Personal finance expert says that many people would be better off with a different kind of savings account

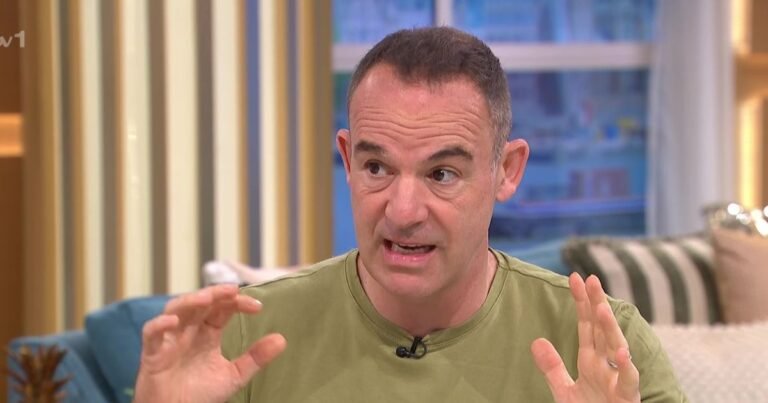

A finance guru has issued a stark warning to anyone with £5,000 or less in premium bonds. He suggests that a regular savings account may be a better option for most.

Premium bonds are a type of savings product that allows you to stash away money with the opportunity to win tax-free cash prizes. These prizes are there instead of earning interest.

For every quid, you will receive a unique bond number entered into a monthly prize draw, with prizes ranging from £25 to £1 million, with a greater chance of winning the more bonds you hold.

In an update to his website Money Saving Expert, Martin Lewis, revealed that premium bonds are only worth getting if you have a certain amount of dosh. In particular he advised that many grandparents would be better off giving grandchildren cash via normal savings accounts.

He observed that premium bonds are “best for”:

- Those with larger savings, say over £5,000, as then you’ve a better chance of earning closer to the published prize fund rate. “With less, the odds are you will win little or nothing”, he said

- Those who pay tax on their savings interest, who have used up their ISA allowances, as premium bond winnings are always tax-free

He stated: “For years, many people, especially grandparents, have gifted children premium bonds. And frankly, in my view, for many they would’ve done better sticking with normal savings.”

He elaborated further: “Premium bonds are govt-backed savings, where the interest is based on a prize draw. The current prize fund rate is just 3.6 per cent, yet even that overestimates what most people will actually win with typical luck.”

Martin said that premium bonds are typically only worth buying if you have more than £5,000, to give you a chance of winning the prizes. He noted that premium bonds are “best for”:.

He added: “As most children have small amounts of savings and aren’t taxpayers, premium bonds are particularly unsuitable. Of course, there’s the ludicrously small chance your child will win a million, but they could also toss a coin and it land on its edge.

“So if you’re thinking of putting £1,000 or less into premium bonds for a child, it’s worth noting that with average luck our premium bonds probability calculator shows they are likely to win nothing over a year (give it a try based on your scenario).”

You can use the Money Saving Expert premium bonds probability calculator, here.