India’s equity market has been experiencing heightened volatility, influenced by global economic trends, policy decisions, and geopolitical developments. One major sector of the Indian economy remains the automobile industry.

From original equipment manufacturers (OEMs) to auto component manufacturers, the automobile sector has contributed considerably to GDP growth and has solidified India’s global role in the auto supply chain.

Despite this, appearances from geopolitical events and trade policies in global locations still weigh on the automobile industry. Adding to the complexity of the automobile sector is the announcement of a 25% tariff on auto imports by the 47th U.S. President Donald Trump, effective April 03, 2025.

The potential impact of this policy would be on fully assembled vehicles, key auto parts, and components, potentially disrupting supply chains. Although India has minimal exports to the US automobile sector, the ramifications from these tariffs will potentially impact auto component manufacturers and OEMs in India. The impact even extends to mutual funds holding auto stocks.

India’s auto industry and Its U.S. exposure

India’s auto component exports have experienced consistent growth over the past several years. As reported in the Automotive Component Manufacturers Association of India (ACMA) annual industry performance report, Indian auto component exports rose by 5.5% during the last financial year, amounting to USD 21.2 billion.

The U.S. is a meaningful export market for India, with the U.S. accounting for 27% of global exports. Despite this growth, India’s contribution total U.S. auto component imports is just 3% of an estimated USD 97 billion in annual imports.

Therefore, while these factors suggest that the tariffs will likely not have as immediate of an impact on India’s auto component industry, there are second-order effects that can seep into the industry. Tariffs may disrupt supply chains and raise costs for U.S.-based OEMs, who would then likely consider changing their sourcing strategy away from the Indian manufacturers who supply them.

Indian auto stocks, both in the OEM and auto components space, have already witnessed volatility as a result of the tariff announcement. Investors are sceptical that any indirect impact resulting from supply chain changes, potential export order changes, or global economic uncertainty could affect the performance of auto-related stocks.

From a broader perspective, three major effects are likely to play out:

- Decline in export demand:

India’s stake in the U.S. auto component market is relatively small, but particular component manufacturers that supply U.S. firms are likely to notice order slowdowns and/or price renegotiations. If U.S. automakers respond to higher tariffs by localising their supply chains, Indian suppliers may lose their competitive advantage.

- Supply chain disruptions and cost inflation:

Raising trade barriers may interfere with global supply chains, leading to higher input costs for Indian manufacturers, which could affect margins. Companies that source imported raw materials for manufactured products might have higher input costs and increased production costs, which would negatively impact profitability.

- Market sentiment and investment trends:

The recent slump in select auto stocks seems to be an indication that investor sentiment in the sector is taking a cautious turn. Mutual funds with large investments and long positions in the auto sector may see temporary volatility in the valuation of their portfolio, which may prompt fund managers to review allocations.

Having said this, mutual funds holding auto stocks will need to manage this recent development in light of the structural changes in the global automotive trade environment.

Here, we have curated a list of top 5 equity mutual funds holding high allocations to auto stocks.

#1 – SBI Automotive Opportunities Fund

It is a thematic mutual fund recently launched in June 2024 and aims to generate long-term capital appreciation by investing in equity and equity-related instruments of companies engaged in automotive and allied business activities.

The scheme currently holds an AUM of Rs 5,036.52 crores, and it is designed to capture growth opportunities in the Indian automobile sector, which includes vehicle manufacturers, auto components, EV players, and emerging mobility trends.

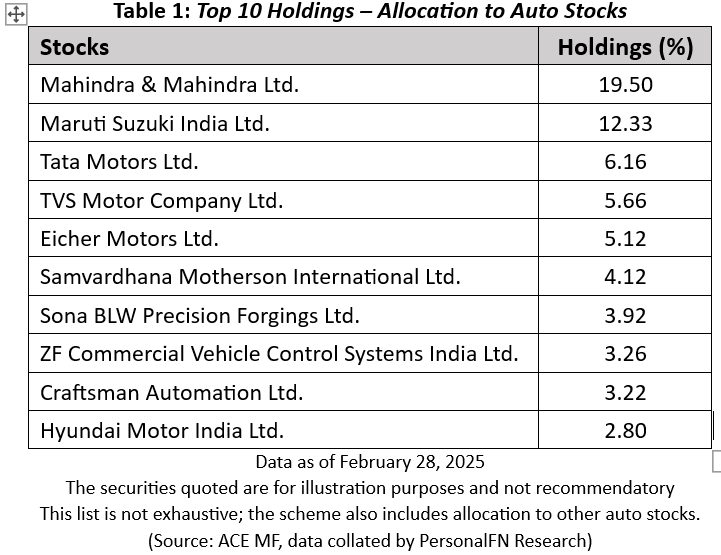

SBI Automotive Opportunities Fund invests in top automobile manufacturers and key component suppliers. Major holdings include M&M Ltd. and Maruti Suzuki, alongside Tata Motors, TVS Motor, and Eicher Motors, which cover various vehicle segments.

The fund also includes important auto part suppliers such as Samvardhana Motherson, Sona BLW, and ZF Commercial Vehicle, offering exposure to both vehicle production and the automotive supply chain. Currently, the overall exposure to auto stocks accounts for 96.98% of the scheme’s assets.

Do note the scheme has a limited performance history, having been introduced last year.

#2 – HDFC Transportation and Logistics Fund

Launched in August 2023, the scheme focuses primarily on investing in companies operating within the transportation and logistics sector. This includes businesses engaged in road, rail, air, and sea transportation, as well as logistics services like warehousing, supply chain management, and courier services.

The fund’s performance is generally linked to factors such as demand for transportation services, infrastructure growth, and government policies regarding logistics and supply chains. The fund may perform well during periods of strong economic growth, infrastructure development, and rising demand for logistics services.

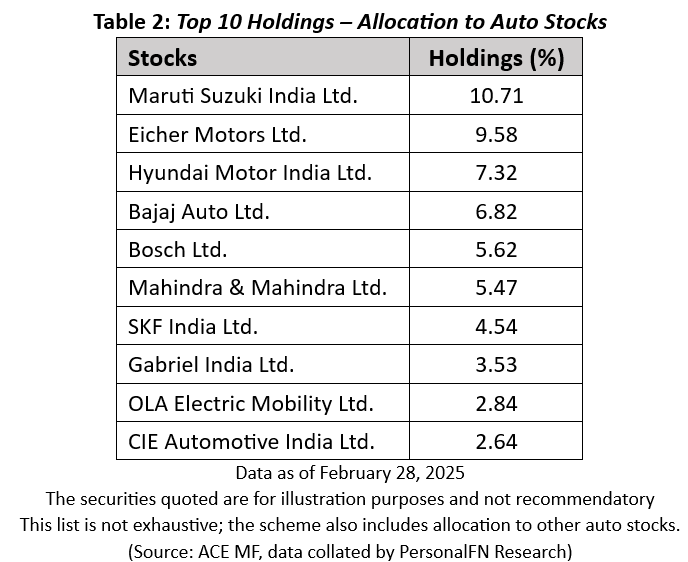

HDFC Transportation and Logistics Fund has a diversified combination of major players in the transportation and automotive sectors. Key holdings in the fund include Maruti Suzuki India Ltd, Eicher Motors Ltd, Hyundai Motor India Ltd, Bajaj Auto Ltd, and Bosch Ltd. Currently, its total exposure to auto stocks is 83.14% of the total scheme.

#3 – ICICI Pru Transportation and Logistics Fund

The goal of the fund is to take advantage of the growth and development of infrastructure in India, specifically in the transportation (rail, road, air, and sea) and logistics sectors. The scheme was launched in October 2022 and is intended to take advantage of the increasing demand in the country, especially for efficient supply chain solutions, logistics for e-commerce, and the expansion of infrastructure in general.

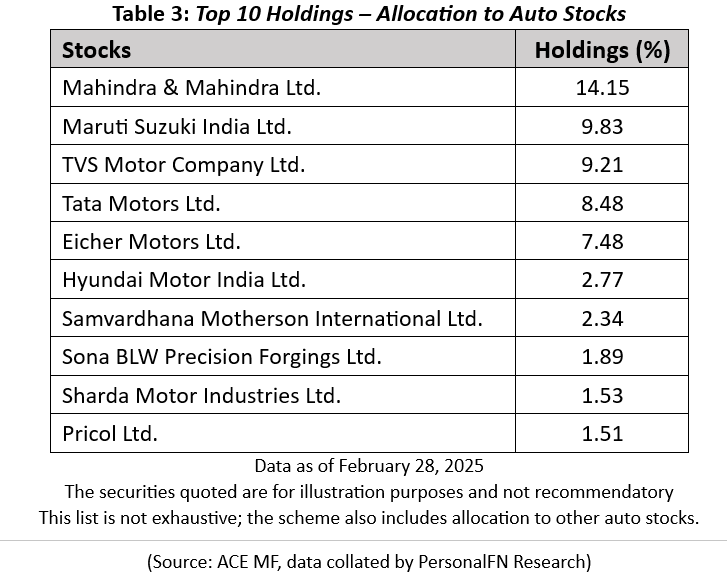

ICICI Pru Transportation and Logistics Fund mainly invests in established firms recognised for their sizeable stakes in M&M, Maruti Suzuki, Tata Motors, TVS Motors, and Eicher Motors. The fund demonstrates its investment focus on automotive manufacturers as well as its position as a third-party suppliers to manufacturers within the transportation and logistics ecosystem. As of now, the cumulative weight of auto-related stocks in auto is 72.75% of the total scheme AUM.

#4 – UTI Transportation & Logistics Fund

The scheme primarily pertains to investing in the transportation and logistics sector, encompassing industries such as railways, shipping, air cargo, logistics infrastructure and all industries tied to the movement of goods and people. This fund is focused on the industries that are most critical to India’s transportation and logistics ecosystem.

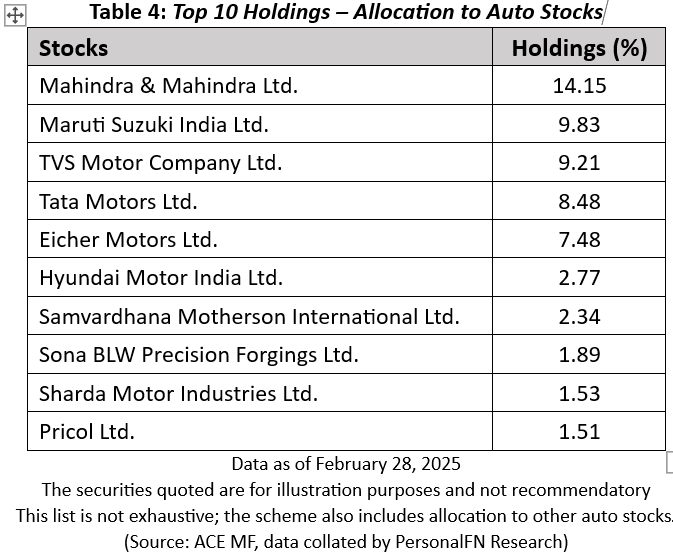

Prominent holdings include Mahindra & Mahindra, Maruti Suzuki, TVS Motor, Tata Motors, and Eicher Motors, all of which are key players in the Indian automotive industry. Additionally, the fund invests in companies like Sharda Motor Industries and Pricol, which contribute to the manufacturing and supply chain aspects of the transportation and logistics sectors. Currently, the overall exposure to auto stocks accounts for 74.83 % of the scheme’s assets.

#5 – Bandhan Transportation and Logistics Fund

The fund aims to capitalise on the growth potential of the transportation and logistics sector, which is critical to economic growth, trade, and supply chains globally. The Bandhan Transportation and Logistics Fund primarily invests in companies that play a significant role in transportation, infrastructure, and logistics.

Some of the major holdings are similar across the schemes mentioned above. Other prominent stocks include Tata Motors Ltd., Eicher Motors Ltd., and Hyundai Motor India Ltd. These companies are involved in various aspects of the automotive and transportation industries, spanning manufacturing, components, and vehicles, positioning the fund to benefit from growth in the sector.

Currently, the overall exposure to auto stocks accounts for 71.37 % of the scheme’s assets.

The transportation and logistics sectors are closely linked to economic cycles, government policies, and infrastructure investments, which makes the fund’s performance sensitive to changes in macroeconomic conditions.

Such sectoral/thematic schemes are suitable for high-risk-tolerant investors seeking sector-specific exposure to India’s transportation and logistics industry or automotive-related stocks. Investors should be aware that since the fund focuses on a single sector, it may be more volatile compared to broader market funds.

To Summarise…

Beyond mutual funds, the tariff move could reshape global automotive supply chains, prompting multinational companies to rethink sourcing strategies. India, with its cost-efficient manufacturing base, may either face headwinds from reduced U.S. demand or find opportunities if global firms look to diversify away from China.

Additionally, India’s domestic auto industry remains driven by internal factors such as government policies on electric vehicles (EVs), infrastructure development, and consumer demand. If external trade disruptions increase, policymakers might respond with measures such as incentives for domestic manufacturing, benefiting mutual funds with exposure to domestic auto-focused stocks.

Disclaimer

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.