It’s easier to make a case for using fairly priced, proven active bond funds than it is for stock funds.

That’s the upshot of recent research by Morningstar’s Eric Jacobson and Maciej Kowara. In “The Bond Market as Fertile Ground for Active Management,” Jacobson contends that the bond market’s makeup and indexing challenges give skilled active managers a chance to distinguish themselves.

In “Do Active-Passive Performance Comparisons Make Sense in the Bond World?” Kowara uses portfolio data to show that actively managed bond funds have access to and make use of tools, asset classes, and flexibility around interest rate and credit risk exposures to gain an advantage over passive funds and their indexes.

Conflicting Claims, Methodology, and End-Point Bias

Investors need to consider the sources of the many conflicting claims in the active-passive debate. A prominent index firm, for example, argued a few years ago that active bond managers struggled to beat their benchmarks across fixed-income categories based on the asset-weighted returns of all share classes. Twelve months later, a well-known investment firm claimed active bond management was superior because the institutional share classes of most active bond funds beat their median passive rivals after fees.

The studies’ different methodologies influenced their results. Asset-weighting share class returns reflects all fund investors’ experience as share class expenses vary even within the same fund. But it is less meaningful as a gauge of active managers’ ability to beat their benchmarks after a reasonable fee. For that, picking an institutional share class is better, but it ignores outcomes for investors in higher-fee share classes.

Starting and end points matter, too. Morningstar’s US Active/Passive Barometer, which uses asset-weighted share class returns, found that 79.3% of intermediate core bond active Morningstar Category funds outperformed their passive composite in 2024. But April’s credit selloff dropped the one-year success rate by June 30, 2025, to 51.7%. Interestingly, though, the five-year success rate between year-end 2024 and mid-2025 increased 7 percentage points to 63.9%, as March 2020’s selloff rolled off the five-year record.

Shifting Success Rates and Active Bond Versus Stock Funds

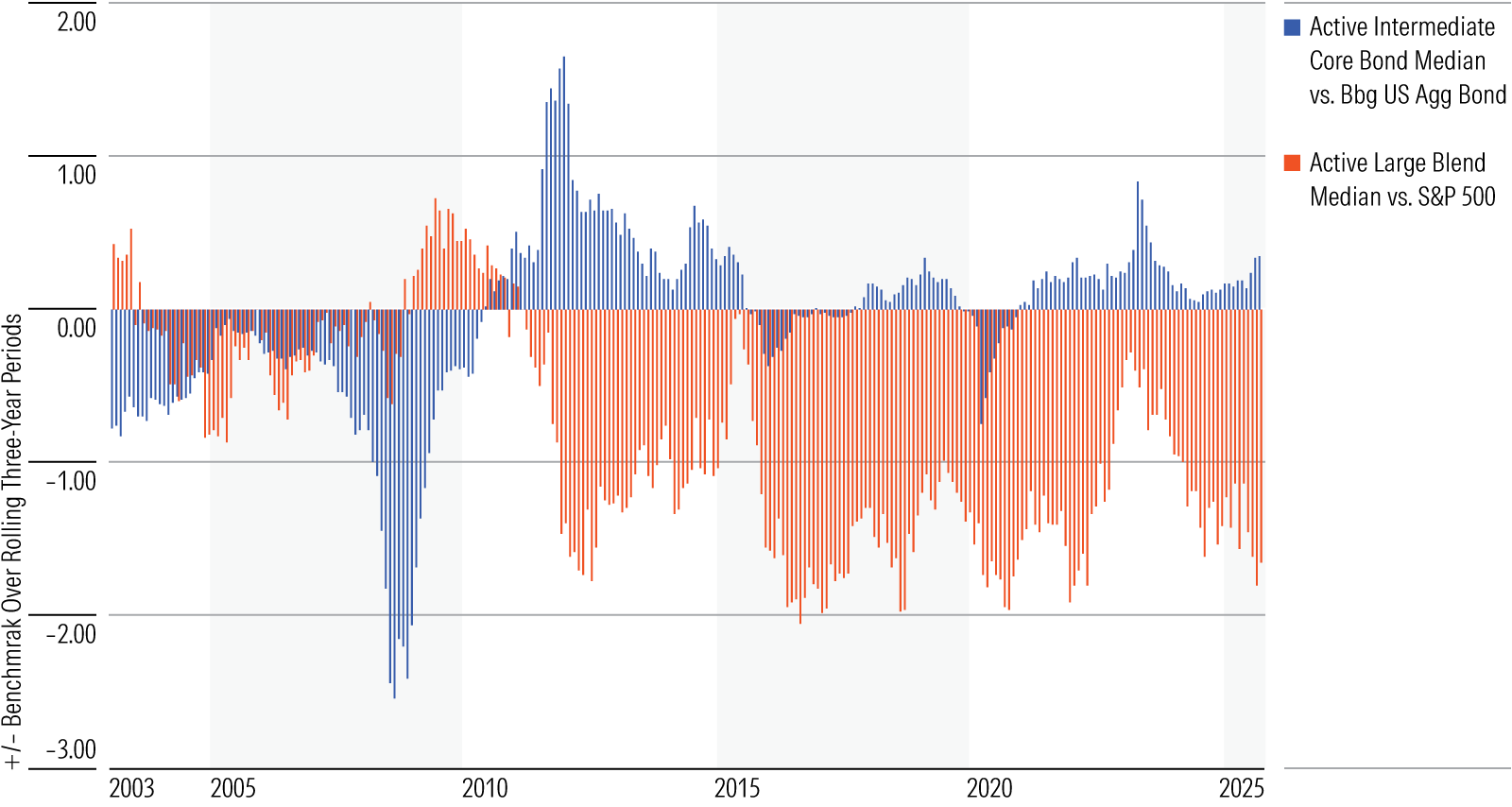

Jacobson’s research notes that active bond funds’ success rates versus passive bond funds often shift depending on time periods or crises. Active bond fund managers with modest fee hurdles, however, have consistently had more success against their broad market benchmarks than active stock fund managers.

Over the 25 years through July 2025, the intermediate core bond active median beat the Bloomberg US Aggregate Bond Index in 54% of rolling three-year periods compared with 13% versus the S&P 500 for the active large-blend median (using the cheapest share class for each).

Bond Market Fundamentals and Indexing Challenges

Jacobson helps investors understand the fundamental reasons why active management can make sense in the bond market. Lingering market inefficiencies through concentrated ownership, infrequent trading, and complexity combine to create bargains for patient and opportunistic managers, especially in the securitized market, where collateralized mortgage obligations, for example, can become very mispriced.

Jacobson also considers bond market indexing challenges. Whereas cheap, whole stock market vehicles like Vanguard Total Stock Market ETF VTI give more weight to the most successful US publicly traded firms, as measured by their market capitalizations, market-cap-weighted bond indexes emphasize heavily indebted firms that are vulnerable to distress.

Moreover, it’s not possible to buy the whole bond market. Index coverage extends to only about 80% of agency mortgage-backed securities, 60% to 70% of commercial mortgage-backed securities, and roughly one-third of asset-backed securities. Nor do passive options exist for collateralized loan obligations and housing-related debt like credit risk transfer securities and reperforming loans despite these markets’ considerable size.

Another challenge is bond investing’s checkered history. All major bond sectors have had meaningful market distortions during which indexing proved unwise. After the 2008 financial crisis, for example, economic policy caused the US investment-grade bond market’s interest rate sensitivity as measured by duration to increase from a range of 4 to 5 years to 6.5 years by late 2021, suggesting a 6.5% loss for every 100-basis-point rise in rates, all else equal.

As duration lengthened, the high-grade bond market began to struggle. Indeed, heightened interest rate sensitivity was the biggest factor in the Bloomberg US Aggregate Bond Index’s 18.4% cumulative loss from Aug. 7, 2020, to Oct. 24, 2022, a period in which the yields across the US Treasury curve rose between 320 and 450 basis points. Active managers’ ability to limit interest rate risk then helped; the active intermediate core bond 17.6% median loss was 80 basis points better than the benchmark.

The Structural Advantage of Active Managers

Active managers have more flexibility than their benchmarks in many other areas, as Kowara’s research shows. Improved portfolio disclosures through SEC-mandated N-PORT filings reveal that many actively managed intermediate core bond funds have more market exposure compared with a US Aggregate Bond benchmark proxy like the Vanguard Total Bond Market Index Fund VBTLX.

Some funds, for example, use financial leverage or borrow money to increase market exposure. While most intermediate core bond portfolios have little-to-no financial leverage, some have more aggressive profiles. More than one-fourth of those (43 out of 158) Kowara surveyed use financial leverage exceeding 105%.

since funds have 60 days to file N-PORT data with the SEC.

Morningstar portfolio data further highlights the extent to which actively managed intermediate core bond funds differ from the Vanguard benchmark proxy not just in terms of interest rate risk but also holding types and credit risk. Three holding types—Treasuries, corporate bonds, and agency mortgage-backed securities—combine for more than 90% of the Vanguard’s fund’s assets, while actively managed fund weightings are generally more varied.

Underweighting Treasuries allows for much of that variation. The Vanguard portfolio’s 47.7% Treasury stake in March 2025 was nearly twice the category’s 25% median. Many active managers instead overweight asset-backed securities—the category’s 5.9% ABS median was more than 10 times the Vanguard fund’s 0.55% allocation.

Even when active managers share an exposure type with the benchmark, credit quality can differ. The Vanguard fund’s 24.65% corporate bond weighting was close to the 23.74% peer median, but many active managers overweight bonds with lower credit ratings of BBB and/or own below-investment-grade-rated corporate bonds that the benchmark doesn’t include. Active managers have an incentive to take more corporate credit risk because those bonds’ higher income helps cover their fees and beat their benchmarks if credit doesn’t sell off.

A Recipe for Outperformance?

Even if a credit selloff hurts in the short term, Kowara’s holdings-type research provides a basic recipe for active managers to increase their chances of outperforming in most market environments. Starting in 2002, the earliest common date for the index data, a portfolio weighted 85% in the Bloomberg US Aggregate Bond Index, 10% in the Bloomberg Asset-Backed Securities Index, 4% in the Bloomberg US High Yield 2% Issuer Capped Index, and 1% in the Morningstar LSTA US Leveraged Loan 100 Index that was rebalanced annually through mid-2025, would have beaten the Bloomberg US Aggregate Bond benchmark in 78% of five-year rolling periods. Moreover, the success rate of its volatility-adjusted returns as measured by Sharpe ratio was 92.83%, with the only stretch of underperformance occurring from mid-2008 to late 2009, that is, during a severe credit selloff.

Conclusion

Given that a simple recipe of holding types can increase an active manager’s chances of beating the benchmark, Kowara wonders whether that outperformance reflects skill, better tools, or some combination of the two. It is in that sense he asks if active-passive performance comparisons even make sense in fixed income. Ultimately, both Kowara and Jacobson conclude most fund investors would do well to consider fairly priced, proven active managers as an option for bond market exposure.

Granted, choosing the right active manager isn’t easy. Funds with stellar performance over years can later prove to be poor choices, such as AlphaCentric Income Opportunities IOFIX.

Yet, Morningstar Medalist Ratings regularly identify actively managed bond funds that our analysts believe are likely to outperform over a market cycle. Investors considering active management should start there, beginning with Gold-, Silver-, or Bronze-rated funds with modest expense ratios and a parent firm behind them with either a High or Above Average rating.