Small-caps chased by retail investors over more than two years plunged nearly 24% from their most recent highs, before a rally over the last three days limited losses to 20%. However, it remains to be seen whether this momentum will continue and if the correction is truly over.

Also read | Smallcap survivors: These sectors weathered the market correction

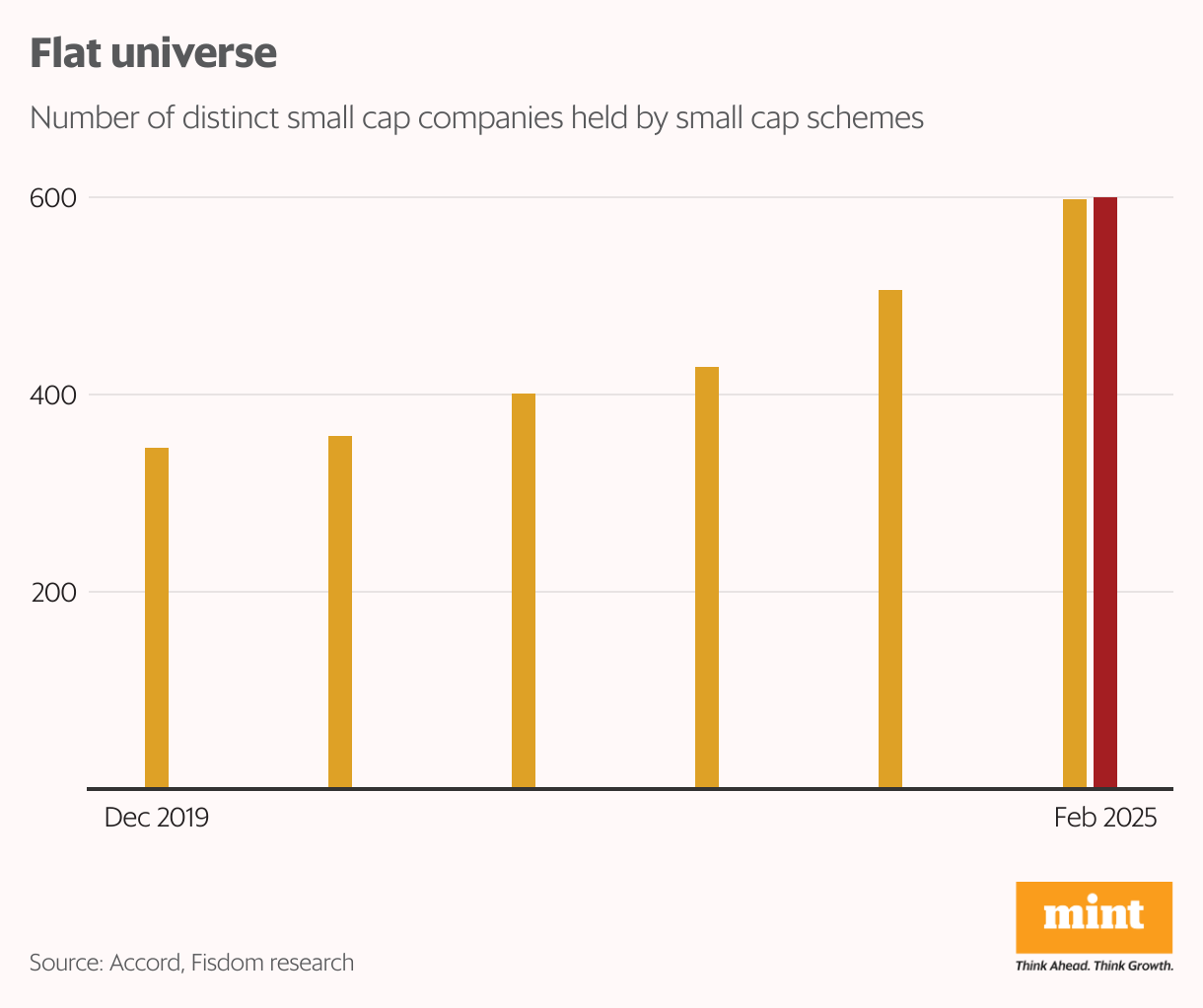

The small-cap rally over the last two to three years was largely driven by excess liquidity and a heightened risk-on sentiment, noted Abhilash Pagaria, head of Nuvama Alternative & Quantitative Research. The BSE Smallcap Index surged over 28% in 2024 and an impressive 47% in 2023. But these stocks are now in bear market territory, and have shed 16.6% in 2025 alone. The fall in valuations may trigger bargain hunting by professionally-run schemes which had adopted a wait-and watch approach, experts said.

Anirudh Garg, partner and fund manager at Invasset PMS said the recent correction has certainly led to a more compelling valuation landscape in the small-cap segment, offering selective opportunities for long-term investors.

With market conditions becoming uncertain, fund managers are focusing on small-cap companies with robust earnings growth and attractive valuations rather than chasing speculative gains, Nuvama’s Pagaria said. This tempered approach represents a notable departure from the high-risk, high-reward strategy that previously defined small-cap fund management. Also, since incremental flows into small cap funds have slowed, fund managers have limited cash to deploy in fresh picks.

Fund managers have fully exited certain stocks to make space for new and better ones, said Umeshkumar Mehta, chief investment officer at Samco Mutual Fund. “Select stocks from the pharmaceutical, healthcare, NBFC (non-banking financial companies) and metal sectors are gaining traction in the small cap space right now,” he said.

Also read | Equity rush, capex halt, bond’s lure: What strategy will companies opt for amid market corrections?

However, Sachin Shah, executive director and fund manager at Emkay Investment Managers thinks otherwise. “It is too early to churn portfolios now. The current rally is more likely driven by fund managers buying existing stocks (in their portfolios) at much cheaper prices.”

Experts suggest this could be a calculated step to boost fund net asset values, especially with the financial year-end approaching.

Top mutual funds including HDFC Mutual Fund, SBI Mutual Fund, Kotak Mutual Fund, and Axis Mutual Fund have tweaked their small-cap holdings in February, Nuvama data showed. During February, when a widespread market downturn gripped Indian equities, mutual funds collectively poured ₹36,200 crore into the secondary markets, while overseas investors sold. A sneak peek at key mutual funds’ activity across market cap schemes provides insights into the current focus of domestic institutional investors. The report indicates mutual funds (across all market capitalization schemes) have fully exited three small-cap stocks: Krystal Integrated Services, Savita Oil Technologies, and Shyam Metalics.

Also read | SIPs stop, demat accounts slump: Are retail investors running scared?

These exits are more of a strategic positioning, said Pagaria, where fund houses are cutting loose bad performers at a time when liquidity is scarce and high valuations demand strict justifications.

Savita Oil Technologies, for example, a petroleum derivatives manufacturer and wind power generator, has offered dismal returns this year. The stock is down almost 25.3% this year and has reported a 78% year-on-year (y-o-y) decline in its net profit in Q3FY25. The stock even saw a decline in retail shareholding from 13.45% in Q2 to 12.95% in Q3 FY25.

Despite the fall, the company remains pricey with current price-to-earnings (P/E) ratio of 23.9x, significantly exceeding its five-year median P/E of 10.5x. This, coupled with a disappointing earnings performance, could have led fund houses to shun Savita Oil.

However, decent returns and strong earnings performance do not guarantee mutual fund interest, particularly in volatile markets. Shyam Metalics, a prominent steel and ferro alloys manufacturer focusing on value-added steel products, was let go despite it delivering positive returns and posting strong bottomline growth in Q3. The stock delivered year-to-date (YTD) returns of 17.8% and its net profit grew 48.5% on a y-o-y basis to ₹119 crore, albeit below Bloomberg analysts’ consensus estimate of ₹252 crore. The company’s current P/E ratio of 26.3x is considerably higher than its five-year median of11.1x. Retail participation moderately declined, with holdings slipping from 4.72% in Q2 to 4.43% in Q3.

Also read | The retail investor bloodbath in smids might just be the beginning

This suggests that strong earnings performance or current returns are not enough to convince these domestic investors to pay exorbitant prices. They are driving hard bargains.

But even undervalued stocks do not always convince mutual funds to hold, as seen with Krystal Integrated Services. The facility management solutions provider, specializing in housekeeping, security, and maintenance services, is currently trading at a nearly 34% discount to its historical valuations. On the operational front, its revenue fell by 5% on-year to ₹261 crore, while net profit rose by 16% to ₹14.4 crore in the December quarter.