Illustration: Binay Sinha

Thematic investing is the flavour of the season, with the category becoming the top draw in the equities segment.

It is set to receive a further boost with a slew of passive product launches in this space. Industry players see this as the cosmosis of two forces.

Passive investing has already been gaining popularity over the years on account of their low cost of investing and relative outperformance.

In recent weeks, six new fund offerings (NFOs) on the passive side collected over Rs 2,600 crore.

These include Tata Nifty India Tourism Index Fund, Motilal Oswal Nifty India Defence Index Fund, Kotak BSE PSU Index Fund, Axis Nifty 500 Index Fund, Bandhan Nifty Total Market Index Fund and HDFC Nifty100 Low Volatility 30 Index Fund.

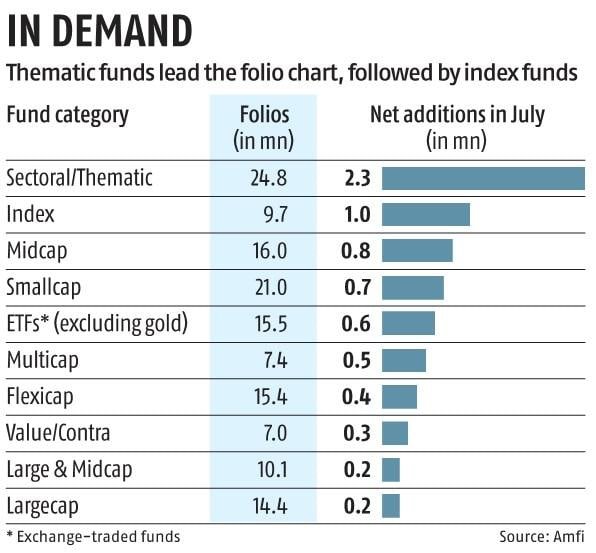

This accounted for 14 per cent of the total net folio additions for mutual funds (MFs) during the month.

By comparison, index funds had added just 0.4 million accounts in June.

According to MF executives, the sharp surge in index fund folio count in July was a result of a slew of NFOs, particularly in the thematic space.

“There is no doubt that index funds are gaining traction with investors. The industry has seen many new types of index being launched over the last few months. We ourselves have launched a series of index funds including India’s first Tourism index fund by the name — Tata Nifty Tourism index fund. All this is leading to increased interest levels among investors,” said Anand Vardarajan, CBO, Tata Asset Management.

The recent index fund offering notwithstanding, investor affinity for thematic funds is more pronounced on the active side.

Sectoral and thematic funds are now the largest active equity MF category with the assets under management (AUM) growing over two-folds in the last one year.

The category, considered to be the riskiest among all MF offerings, had an AUM of Rs 4.21 trillion at the end of July vis-a-vis Rs 2 trillion in July 2023.

Pratik Oswal, chief of business Passive Funds, Motilal Oswal AMC, also said the surge in folio additions reflects growing investor interest in thematic funds.

“Motilal Oswal AMC added around 417,000 new passive folios last month alone, reflecting a significant rise in investor interest in thematic index funds. While it’s difficult to estimate the growth rate of other players, the usual trend in the index fund category is around 350,000 to 400,000 each month,” he said.

Overall, index funds have added 2.2 million folios in the first four months of this financial year.

The tally is already 59 per cent of the 3.7 million net additions seen in FY24, according to data from the Association of Mutual Funds in India (Amfi).

Apart from thematic offerings, the demand for index funds is also being driven by factor funds. Several AMCs have launched index funds which track various single or double factor indices.

In a recent report, the Motilal Oswal MF noted that the AUM of passive funds have surged past Rs 10 trillion and now account for 17 per cent of the market share.

As of July, index funds had an AUM of Rs 2.6 trillion, while exchange traded funds (ETFs), except for gold ETFs, were managing Rs 7.8 trillion.

Commodity ETFs, which track gold and silver prices, and most of the international MF offerings also fall in the passive bracket.

ETFs — that mimic the returns of their underlying benchmark index such as the Nifty, Sensex or the MSCI Emerging Market index — have seen their popularity rise over the past decade.

Domestic ETF’s assets under management (AUM) have surged 68x from Rs 15,000 crore in 2015 to Rs 10 trillion at present.

First Published: Aug 22 2024 | 8:49 PM IST