Laith Khalaf at AJ Bell highlights how active fund outflows eased in 2025 but remain structurally entrenched, with passive investing and cash continuing to dominate as UK equity funds suffer a decade of sustained withdrawals despite periods of strong market performance.

Laith Khalaf, head of investment analysis at AJ Bell:

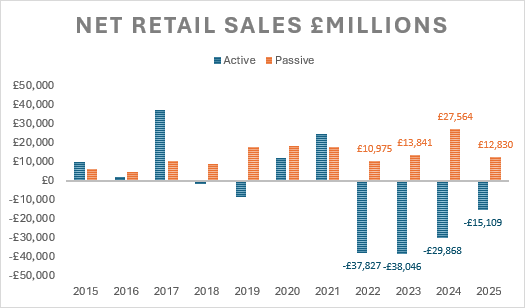

“In 2025, active fund flows were as good as they have been for four years, with ‘only’ £15.1 billion of outflows. That’s a significant improvement from the £29.9 billion that was withdrawn in 2024 and it’s best not to speak about the year before that.

“This means that over the last four calendar years £120.9 billion has been withdrawn from active funds. Things are still abysmal out there for active fund managers, just not quite as bad as they have been.

“A large chunk of this money is flowing from active into passive funds. In 2025, there were £12.8 billion of inflows into index trackers, and over the last four years there were £65.2 billion of inflows. Passive funds are simpler, cheaper, and have been performing better. As our latest Manager versus Machine report shows, over the last ten years just 24% of active managers have beaten a passive alternative.

Source: Investment Association

“Index trackers also appeal to those who invest money on behalf of others. Explaining why an active fund you have chosen has underperformed isn’t a fun job for pension scheme managers and financial advisers. If an index tracker falls in value, that can simply be attributed to Mr Market. Investing in passive funds therefore removes some significant career risk, and at a lower pricing point to boot.

“There’s even more bad news for active managers. Despite trackers holding the whip hand for four years now, it’s still the case that only 25% of total fund assets are invested passively. That means plenty more acreage for trackers to grow into. In the US, where investment trends tend to foreshadow our own, this number has tipped over 50%. Active managers shouldn’t therefore bank on an imminent turnaround in fortunes in terms of fund flows.

“Not all of the money flowing out of active funds has gone into index trackers though. Almost half of it has left the funds universe altogether. In 2025, £2.3 billion was withdrawn from funds in aggregate, but that rises to £55.6 billion if you look over the last four years. There isn’t a GPS tracker which accurately tells us where this money has gone, but there are some obvious bolt-holes.

“Rising interest rates have almost certainly lured money away from funds into cash accounts and paying down mortgages. Even within the funds universe the dash for cash is playing out, with money market funds seeing record inflows of £6.9 billion in 2025.

“The inflationary crisis has also limited the amount of discretionary income many households have at their disposal to top up their investments. Meanwhile ETFs, individual stock trading and crypto continue to soak up demand which might otherwise have headed for traditional open-ended funds.”

The dismal decade for UK equity funds

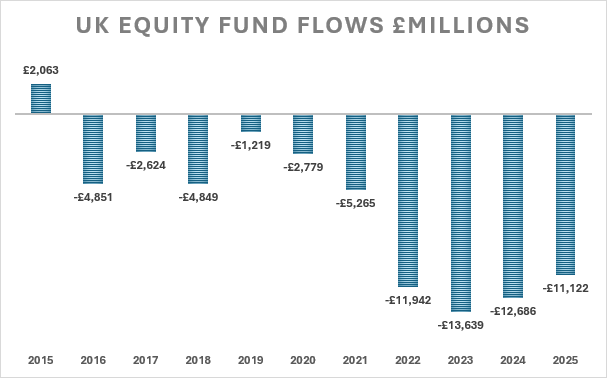

“UK equity funds have had a dismal decade, witnessing 10 years of relentless outflows totalling £71 billion. Part of this can be explained by the shiny lights in Silicon Valley attracting money to the other side of the Atlantic. Part can be explained by the fact that DIY investors feel more comfortable investing in individual stocks in their domestic market, so they have less call for a fund manager to do this for them.

“However a big part of the story lies in the shift towards passive investment strategies and the global benchmarking of portfolios. The UK stock market makes up just under 4% of the MSCI World Index, and yet the UK All Companies fund sector is the second most popular after the Global sector, with £147.8 billion of assets.

“This means that despite a decade of outflows, UK fund investors are still heavily overweight UK stocks compared to global benchmarks. This is a legacy of a time when there wasn’t so much supply of overseas offerings from fund groups, or so much demand from investors, and UK equity funds ruled the roost. The unwinding of this overweight position may therefore yet have a long way to run.

“Strong performance from the UK stock market in 2025 doesn’t seem to have stemmed the tide. £11.1 billion of outflows speaks for itself, and suggests the rally in domestic stocks was heavily influenced by overseas buyers, rather than demand from UK fund investors.

“If that scale of outflows happen in a year of strong performance, there won’t be many newly qualified investment managers gagging to score a job on a UK equity desk, nor many fund groups seeking to employ them for that matter. That will only serve to further entrench the shift away from UK equity funds.”

Source: Investment Association