Many of us make a common mistake in life – not planning for retirement. Reasons may be plenty – low starting salaries, busy work schedules and a lack of knowledge about investing. Investment gurus always say that the most important thing in investing is ‘start’ and the second most crucial thing is ‘patience’, and the result of these two is ‘success’. This is what legendary investor Warren Buffett also teaches us: time and patience are the key to building wealth through the magic of compounding.

Mutual fund SIP best way to exploit the compounding benefit

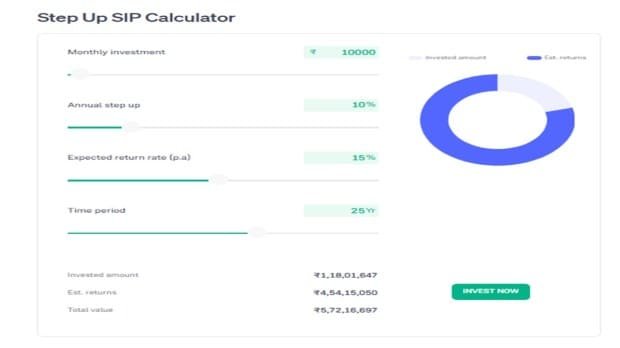

So if you develop a habit of regular investment, even small investments can be converted into a substantial corpus through a mutual fund systematic investment plan (SIP). This write-up will explain how you can build a big retirement corpus of over Rs 5 crore through a regular step-up SIP and retire stress-free at the age of 50.

Let’s look at a practical approach to when and how much one can start investing through SIPs. While there is no fixed limit, considering the current average salary in many sectors, it can be assumed that one can begin with a monthly SIP of Rs 10,000 once financially stabilised in a job.

For this example, let’s assume a person enters the job market at the age of 22. This is usually when most of us start working and gradually gain professional stability. In the first three years, we learn to manage our expenses while balancing lifestyle needs, monthly budgets, and other financial responsibilities.

After three years of working, let’s assume the person feels financially confident and begins investing through an SIP. As a beginner, the individual can start with a monthly SIP of Rs 10,000. This amount is quite practical, considering the average salaries professionals earn after three years of experience in most sectors today.

As salaries rise over time, the SIP contribution can be increased by 10% annually (step-up). This not only boosts the overall investment amount but also enhances the power of compounding over the long term. That’s why starting early and gradually stepping up your investments is critical for building wealth.

When it comes to returns, one can reasonably expect around 15% CAGR over a 25-year investment horizon. In fact, Value Research data shows that more than three dozen equity funds out of around 130 that have been in the market for over 20 years have delivered returns above 15%.

How to build a Rs 5 crore corpus? (Step-by-step calculation)

Assuming:

Starting SIP amount: Rs 10,000/month

Annual increase (step-up): 10%

Estimated CAGR: 15%

Investment period: 25 years (25 to 50 years)

Annual SIP amount and estimated corpus:

First year: Rs 10,000 × 12 = Rs 1,20,000

Second year: Rs 11,000 × 12 = Rs 1,32,000

Third year: Rs 12,100 × 12 = Rs 1,45,200

10% increase every year thereafter for the next 22 years…

Total investment over 32 years: approximately Rs 1.18 crore

Estimated returns: Rs 4.54 crore

Corpus after 25 years at 15% CAGR: Rs 5.72 Crore

Courtesy-Groww

Compounding effect of SIPs:

Not only investment gurus, but even Albert Einstein acknowledged the power of compounding, calling it “eighth wonder” of this world.

The biggest advantage of SIPs is compounding. This is the process by which returns from your investments are added to your capital each year, leading to even higher returns the following year. Small investments grow over time into a substantial corpus.

Over a period as long as 25 years, investors who make regular SIPs benefit from long-term average returns, regardless of market fluctuations. This is why SIPs are considered the most effective way to grow even small investments over the long term.

Caution: Past returns do not guarantee future returns

Here, we are assuming a CAGR of 15%, which we have seen scores of equity funds delivering over the long term. But remember that past returns do not guarantee future returns. Markets fluctuate, and risk always exists.

Therefore, it’s crucial to consider fund selection, diversification, and your risk profile when investing. It’s always beneficial to gather accurate information and be risk-aware before making any investment decision.

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.