The Guardian: “David McCormick […] Led the Largest Hedge Fund in the World While It Managed and Advised Funds Holding Hundreds of Millions of Dollars in Russian Debt”

PENNSYLVANIA — Today, veterans and members of National Security Leaders for America called out new reporting revealing that David McCormick invested $415 million in Russian debt as CEO of Bridgewater Associates.

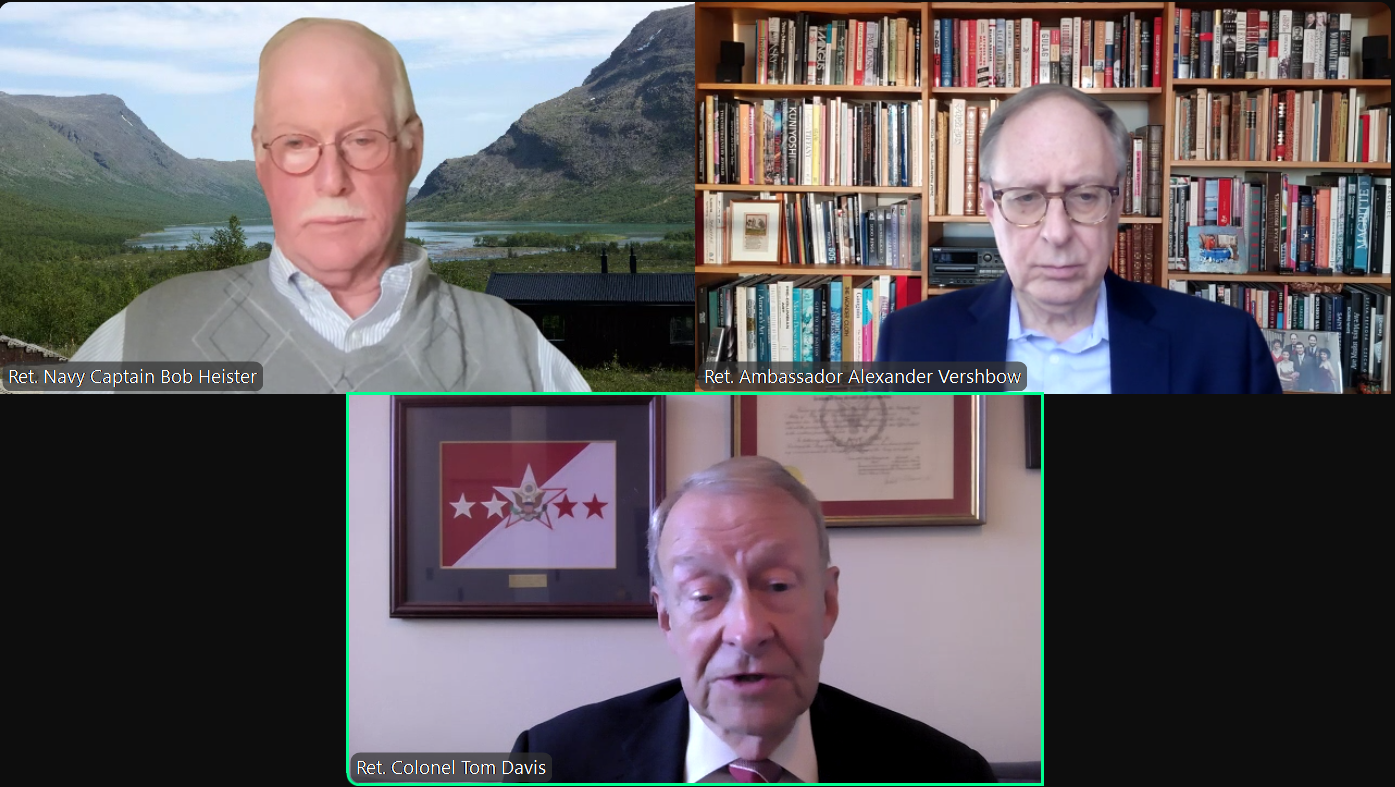

“David McCormick having a record of investing in America’s foreign adversaries as he runs for US Senate is troubling,” said Alexander Vershbow, Retired Ambassador to Russia. “America’s elected officials have a responsibility to prioritize the country’s national security rather than supporting our adversaries.”

“It’s deeply concerning and irresponsible that someone seeking to represent Pennsylvania in the US Senate has so many foreign financial ties,” said Tom Davis, Retired Army Colonel Tom Davis. “Pennsylvanians deserve to know that their leaders are committed to putting America’s national security interests ahead of any investment interests, especially those with US adversaries.”

“America’s leaders have a responsibility to put the country’s priorities ahead of their own, or of our adversaries,” said Bob Heister, retired Navy Captain. “Pennsylvanians can’t trust someone who has a record of helping their own bottom line by investing millions with America’s adversaries, as David McCormick has. There are more patriotic ways of acquiring wealth but, while getting rich, McCormick made choices that devastated Pennsylvania communities, and that hurt this country.”

Read More About David McCormick Prioritizing America’s Adversaries:

David McCormick led Bridgewater Associates while it invested $415 million in Russian government bonds.

David McCormick helped grow China’s military.

- As CEO of Bridgewater, McCormick also increased investments in China by 108,000%, including in blacklisted Chinese companies with ties to the Chinese military.

McCormick invested in companies that did business with Iran.

- As CEO of Bridgewater, McCormick invested in companies that Pennsylvania’s Treasury divested from and a subsidiary of a company whose assault weapons and grenade launchers were seized from the terrorist group Hamas.

McCormick has also been criticized for managing money for the Saudi sovereign wealth fund.

###