French stocks and bonds continued to fall on Tuesday as a collapse of the country’s minority government looked increasingly likely.

The three main opposition political parties said on Monday they would not back Prime Minister Francois Bayrou in an upcoming confidence vote, amid plans for sweeping budget cuts.

France’s fiscal woes have deepened this year as the country struggles under the weight of high public debt, persistent budget deficits and political fragmentation.

Should Bayrou lose the 8 September National Assembly vote, his government will fall.

President Emmanuel Macron would then either name a new prime minister, ask Bayrou to stay on as head of a caretaker government, or call a snap election.

France’s blue chip CAC40 was down 2.2 per cent by mid-morning in London after a similar fall in the previous session, with banking giants BNP Paribas and Soociete Generale each down more than 6 per cent.

French Prime Minister Francois Bayrou’s minority government faces collapse as confidence vote looms

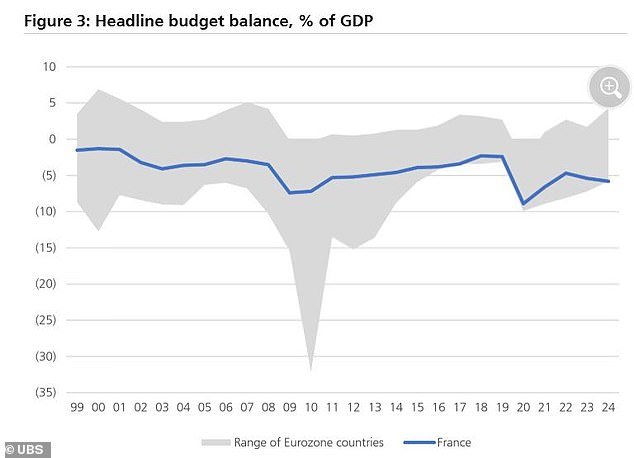

France has the highest budget deficit in the eurozone

France’s 10-year government bond yield – the interest paid on government debt – rose around 4 basis points to around 3.53 per cent, its highest since March and putting it within 5bps of the Italian equivalent.

The gap between French and German 10-year yields – known as the OAT-Bund spread – has widened to around 79 bps – its largest since April.

It follows the resignation of Michel Barnier last year after the former prime minister’s own attempts to rein in France’s budget deficit were rejected by lawmakers.

Neil Wilson, UK investor strategist at Saxo, said: ‘Markets invariably struggle with this sort of political uncertainty but in this case it’s a bit more obvious what is at stake.

‘The vote is over the budget which is required for fiscal consolidation – delaying or ditching reforms will make the debt situation more untenable, and weigh on the economy.

‘But there is a wider issue at stake over the fragile nature of the ruling coalition and whether Macron is just delaying the inevitable election that could see Marine Le Pen’s FN take over.

‘For now, political uncertainty equals economic weakness. ‘

Government’s collapse means more pain for French economy

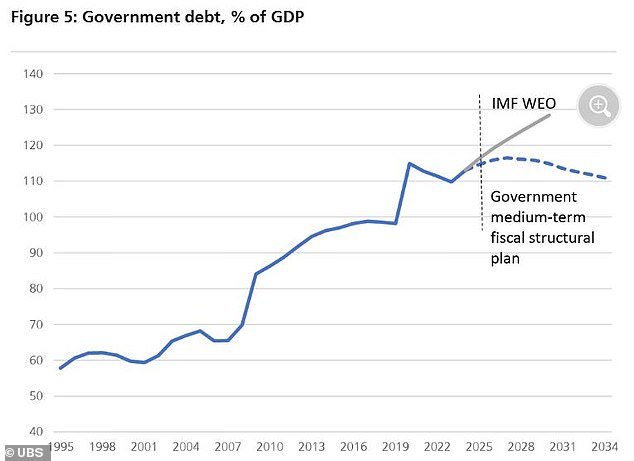

Bayrou’s fiscal plan aims to slash the French public deficit from a projected 5.4 per cent in 2025 to 2.8 per cent by 2029, with €43.8billion in savings outlined for 2026.

It would see a reduction public sector hiring, a freezing of pension allowances and tax bracket indexation – and even scrapping two public holidays.

The French government says the plan will see debt account for 117.2 per cent of GDP in 2029, compared 125.3 per cent if no changes were made.

However, all major opposition parties oppose the deal.

Economist at UBS Felix Huefner said: ‘The backdrop is that France continues to face fiscal challenges.

‘It has the highest budget deficit in the eurozone (5.8 per cent of GDP in 2024), and the second-highest expenditure share after Finland, is in an Excessive Deficit Procedure by the EU, and the government led by PM Bayrou has no majority in parliament.

‘All of this means that budget cuts are required, but the political backdrop complicates the adoption of a budget and raises the risk of a fall in government.’

Charlotte de Montpellier, senior economist for France and Switzerland at ING, added: ‘The likely fall of the government will weigh heavily on the French economy.

‘With only 0.8 per cent GDP growth expected this year, the economy was already weak, and the political crisis adds a new layer of uncertainty.

‘Drafting and passing a 2026 budget will become even harder, delaying fiscal consolidation and potentially worsening France’s debt trajectory.

‘The longer reforms are postponed, the greater the eventual adjustment will need to be.’

The French government is proposing harsh budget cuts to bring debt down

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.