NVIDIA (NVDA – Free Report) reported outstanding results for the second quarter of fiscal 2025, with revenues of $30.04 billion topping the Zacks Consensus Estimate by 5.72%. The top line increased 122% year over year and 15% quarter over quarter. Adjusted EPS came in at 68 cents, surpassing the Zacks Consensus Estimate of 64 cents per share. This compares to earnings of 27 cents per share a year ago.

The data center segment, crucial for AI applications, drove much of NVIDIA’s growth, with revenues reaching $26.3 billion, up 154% year over year and 16% sequentially. NVIDIA’s gross margin was 75.1%, slightly down from the previous quarter due to factors like inventory provisions. Despite this, the company’s pricing power remains robust.

NVDA Stock Down Post Superb Earnings: What’s Wrong?

The NVIDIA stock was down 6.9% in aftermarket hours on Aug. 28, 2024, despite superb results. Let’s find out what went wrong. In the last three successive quarters, NVIDIA recorded revenue growth of more than 200%, and its ability to top estimates is at greater risk as success in each quarter leads Wall Street to raise the bar even higher, per Reuters.

Agreed, CEO Jensen Huang acknowledged the strong demand for Hopper chips. Huang also anticipates significant revenues from the upcoming Blackwell architecture. But media reports hinted at the fact that the new Blackwell chips might be delayed by as much as three months due to design flaws, as quoted on a Motley Fool article.

NVIDIA expects Blackwell production to ramp up in the fourth quarter and continue into fiscal 2026. Overall, NVIDIA’s stock fell in after-hours trading, reflecting high investor expectations and concerns about sustained growth rates. Concerns also remain about slow returns from generative AI investments.

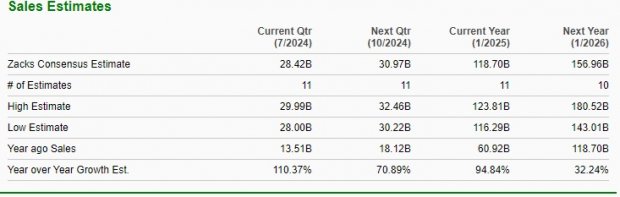

Another Motley Fool article revealed that NVIDIA’s revenue growth will slow down from the triple-digit pace at which it has been growing recently. Prior to the earnings release, the Zacks Consensus Estimate for NVDA’s current-year revenues was pegged at $118.70 billion, up 94.8% year over year. The next year’s revenue estimate was pegged at $156.9 billion, up 32.2% from the current year.

Image Source: Zacks Investment Research

Prior to the earnings release, NVIDIA’s earnings estimate for the current year was pegged at $2.71, up 108.5% year over year. The next year’s earnings estimate was pegged at $3.44, up 27% from the current year. Hence, we can expect a growth slowdown in NVIDIA next year, although it appears strong in the current year.

Image Source: Zacks Investment Research

What Lies Ahead for NVDA Stock?

NVIDIA stock’s Price/Earnings (P/E) ratio (trailing 12 months) stands at 71.28X versus the underlying Semiconductor – General industry’s P/E of 8.23X. The last five years’ growth rate for NVIDIA was 54.20% versus the underlying industry’s growth rate of 9.10%. This exponential growth rate of NVIDIA explains its ripe valuation.

For the next five years, NVIDIA’s growth rate is expected to be 37.60% versus the industry’s growth rate of 16.80%. With slower growth expected for the coming fiscal years, NVIDIA’s forward P/E ratio would decline.

Per Motley Fool, “if it were to grow revenue 30% in fiscal year 2028, a multiple of 30 to 40 times on the stock in 2027 would seem reasonable. That would value the stock between $200 and $270 per share in three years. As such, there is a good possibility that Nvidia’s stock could once again double from where it is now in three years.”

Shareholder’s Value Maximization by NVDA

Nvidia is increasing its returns to shareholders. The board of directors approved an additional $50 billion in share buybacks, adding to the $7.5 billion remaining on its existing authorization.

NVDA ETFs in Focus

If you are worried about NVIDIA’s prospective slowing growth trajectory and still take advantage of the AI boom, you can stay invested in the NVDA-heavy semiconductor exchange-traded funds (ETF). The ETF approach minimizes the company-specific concentration risks.

Some NVIDIA-heavy ETFs include Strive U.S. Semiconductor ETF (SHOC – Free Report) , VanEck Vectors Semiconductor ETF (SMH – Free Report) , Technology Select Sector SPDR Fund (XLK), Grizzle Growth ETF (DARP) and TrueShares Technology, AI and Deep Learning ETF (LRNZ – Free Report) .