Oceans and freshwater play a crucial role in regulating our climate, providing food and livelihoods, and supporting diverse ecosystems. Yet they are under threat and their protection is underfunded; the United Nations Sustainable Development Goal (SDG) “Life Below Water” remains the least funded SDG, not far behind “Clean Water” and Sanitation”, which is the sixth least funded*.

As part of its ongoing commitment to sustainable investing, Fidelity International (“Fidelity”) announces the launch of its Fidelity Funds 2 – Blue Transition Bond Fund (the “Fund”), the first blue transition fixed income fund to launch globally according to its market analysis**.

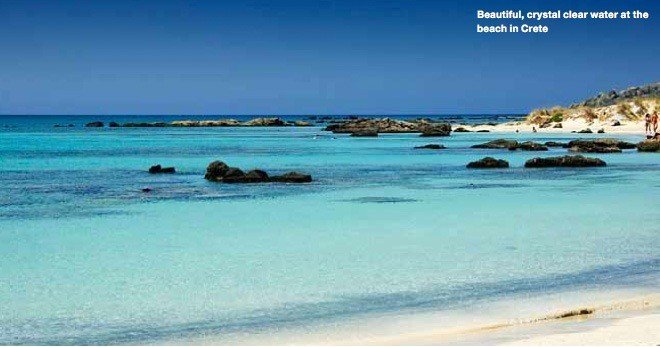

The blue transition aims to balance ocean, coastal and in-land river system usage and resources with the conservation of healthy and productive marine and freshwater ecosystems.

The Fund aims to achieve capital growth over the long term, focusing on supporting the transition towards improved ocean and freshwater health by investing in global bonds or bonds of issuers that:

(i) Contribute to ocean and freshwater objectives aligned with one or more United Nations Sustainable Development Goals (SDG)

(ii) Use bond proceeds to finance projects benefiting ocean and freshwater related sustainability (including blue bonds)

(iii) Aim to improve management of water-related risks and opportunities

(iv) Reduce the negative impact of climate change on the ocean or freshwater

A minimum of 80% of the Fund’s investments are used to meet the environmental or social characteristics promoted by the fund.

The Fund will be managed by Kris Atkinson and Shamil Gohil. Together, they have over 42 years’ experience and are backed by Fidelity’s extensive global investment and sustainable investing resources. The launch follows Fidelity’s broader commitment to developing thematic fixed income investment solutions that address climate change, social issues and the broader UN Sustainable Development Goals.

Kris Atkinson, Portfolio Manager, comments: “The bond market is uniquely positioned to help support the blue transition, given its size and greater number of issuers across both public and private entities in the corporate and sovereign issuer space.

“We are particularly focused on Blue Bonds, a sub-component of the green bond market, which finance ocean and freshwater related projects. However, Blue Bonds alone are not sufficient for investors looking to support ocean and freshwater themes while aiming to generate attractive risk-adjusted returns. A broader more holistic approach needs to start at the issuer level, investors should consider how a company operates, which products and services it offers, and how these align to the blue transition.

“The blue transition is a global challenge and so our approach is global too, covering the broadest fixed income investment universe possible. As credit investors we need to ensure we back our principal and interest so we use Fidelity’s vast and experienced team of investment professionals to screen out bonds which don’t meet our credit fundamental and valuation thresholds. The result is a globally diverse, high-quality, fixed income portfolio which helps to support the blue transition.”

Source: Fidelity International