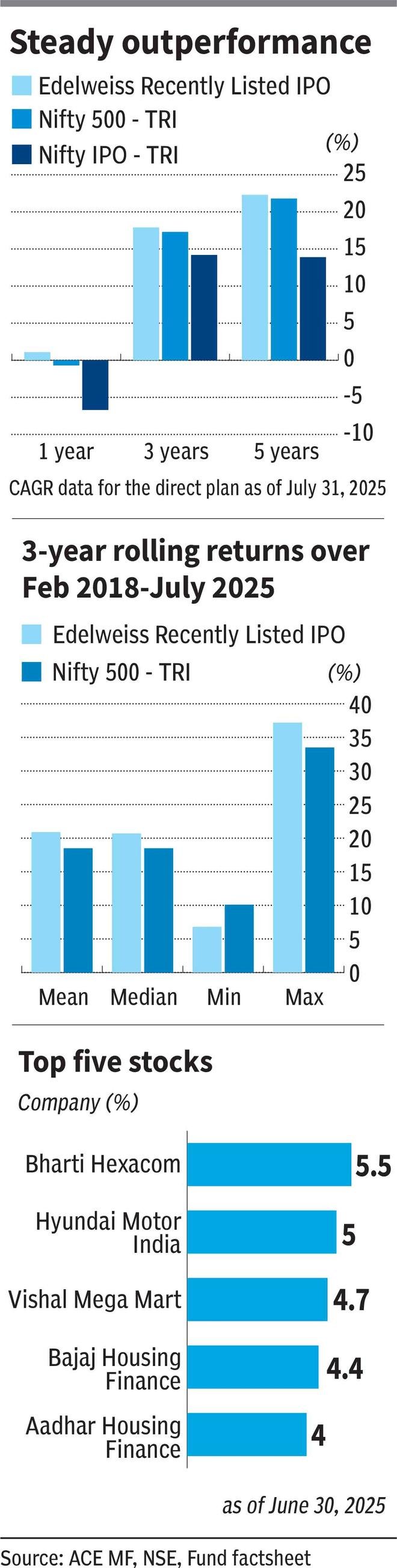

The Edelweiss IPO fund has delivered reasonably well on a point-to-point basis over the medium to long terms. Over the past three-year period, the fund has delivered 17.9 per cent compounded annually, while for the five-year timeframe, the return figure is 22.3 per cent. The scheme is benchmarked against the Nifty IPO index. However, data on this index is not extensively available. However, from NSE data (as of July 31), on a point-to-point basis, the fund has beaten its benchmark by 3-8 percentage points over the medium to long terms.

For comparison, we have taken the Nifty 500 TRI as the benchmark instead. On a point-to-point basis, the Edelweiss IPO fund has done slightly better than the Nifty 500 TRI over three and five-year time periods.

When 3-year rolling returns are taken from February 2018 to July 2025, the fund has beaten the Nifty 500 TRI nearly 56 per cent of the times. Further, on 3-year rolling returns over the above-mentioned period, the fund has given mean returns of 20.9 per cent, while the Nifty 500 TRI managed 18.5 per cent over the same timeframe.

The Edelweiss IPO fund has given more than 12 per cent returns over 89 per cent of the times and in excess of 15 per cent for as much as 79 per cent of the times on a 3-year rolling basis from February 2018-July 2025.

When SIP returns (XIRR) for the past seven years are considered, Edelweiss IPO has delivered 18.8 per cent, while a monthly SIP in the Nifty 500 TRI would have yielded 17.5 per cent.

Though many diversified category funds, especially from the value, momentum, mid and small cap stables have given much higher returns over the past five years, Edelweiss IPO’s performance is still fairly reasonable.

Staying beyond listing gains

In keeping with its mandate, the fund only invests in recent IPOs. Given the frenzy in the primary market, with mostly small and mid-sized firms coming out with IPOs in recent years, the fund is heavily small-cap biased. In fact the proportion has been well above 70 per cent for long periods, though its recent portfolio has a little over 60 per cent in small caps.

The fund holds on the IPOs that it invests in (during or a little while after the IPO) for reasonably long periods (sometimes for periods well over one year), barring rare instances where it exits quickly – during the troubled phase for ecommerce/fintech companies in 2022, for instance.

In the last one year, the fund has benefitted from holding on to stocks such as Bharti Hexacom, Hyundai Motor India, Vishal Mega Mart, Sagility India and Awfis Space Solutions, which have done well even during the turbulent market phase.

Interestingly, Edelweiss IPO holds Kaynes Technology, Bikaji Foods and Doms Industries that listed 1.5-3 years ago. These stocks have delivered quite well in this timeframe and helped the fund in delivering returns.

Given that most IPOs have tended to be priced to perfection or overvalued, with listing gains making them even more expensive, the fund’s style is biased towards growth.

As a diversifier, investors can buy small lumpsums or consider SIPs to take limited exposure. The scheme is certainly not a proxy to make listing gains.

Published on August 2, 2025