Investors looking for exposure to Bitcoin might want to check out this exchange-traded fund.

The stock market has held up quite well so far in 2024. Developments such as weight loss drugs and artificial intelligence (AI) have helped fuel the S&P 500 and Nasdaq Composite to new highs.

But in the background, alternative investments such as crypto have demonstrated some strength as well. In particular, Bitcoin is up 41% so far in 2024.

I understand if you don’t have the appetite to invest directly in crypto, though. While it is relatively new, one workaround could be to buy shares in a spot exchange-traded fund (ETF).

The VanEck Bitcoin Trust ETF (HODL 5.55%) has returned 27% so far this year, handily outperforming the S&P 500 and Nasdaq.

Let’s dig into how spot Bitcoin ETFs work and explore why the VanEck Bitcoin Trust could be a good choice for investors looking for some crypto exposure.

What are spot Bitcoin ETFs?

Owning an ETF is a form of passive investing. Let’s say there is a growth area such as AI that you want to invest in, but you are unsure what specific stocks to buy. ETFs that are focused on AI will comprise several different stocks, giving you exposure to the broader technology theme without owning any particular stock. By owning a basket of stocks instead of individual companies, you inherently mitigate risk through a deep level of diversification.

Spot Bitcoin ETFs serve the same function. If you are looking for exposure to Bitcoin but do not want to purchase it directly though an exchange on Coinbase or Robinhood, for example, a spot ETF could be an optimal workaround.

Image source: Getty Images.

Why VanEck sticks out among the pack

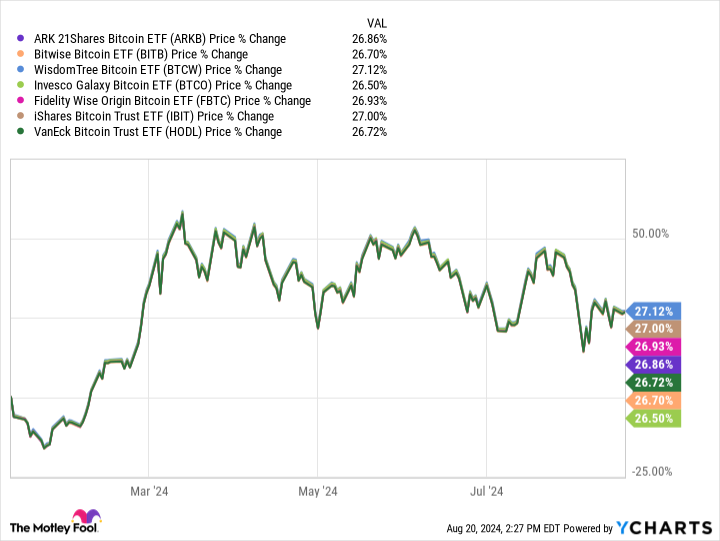

The chart below illustrates the return for several leading spot Bitcoin ETFs so far in 2024.

Given each of these funds track the price of Bitcoin, it’s not surprising to see that all of them have essentially returned roughly 27% so far this year. Let’s look at some factors that I think differentiate the VanEck Bitcoin Trust and make it my top choice.

One of the reasons I like the VanEck Bitcoin Trust in particular is its custodian. VanEck has been around for almost 70 years and has a long history investing in derivatives.

The company’s website says, “VanEck was one of the first U.S. asset managers to offer investors access to international markets and recognized early the transformative potential of gold investing.”

Bitcoin is often referred to as digital gold given its scarcity and tendency to rise in price during periods of high inflation. With $108 billion of assets under management, I think that VanEck understands the value of alternative assets and the potential Bitcoin represents.

Considering each fund illustrated above ultimately has the same broad goal of tracking the price of the crypto, another way they can differ is in their costs to investors.

Per the table below, the VanEck Bitcoin Trust has a lower expense ratio than most of its peers. The only exception is the iShares Bitcoin Trust ETF, which is offering some temporary waivers to its management fees.

| Security Name | Expense Ratio |

|---|---|

| Bitwise Bitcoin ETF | 0.95% |

| WisdomTree Bitcoin Fund | 0.25% |

| Invesco Galaxy Bitcoin ETF | 0.25% |

| Fidelity Wise Origin Bitcoin Fund | 0.25% |

| ARK 21Shares Bitcoin ETF | 0.21% |

| VanEck Bitcoin Trust ETF | 0.20% |

| iShares Bitcoin Trust | 0.12% |

Data source: Company websites

Why you should consider buying shares in the VanEck Bitcoin Trust

In general, I think some exposure to Bitcoin can be good for your portfolio. While crypto is not yet a mainstream financial solution, Bitcoin is about as “blue chip” as it gets for the crypto landscape.

Moreover, given its finite supply, I think a rising number of institutional investors will take the prospects of investing in it more seriously over time. This could dramatically impact the price of the digital coin in the long run, which makes investing in the crypto space right now somewhat tempting.

With that said, I think spot ETFs are a much more prudent approach than buying the cryptocurrency outright. Investors looking for exposure to it at a reasonable price might want to consider the VanEck Bitcoin Trust.

Adam Spatacco has positions in Coinbase Global. The Motley Fool has positions in and recommends Bitcoin and Coinbase Global. The Motley Fool has a disclosure policy.