Rounaq Neroy

Oct 14, 2024 / Reading Time: Approx. 6 mins

Listen to Sector & Thematic Funds See Highest Increase in Folios: Here’s What It Reveals About Investor Psychology

00:00 00:00

Against the backdrop of escalating geopolitical tensions, particularly in the Middle East, volatility in the Indian equity market increased.

RBI Governor, Mr Shaktikanta Das, in his speech on Global Financial Stability; Risks and Opportunities in the September 2024 bulletin, stated that the contagion risk from geopolitics can no longer be ignored, and geoeconomic fragmentation is weighing on the medium outlook for global growth.

As a result, the inflows into equity mutual funds also reported nearly a 10% dip in September 2024 compared to the previous month.

Table 1: Inflows into Open-ended Equity Mutual Funds (Rs in crore)

| Open-ended Equity Oriented Schemes | Apr-24 | May-24 | Jun-24 | Jul-24 | Aug-24 | Sep-24 |

| Multi Cap Fund | 2,723 | 2,645 | 4,709 | 7,085 | 2,475 | 3,509 |

| Large Cap Fund | 358 | 663 | 970 | 670 | 2,637 | 1,769 |

| Large & Mid Cap Fund | 2,639 | 2,397 | 2,912 | 2,622 | 3,294 | 3,598 |

| Mid Cap Fund | 1,793 | 2,606 | 2,528 | 1,644 | 3,055 | 3,130 |

| Small Cap Fund | 2,209 | 2,725 | 2,263 | 2,109 | 3,209 | 3,071 |

| Dividend Yield Fund | 341 | 445 | 520 | 631 | 500 | 1,530 |

| Value Fund/Contra Fund | 1,987 | 1,404 | 2,027 | 2,171 | 1,728 | 1,964 |

| Focused Fund | (328) | (306) | (287) | (620) | (84) | (273) |

| Sectoral/Thematic Fund | 5,166 | 19,213 | 22,352 | 18,386 | 18,117 | 13,255 |

| ELSS | (144) | (250) | (445) | (638) | (205) | (349) |

| Flexi-cap | 2,173 | 3,155 | 3,059 | 3,053 | 3,513 | 3,215 |

| Total | 18,917 | 34,697 | 40,608 | 37,113 | 38,239 | 34,419 |

(Source: AMFI, data collated by PersonalFN Research)

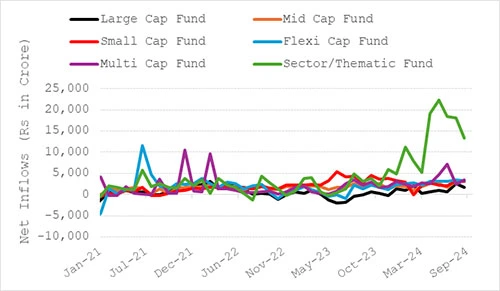

But intriguingly, sector & thematic funds witnessed exceptionally high inflows in September 2024, to the tune of Rs 13,225 crore, in contrast to the other sub-categories of equity mutual funds.

Graph 1: Investors Betting on Sector & Thematic Funds

(Source: AMFI, data collated by PersonalFN Research)

In terms of Assets Under Management (AUM) as well, the largest sub-category of equity funds continued to be sector & thematic funds as its AUM stood at Rs 4.67 lakh crore in September 2024, contributing nearly 39% flows into the actively managed equity mutual fund category.

[Read: Thematic Funds Become Market Leaders with Record-High AUM Growth]

Table 2: Increase in Folios of Equity-Oriented Funds, Aggressive Hybrid, and Passive Funds

| Scheme Type | Folios in September 2024 | Folios in September 2023 | Y-o-Y Change | Change (in %) |

| Sectoral/Thematic Funds | 27,528,614 | 14,315,827 | 13,212,787 | 92.29% |

| Small Cap Funds | 22,338,121 | 14,684,798 | 7,653,323 | 52.12% |

| Mid Cap Funds | 17,511,890 | 11,956,147 | 5,555,743 | 46.47% |

| ETFs (equity-oriented) | 16,728,549 | 12,462,054 | 4,266,495 | 34.24% |

| ELSS | 16,625,720 | 15,423,310 | 1,202,410 | 7.80% |

| Flexi Cap Funds | 16,036,032 | 13,161,385 | 2,874,647 | 21.84% |

| Large Cap Funds | 14,891,416 | 13,047,923 | 1,843,493 | 14.13% |

| Index Funds | 11,233,678 | 5,388,470 | 5,845,208 | 108.48% |

| Large & Mid Cap Funds | 10,606,224 | 8,299,513 | 2,306,711 | 27.79% |

| Multi Cap Funds | 7,988,882 | 4,831,118 | 3,157,764 | 65.36% |

| Value Fund/Contra Funds | 7,522,759 | 5,308,373 | 2,214,386 | 41.71% |

| Balanced Hybrid Fund/Aggressive Hybrid Funds | 5,595,878 | 5,330,143 | 265,735 | 4.99% |

| Focused Funds | 5,096,721 | 5,159,456 | -62,735 | -1.22% |

| Dividend Yield Funds | 1,103,567 | 785,733 | 317,834 | 40.45% |

| Equity Savings Funds | 450,253 | 375,920 | 74,333 | 19.77% |

(Source: AMFI, data collated by PersonalFN Research)

As regards folio (also known as mutual fund accounts), the AMFI data shows that sector & thematic funds added 11.60 lakh folios in September 2024 from the previous month, whereas compared to September 2023, 1.32 crore folios have been added.

The total folio count of sector & thematic funds is a staggering 2.75 crore as of September 2024, the highest among all the sub-categories of equity mutual funds.

What this reveals about investors’ psychology is that in the endeavour to earn higher returns (than some of the traditional investment avenues) are taking the risk.

Also, they are chasing New Fund Offers (NFOs), as a variety of sector & thematic funds have been launched by fund houses capitalising on the upbeat sentiments of the equity markets to lure them into the Rs 10/- proposition.

Perhaps the inflows have also come as most investors have tasted investment success in sector & thematic funds in the past.

The performance data of AMFI reveals that sector & thematic funds have clocked an appealing category average return of 44.2% on an absolute basis (under the Direct Plan) as of October 11, 2024. Even over 5 years, the average compounded annualised returns are 34.8% (as of October 11, 2024.

But a fact also is not all sector & thematic funds have delivered appealing returns to investors. Also, it would be unwise to live under the impression that most sector & thematic funds will perform well year after year.

Remember, the fortune of the sector & thematic fund is closely linked to how the respective sector or the theme it tracks fares. There is a portfolio concentration risk involved. If the underlying sector or theme does not perform owing to the cyclical nature of equities, the returns could falter.

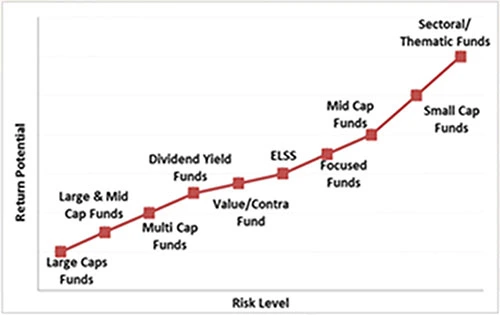

Graph 2: Sector & Thematic Funds Are Placed at the Higher End of the Risk-Return Spectrum

(Source: PersonalFN Research)

The graph above depicts that sector & thematic funds are high risk-high return proposition. However, it is not always true that this hypothetical positive correlation transpires in reality.

If the market conditions turn adverse, i.e. we see a deep correction or a bear phase, plus the particular sectors or themes underperform for a fairly good time period, it could weigh on the portfolio returns. Sorry to say, those who have entered the Indian equity during the COVID-19 pandemic haven’t witnessed what a deep correction or bear phase is and the pain it could cause.

Now, I’m not saying that all sector & thematic funds are bad, and one should totally avoid them. No.

The point I wish to make is that it would be meaningless and imprudent to skew your portfolio to sector & thematic funds just because some fund house has come with a New Fund Offer (NFO) or the historical returns are appealing. Keep in mind that, past returns are not indicative of future returns.

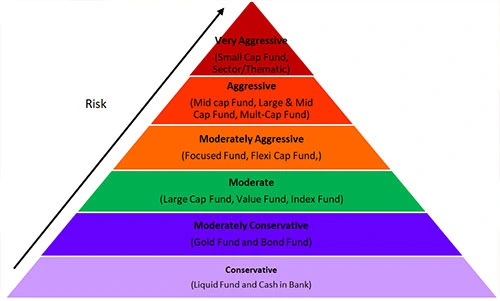

Image: Allocation Pyramid Based on Risk Profile

(Source: PersonalFN Research)

If you have a very high-risk appetite in the pursuit of higher return potential and a longer investment horizon of 7-8 years or more, you could consider adding some of the unique and worthy sector & thematic funds. However, they may be held in the satellite portion of the equity portfolio with a small allocation of up to 10-12% for potential alpha generation.

Your core portfolio of the equity mutual fund portfolio should mainly comprise some of the best largecap funds, flexi-cap funds/multi-cap Funds, and Value/Contra Funds that can add stability to the investment portfolio while it potentially multiplies your wealth. But here too, it is important to have an investment time horizon of around 5 years.

Such a ‘Core & Satellite’ investment strategy shall prove sensible when deploying money into equity funds to address your long-term financial goals. The core portion shall add stability, while the satellite portion would push up the overall returns of the portfolio.

Near the lifetime high of the Indian equity market and when valuations look stretched even on a 12-month forward P/E (Price-to-Earnings) ratio compared to global peers, approach your mutual fund investments sensibly. When making a lump sum stagger your investments, or even better is to make SIP investments.

Fortunately, SIP (Systematic Investment Plan) contributions touching a high of Rs 24,509 crore in September 2024 are a testimony to the fact that investors are recognising the benefits of taking the SIP route. The SIP has hit an all-time high of Rs 13.81 lakh crore as of September 2024. Capital market regulator, SEBI, now has also proposed the idea of Micro SIPs. Watch this video:

Apart from equities for wealth creation, also allocate sensibly to debt & fixed income instruments and gold. An adequate prudent exposure to these two asset classes may add some stability to your portfolio, they may protect you when equities undergo turbulent times.

If you are looking for a tactical allocation to equity, debt, and gold, investing in a Multi-Asset Fund would also be a meaningful choice now.

[Read: Why Investing in Multi-Asset Allocation Funds Makes Sense Now]

Following a sensible asset allocation as per your risk profile and envisioned financial goals, paves the way to financial success in the long run.

Be a thoughtful investor.

Happy Investing!

-New.png)

ROUNAQ NEROY heads the content activity at PersonalFN and is the Chief Editor of PersonalFN’s newsletter, The Daily Wealth Letter.

As the co-editor of premium services, viz. Investment Ideas Note, the Multi-Asset Corner Report, and the Retire Rich Report; Rounaq brings forth potentially the best investment ideas and opportunities to help investors plan for a happy and blissful financial future.

He has also authored and been the voice of PersonalFN’s e-learning course — which aims at helping investors become their own financial planners. Besides, he actively contributes to a variety of issues of Money Simplified, PersonalFN’s e-guides in the endeavour and passion to educate investors.

He is a post-graduate in commerce (M. Com), with an MBA in Finance, and a gold medallist in Certificate Programme in Capital Market (from BSE Training Institute in association with JBIMS). Rounaq holds over 18+ years of experience in the financial services industry.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, Membership of BASL and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes. Use of this information is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and use such independent advisors as he believes necessary.