The hottest investment trends are often easier to identify than consistently make money from. This is evident from the returns of thematic exchange traded funds (ETFs) which, per past studies, have tended to perform poorly.

That’s often because these funds launch at a time when a theme is at its most hyped, and so buy into a sector when valuations are especially high.

Such funds have also run into other woes, be it focusing too narrowly on a handful of stocks and so becoming too concentrated or, conversely, having a cautious approach that gives investors something of a watered-down take on a theme.

These factors, and the fact that bets on a single sector can be subject to big ups and downs anyway, mean that ETFs targeting a promising theme can go awry.

Take sector poster child the iShares Global Clean Energy Transition ETF (INRG), which is down by 7 per cent over the five years to 21 July 2025, or the iShares Ageing Population ETF (AGES), which has returned just 35.8 per cent over the same period compared with c80 per cent from the MSCI World index.

It’s for this reason that we approach these funds with caution, including just a few thematic names in our annual Top 50 ETFs list.

But investors who share our doubts about such funds can still use them as a source of inspiration by assessing the holdings that appear most prominently in such portfolios.

In doing so, they can spot sector leaders, as well as identifying which names might in fact turn out to be crowded trades.

For this article, we have looked at the stocks appearing in the recent top 10 holding lists of different thematic ETFs as an indication of the top names. However ETFs do have to disclose everything they hold, meaning investors can dig deeper if they feel the urge.

Read more from Investors’ Chronicle

Notes on a theme

Our research starts with defence, given the substantial uptick in nations’ spending on this front and the rich returns the sector has already generated in 2025. While there is a risk that shares may struggle to keep up their recent momentum, investors may well want to assess potential holdings as a longer-term play on political developments.

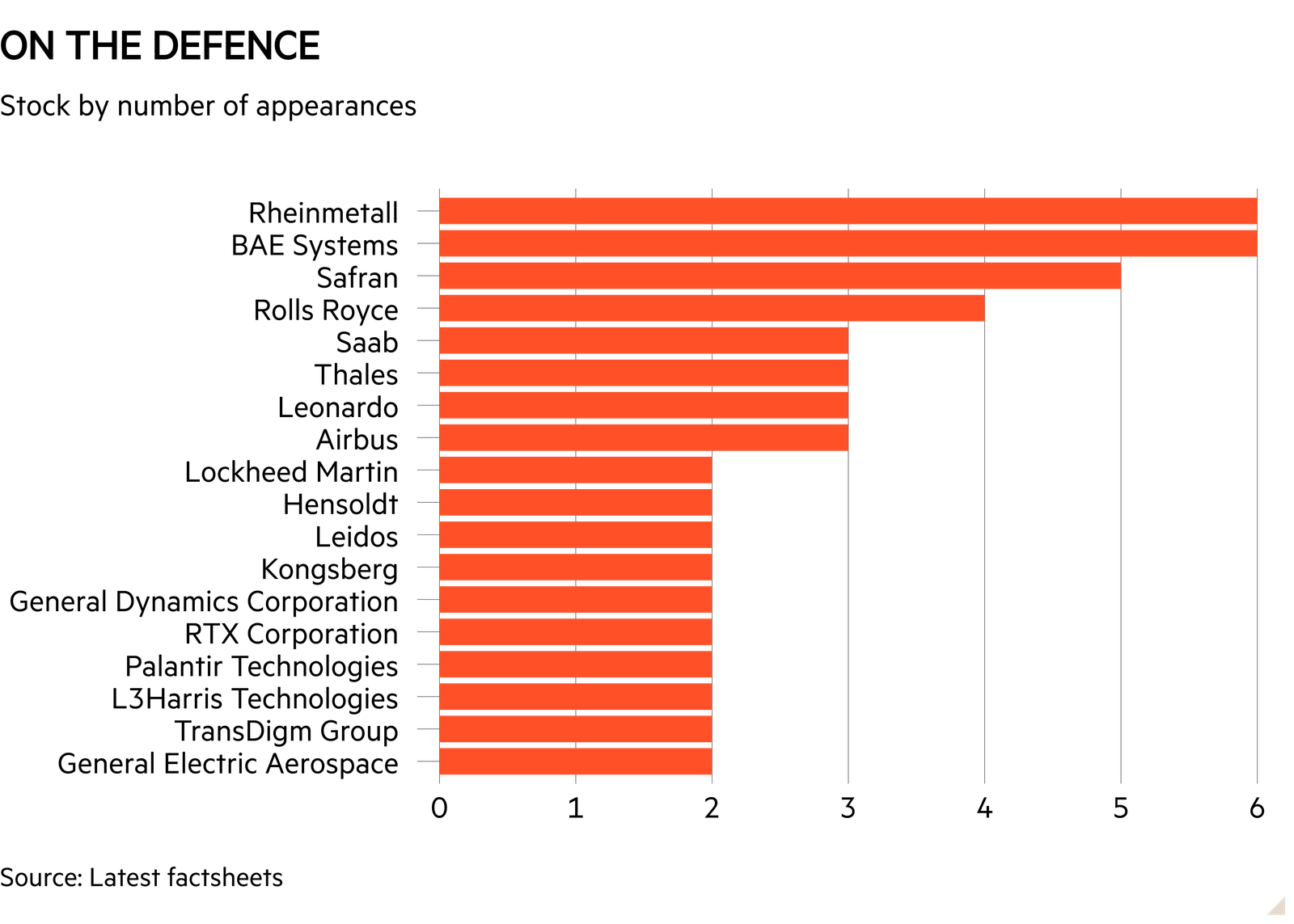

We have analysed seven different defence-focused ETFs, details of which can be found at the bottom of this article.

Of the most commonly occurring stocks they hold, some will be more than familiar given their substantial gains in recent months. Rheinmetall (DE:RHM), which has seen its share price rise by almost 200 per cent in 2025 to date, is a top 10 holding in all but one of the ETFs in our sample, as is UK-listed BAE Systems (BA.).

Rolls-Royce (RR.), a common holding in generalist UK equity funds after its blistering recovery of recent years, is also prominent, as are the likes of Safran (FR:SAF), Saab (SE:SAAB.B), Leonardo (IT:LDO) and Thales (FR:HO).

As the chart shows, there is a long tail of stocks that are held by just two of our sample ETFs. These range from US aerospace manufacturing outfit TransDigm Group (US:TDG) to Palantir Technologies (US:PLTR), which provides software for the armed forces.

As this list shows, whether it be out-and-out defence stocks, aerospace companies, or businesses focused on cyber security, there are many ways to invest for more turbulent times.

This is also reflected in the nature of our sample of funds. Some are focused on different regions (Europe, for example), and they tend to strike a different balance between holding some form of industrials versus tech shares.

Such calls can make a difference: on the geographic front, we have noted that US defence shares are lagging rivals in recent months, given the push to increase defence spending in Europe in particular. Stock specifics do, of course, remain important: Lockheed Martin (US:LMT) slashed its earnings outlook earlier this week on the back of impairments taken on some projects.

Click below to see our Top 50 ETFs

Intelligent picks

If defence is a major emerging theme, artificial intelligence (AI) remains hard to ignore, too. And whether investors are looking for overlooked opportunities or confirmation about what they see as crowded trades, dedicated AI ETFs can offer inspiration.

A sample of five ETFs that look to capture the AI opportunity reminds us that some of the world’s biggest equities are still seen as the most obvious beneficiaries in certain quarters. Amazon (US:AMZN), Nvidia (US:NVDA), Meta (US:META) and Microsoft (US:MSFT) all appear in at least two of the top 10 holding lists, as does Asia’s TSMC (TW:2330).

However we do also come across Advanced Micro Devices (US:AMD), Cisco Systems (US:CSCO) and, again, Palantir.

In fact, most of the names in this sample only crop up in one of the five top 10 holding lists we have examined. That underlines the different interpretations of this particular investment theme, as well as the fact some of the ETFs also branch out into areas such as big data.

Shares included range from Super Micro Computer (US:SMCI), which enjoyed huge gains last year, to Datadog (US:DDOG), Cloudflare (US:NET), NXP Semiconductors (US:NXPI), Qualcomm (US:QCOM), IBM (US:IBM) and even Bank of America (US:BAC).

The AI trend has, for now, been easy to capture via conventional global tracker funds, US funds and active technology equity portfolios.

The specialist ETFs have had a mixed record when it comes to beating this more vanilla form of exposure: the Xtrackers Artificial Intelligence & Big Data ETF (XAIX) has made a return of almost 100 per cent over three years, putting it comfortably ahead of the MSCI World’s 42 per cent and even the 67 per cent return from the Nasdaq 100, while the L&G Artificial Intelligence ETF (AIAG) stands out with a 70 per cent return. But the WisdomTree and Global X ETFs in our list have lagged behind.

Investors may therefore prefer to turn to these funds for inspiration rather than actual investment. And in this regard they give us some ideas that still don’t crop up that prominently in regular index funds.

ETFs in our sample

Defence:

-

First Trust Indxx Global Aerospace and Defence (MISL)

-

Han Future of Defence (NATP)

-

Han Future of European Defence (NAVY)

-

Invesco Defence Innovation (IDFN)

-

iShares Global Aerospace and Defence (DFND)

-

Global X Defence Tech (ARMG)

-

WisdomTree Europe Defence (WDEP)

AI:

-

Invesco Artificial Intelligence Enablers (IVAI)

-

L&G Artificial Intelligence (AIAG)

-

Global X Artificial Intelligence (AIQG)

-

WisdomTree Artificial Intelligence (INTL)

-

Xtrackers Artificial Intelligence and Big Data (XAIX)