Richard Carter, head of fixed interest research at Quilter Cheviot, comments on the UK’s ongoing fiscal pressures and bond market volatility as today marks three years since the ‘mini budget’.

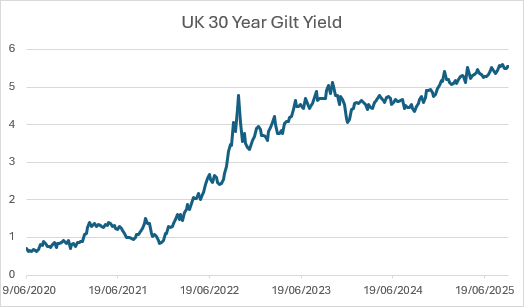

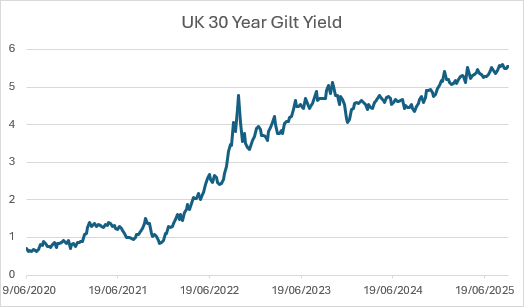

As we reach the three-year anniversary of the ill-fated ‘mini budget’, delivered by Liz Truss’ short-lived government, there remains pressure on the UK public finances, particularly from the bond markets that resulted in the downfall of that Conservative government. The yields on UK government debt have been reaching levels of late not seen since 1998, with long-term borrowing costs increasing due to economic outlook concerns, both domestically and overseas.

Rising yields are a result of falling bond prices (yields move inversely to price) and the decline in long-dated UK government bonds has caused some concern among investors. November’s Autumn Budget has taken on a new importance as Chancellor Rachel Reeves will seek to reassure financial markets that her borrowing and spending plans are sustainable. She will most certainly be wanting to avoid any repeat of the scenes seen in 2022.

Despite the Bank of England (BoE) lowering interest rates five times since August 2024, taking the base rate to 4.0%, the 30-year gilt yield has risen, getting as high as nearly 5.70% but has since settled down to the 5.5% mark. This level is comfortably above the 5.1% peak seen during the ‘mini budget fallout.

Source: Bloomberg, Quilter Cheviot

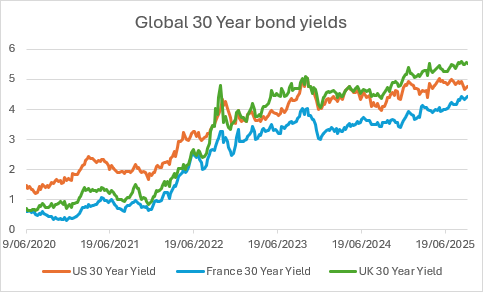

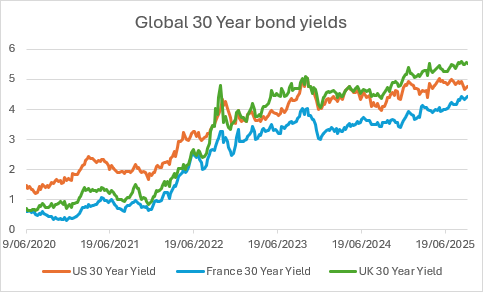

The UK has two main factors that is causing the concerns around the bond market just now. Firstly, inflation remains persistently higher than the 2% target, currently sitting at 3.8% and expected to climb higher this year yet due to increases to national insurance and the minimum wage, as well as higher energy and food costs. Meanwhile, economic growth remains anaemic and borrowing is increasingly having to be relied upon for day to day spending by the government. This and the seeming inability to make substantial spending cuts (U-turn on the winter fuel allowance and welfare reform) has damaged fiscal credibility and raised expectations of further significant tax rises in the forthcoming budget, and thus dragging further on growth.

While the UK is not alone in its fiscal challenges, rising bond yields represent something of a vicious cycle for the government as they increase the cost of servicing existing debt, and for this government it is an issue it needs to get a hold of before market sentiment sours further. Interest costs are already a huge expense for the government with the OBR expecting a bill of around £110bn in 2025-26[1] – roughly double what the UK spends on defence.

Source: Bloomberg, Quilter Cheviot

Despite rising yields, we are not yet at a point where confidence has been well and truly lost by investors and the risk of a repeat of the gilt market meltdown that took place after the ‘mini budget’ remains low. The market reaction seen in 2022 was a result of unexpected and fairly radical policy announcements that caught many off guard. It could easily be, however, a more slow motion effect in this instance particularly if yields keep on rising in the medium term. However, worries about a 1970s style IMF-crisis certainly seem overblown with credit derivative markets showing little concern about a potential debt default. Rating agency Fitch recently reaffirmed the UK’s AA- credit rating. Sterling is showing little cause for concern in this regard, holding up fairly well in recent months.

One potential catalyst to watch, however, would be Rachel Reeves relaxing her fiscal rules, downgrading their importance by suggesting less fiscal prudence or being replaced by a more “left-wing” chancellor — when speculation mounted that Reeves may be leaving the role earlier this year there was a swift drop in gilt markets, pushing yields higher. While gilt markets have calmed in recent weeks, as we approach the budget in November, tensions will begin to rise once again. It is a delicate act that Reeves needs to produce, and markets may just start pressuring for results sooner rather than later.