This year sure has been a wild ride for tech investors. Through July 10, the Nasdaq Composite was up more than 26%. Driven by the investing world’s love affair with artificial intelligence (AI), stocks in the space saw absolutely monster returns. The poster child, Nvidia, returned a whopping 180% in the same time frame.

Nvidia is a semiconductor company, meaning it’s involved in the creation of computer chips. The hyper-advanced versions that Nvidia designs are the lynchpin of the AI industry; without them AI as we know it would not be possible. That is why it, and other semiconductor companies, are so valuable.

The market has since cooled off as investors weigh current valuations and the possibility of a not-so-soft landing the economy may be in for in the near future. Despite this, the promise of AI remains. If you believe in its long-term thesis, now may be a perfect time to invest as stocks are discounted from their peak just a month ago.

But where to put, say, $1,000? Instead of picking and choosing individual stocks — perfectly valid if done judiciously — you could opt for an exchange-traded fund (ETF). These are bought and sold in the same way you would an individual stock. However, owning it provides exposure to a basket of companies at once. It’s a great way to quickly and simply diversify your holdings. There are all kinds of ETFs, but thematic ETFs are some of the more interesting ones, focusing on a specific sector or area of the market, like semiconductors. Let’s take a look at my favorite semiconductor ETF and one alternative.

This is the top-performing semiconductor ETF this year and my top pick

The best performer this year by a pretty wide margin is also the biggest semiconductor ETF, the VanEck Semiconductor ETF (SMH 1.88%). The ETF has returned 40% this year so far. Much of this success comes from the ETF’s heavy weighting toward Nvidia. More than 20% of the ETF is invested in the company. This chart shows the top five holdings; notice the steep drop-off from No. 2 to No. 3.

| Company | % of Net Assets |

|---|---|

| Nvidia | 20.8 |

| Taiwan Semiconductor Manufacturing | 13.8 |

| Broadcom | 8.5 |

| Texas Instruments | 4.9 |

| Advanced Micro Devices | 4.9 |

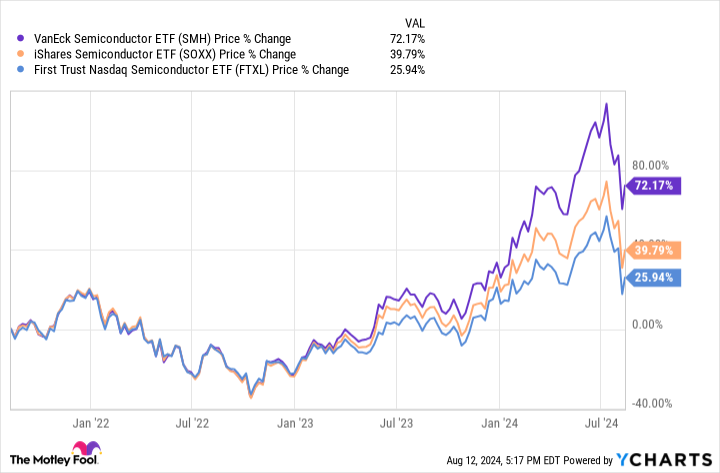

Now, this has to do with the methodology of how VanEck chooses to invest its funds, or rather, the methodology of the index that the ETF is designed to track. The fund is passively managed, which means there is not a fund manager actively trading assets at their own discretion. Instead, it mimics a specific index, in this case the MVIS US Listed Semiconductor 25 Index (MVSMH), which tracks the 25 largest semiconductor companies that generate at least half of their revenue from semiconductors or semiconductor equipment.This index has proven a winner for VanEck. Take a look at its returns over the last three years compared to two major competitors.

The ETF has consistently outperformed its rivals. Now, there is a management fee — that is true of all ETFs — but it’s on the low end at just 0.35%, or $35 annually per $10,000 invested. That’s pretty cheap for ETFs. The main issue I have with this ETF is its concentration. It is heavily weighted to just a handful of companies. This is part of why it returned more than some of its competitors, but it also poses more risk.

There are some options, like the iShares Semiconductor ETF, that provide slightly more diversification. iShares’ offering invests in about 10 more companies and the weighting is less concentrated at the top. Of course, this is only marginally less concentrated. These are highly targeted ETFs, after all. These are meant to be held as a part of a wide-reaching and diverse portfolio.

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, Taiwan Semiconductor Manufacturing, Texas Instruments, and iShares Trust – iShares Semiconductor ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.