The former accountant of media tycoon Kerry Packer has cracked the ‘conservative’ formula for turning a $200,000 deposit into a $24million property portfolio.

While pulling together $200k might sound like a stretch, it’s more achievable than many realise – especially if you own your family home, says Allan Mason.

That’s because selling the family home attracts no capital gains tax, unlike most other investments. If you’re sitting on a property that’s paid off or has significant equity, it can be the perfect launchpad.

‘A major part of wealth creation is your home,’ says Mr Mason, from Brisbane.

‘It can be a massive starting point in wealth creation because, quite simply, there is no other investment that you can make money on that is tax free.’

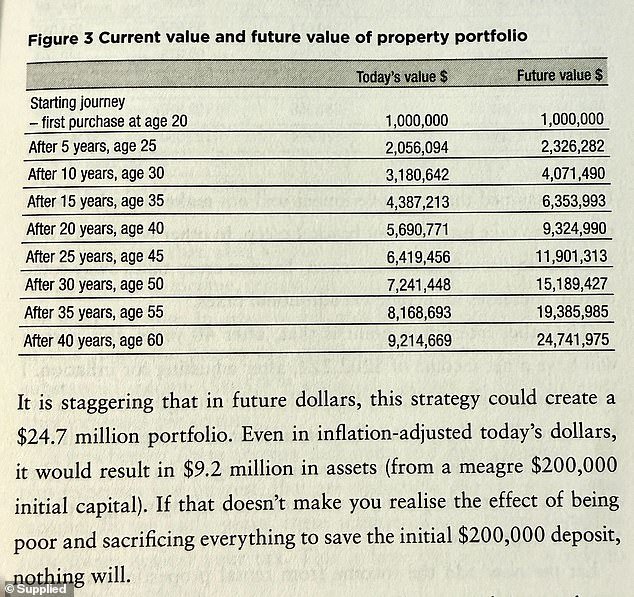

In his book Property Secrets of the Rich, Mr Mason reveals that by following the right steps, you could be left with a $24million property portfolio by the age of 60 – with a passive net income of $404,775.

The first step is saving for a 20 per cent deposit, then properly researching areas to invest in to make sure you aren’t just following the crowd. Then, once the first property is secure, wait four years to buy the next, and then repeat the process.

‘You have to start somewhere – just start. Set your goals and priorities and save like crazy, make that first purchase – but don’t sell. Buy with your head, not your heart. And don’t expect a quick gain,’ he says.

Allan Mason has cracked the ‘conservative’ formula for turning a $200,000 deposit into a $24million property portfolio. Saving up that first $200k can be a tough task for younger would-be investors, but for older Australians with a family home, it’s more than achievable

‘A major part of wealth creation is your home,’ says Mr Mason. ‘It can be a massive starting point in wealth creation because, quite simply, there is no other investment that you can make money on that is tax free’

Mr Mason adds that buying the first property is always the hardest because it typically requires excessive saving – either by working multiple jobs or getting help from family members.

But he maintains that his strategy of saving 20 per cent for a deposit and then waiting four years to buy your next property is a ‘conservative, risk-averse’ approach that many investors prefer.

‘We can’t predict the future property cycles. The last thing you want to do is overextend yourself, because if the property sits for five years and doesn’t grow in value, if you lose your job and can’t make the repayments, you’re in trouble,’ he adds.

THE PROPERTY CHECKLIST

As real estate agents say, it’s all about location – and Mr Mason agrees.

Ideally buying within a 15km radius of a major capital city is preferred over regional areas or mining towns that may be experiencing only a temporary boom.

‘Be careful with regional areas because they’re making more land. They’ll start developing and rezoning acreage or farming land to cut up into housing developments. So supply can increase very quickly, whereas in Sydney, Brisbane or Melbourne the supply is limited,’ he said.

‘Location is so important. You want to be close to schools, close to work, where people want to be, and near public transport.’

Your first property should also be an investment, not your dream home.

Investments are assets which generate a rental income and deductions can be made at tax time, whereas your principal place of residence (PPR) cannot.

If the property you’re buying is an asset, Mr Mason suggests searching for properties with a nine to 11 per cent rental yield (the annual rental income as a percentage of the property’s market value). This may sound outrageous given that property yields tend to teeter at about three to five per cent; however, Mr Mason says it’s not impossible.

‘In the early stages, you need to try to aim for that high yield. Buy something that’s undervalued or might need a renovation to increase the value,’ he said.

‘For instance, if you bought a rundown unit, you might have to spend $10,000-$20,000 to make it look nice, or if you buy a house you could build a granny flat out the back. This will attract tenants and increase the rent.

‘Stressed property sales come up all the time, such as sales following divorce or death, which is another opportunity to get a good price.’

The above figure predicts a portfolio value of $24million over 40 years with an average growth rate of five per cent. This involves buying one property every four years from age 20 and holding it until you’re 60. The two columns are inflation-adjusted value in today’s dollars and the future value – not inflation adjusted

DON’T BE AFRAID OF DEBT

According to Mr Mason, debt is a ‘case of simple maths’ – and you’re better off jumping in as soon as possible rather than waiting on the sidelines.

He said if you are paying six per cent on a loan on an investment property and that loan is tax deductible, then the real cost is only three or four per cent due to the tax refund at the end of the financial year.

Then, if it applies, you claim depreciation, you actually can be positively geared where the rental income covers the expenses.

‘If your property goes up say 10 per cent per annum, you are more than ahead. But it gets better. Assume you borrowed $800,000 on a $1million property. Say, in five to ten years that property is now worth $2million,’ he said.

‘Your $200,000 deposit has earned you $1million. That is a five times (500 per cent) gain on what you started with – all in five to ten years (depending on the property cycles).

‘Then assume you don’t sell and use the equity to buy another property and so on over your lifetime. On your first property you have just made $1million tax free (until you sell) and through the ownership period the ATO has subsidised your wealth creation by giving you tax relief on your PAYG tax on your salary.’

TIME IN THE MARKET IS EVERYTHING

Mr Mason explains that property has proven to always increase in value over time in Australia – but the progress isn’t linear.

It is important to be aware that there are many periods over the last 50 years where there was no movement for five to ten years, then a massive jump.

‘You need to be in the market. Own properties that you can support and not expect any short-term gains. But be assured that in time it will happen. Remember, this is a lifetime strategy, not a get-rich-quick scheme,’ he said.

LOOKING AHEAD

As for the future of the Aussie housing market, Mr Mason says it’s an ‘impossible prediction’ to make.

‘Everywhere you look the projections vary. The market seems overheated, but continues to climb,’ Mr Mason said.

‘I feel the fundamentals are still there – population increases, immigration, low supply and a continuing pressure on building costs.

‘The other aspect that is not mentioned is underlying inflation. While the Reserve Bank tries to keep a lid on inflation, the only way Australia will get out of its massive, accumulated debt is to inflate its way out. That means all assets will go up.

‘I believe over the next five years the Reserve Bank will need to increase money supply by printing more money – America just did exactly that. The net effect is inflation and price increases.

‘So, on balance, I still believe in the next five to ten years we will continue to see the same gains Australia has had over the last five years.’

READ THE LATEST FROM DAILYMAIL+

Here are some great stories you may have missed: